Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

It is not the critic who counts; not the man who points out how the strong man stumbles, or where the doer of deeds could have done them better. The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood; who strives valiantly; who…

I’m a big reader. Huge. My library consists of thousands of titles, mostly all of which are non-fiction (biographies, finance, business, economics, psychology, history, ethics, etc.) If I were to reproduce it, the cost would be somewhere between $12,000 and $30,000 depending on how difficult it was to get your hands on many of the…

Using Wal-Mart Stores as an Example of Earnings Yields vs. Treasury Bond Yields I was up until 5 a.m. this morning reading through the past few years’ of Wal-Mart Stores, Inc. annual reports, filings with the SEC, analyst reports, transcripts, and other documents. It is about time to have the businesses make another contribution to…

Very early in life, I had three important insights that helped me achieve the things I desired within a year or two after graduating college. These three insights were based upon my observation of the world and years of sitting in a reading chair by the fireplace pouring over history, accounting, economics, philosophy, psychology, ethics,…

Though I very rarely talk about my personal life on the blog due to privacy concerns, I will say that for years, I have attended a flexibly-scheduled weekly family dinner that rotates among the members’ households with the host cooking for the guests. This is an extension of the tradition that began during my childhood…

Mental Model: Using the Primary Mission of Your Life to Determine the Hierarchy of Priorities Between Task and Relationship One of my mentors from early in my career shared a mental model that has been a fantastic guideline and framework through which I’ve conducted my life. It involves determining the hierarchy between personal relationships and…

Americans Continue to Deleverage as Measured by Average Household Debt as a Percentage of After-Tax Income Paul Wiseman wrote in a recent Associated Press article: “Soaring housing prices in the mid-2000s made millions of Americans feel wealthier than they were. They borrowed against the inflated equity in their homes or traded up to bigger, more…

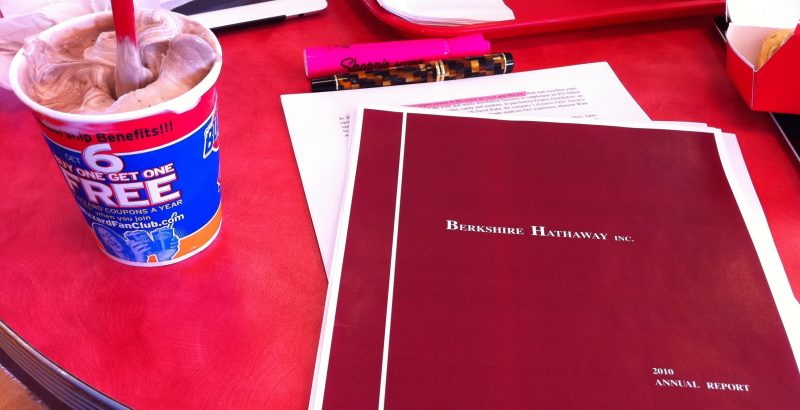

In the most recent Berkshire Hathaway shareholder letter, Warren Buffett remarked that the three best investments he ever made included his home in Omaha (the other two were wedding rings). He conceded that he would have had more money if he had instead rented and invested the cash, but the utility of the home far outweighed the opportunity cost. Now that I am in my late twenties, I understand what he meant.

In 1960, Miller Gorrie was around 25 years old. Throughout his life, he had taken his earnings from paper routes and poured them into IBM stock, which had compounded at 20%+ for many years. This led to the young man possessing a portfolio worth more than $100,000, which adjusted for inflation, is more than $728,000…

Berkshire Hathaway shares are now trading at around the lowest valuation relative to earnings and assets that they have since the dot-com bubble in the late 1990s. How is that possible? As the famed holding company of Warren Buffett has added businesses such as Burlington Northern Santa Fe, the stock price has treaded water so each dollar invested at today’s price represents more profit and equity than it did in the past.