Investing is the process of putting aside money today in exchange for more money in the future. This process involves risk but, when well managed, can help grow your wealth over time due to the power of compounding. This is the investing archive that includes articles published on JoshuaKennon.com. If you are looking for more great content, visit Joshua’s Investing for Beginners site at About.com, a division of The New York Times.

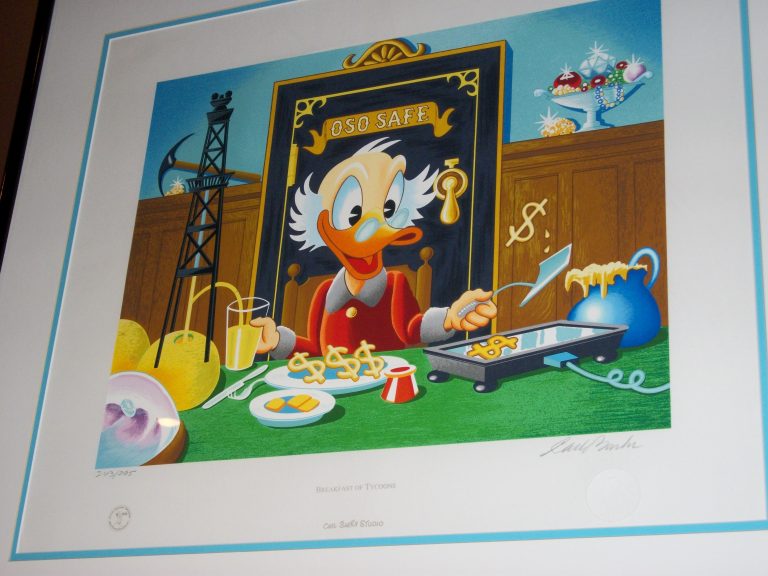

We added Breakfast of Tycoons to the official Carl Barks collection. We’ve been selectively acquiring more and more of his stuff when the price is attractive and it just fits with all of the framed stock certificates and financial artwork.

I mentioned yesterday in the article on Dairy Queen franchise owners that after graduating from college, Aaron and I had looked into putting capital to work by opening several franchises in the town where we grew up.

A week or two ago, I wrote an article called Understanding Stock Repurchase Plans for About.com, a division of The New York Times, which discussed Sonic Restaurant and the massive stock buy back program that had taken place over the past few years. In it, I walked the readers through a lot of the math and explained that I had purchased a couple hundred shares to watch and monitor the stock through one of my companies, Mount Olympus Awards, LLC. (I’ve since increased it to about 500 shares to continue watching and waiting to see how events unfold).

John Templeton was a billionaire mutual fund pioneer that specialized in using a value investing strategy to buy stocks around the world. By practicing a disciplined version of Benjamin Graham’s teaching on a global scale, Templeton amassed an astounding record that made shareholders of his fund wealthy and earned him hundreds of millions of dollars in well-deserved fees. Toward the end of his life, John Templeton ran his international investments from his mansion on Lyford Clay in the Bahamas.

One of the least discussed secrets of great practitioners of the value investing strategy is the use of cash, cash equivalents, and bonds to augment returns. From Benjamin Graham and Warren Buffett to Wallace Weitz and Marty Whitman, intelligent use of excess funds has as much to do with growing your capital over the long run as does selecting individual common stocks. We’re going to look at some of the techniques that have been used by value investors to manage their reserves, and the role played in the overall portfolio.

The focus value investing strategy is different from traditional, Benjamin Graham value investing strategy because it is based upon the idea of putting money into more of an investor’s “best ideas”, as Warren Buffett put it. Some value investors despise focused investing, while others swear by it. I’m always very hesitant to talk about this particular strategy on Investing for Beginners where I publish my investing articles for total newbies, mostly because some lazy person may not study far enough and realize that focused value investing is only possible when someone has diversified income sources. Done wrong, it can be financially devastating.

Peak earnings are a common value investing trap that most often hurts inexperienced investors who look only at the earnings per share and not the underlying driver of those profits. The last big round of peak earnings value traps occurred at the end of the housing bubble. By knowing what to look for, you’ll be better equipped to spot value traps, lowering the chances your portfolio will be damaged by them.

Many famous portfolio managers that practice a value investing strategy have said they think of stocks as “equity bonds”. Instead of receiving a fixed rate of return, like you would when you buy a traditional bond, you receive a variable return based on the company’s underlying profit. This approach makes it easier to value a business. The most common starting point for the valuation process is calculating a financial ratio known as earnings yield. In this article, you will learn what the earnings yield ratio is, how to calculate it, and why it is important to so many value investors.

In his classic treatise, The Intelligent Investor, Benjamin Graham, the father of value investing, created an allegory to help new investors understand how to think about stock prices and value investing in general. By using it, you can help protect yourself from overpaying for a stock, panicking when the market crashes, or doing foolish things resulting from emotional reactions to the nightly news. Along with the margin of safety concept, Mr. Market is a cornerstone of the value investing strategy.

The single most important concept in all of investing, according to Benjamin Graham and later confirmed by his star student, Warren Buffett, comes down to three simple words: Margin of Safety. What is the margin of safety? How do you calculate it? How important is it to developing a successful value investing strategy? As you’ll see in a moment, the theory behind value investing is that the ultimate return you earn on your investments will be closely related to the size and quality of the margin of safety you build in to your purchasing decisions, whether you are buying shares of Coca-Cola or building a hotel.