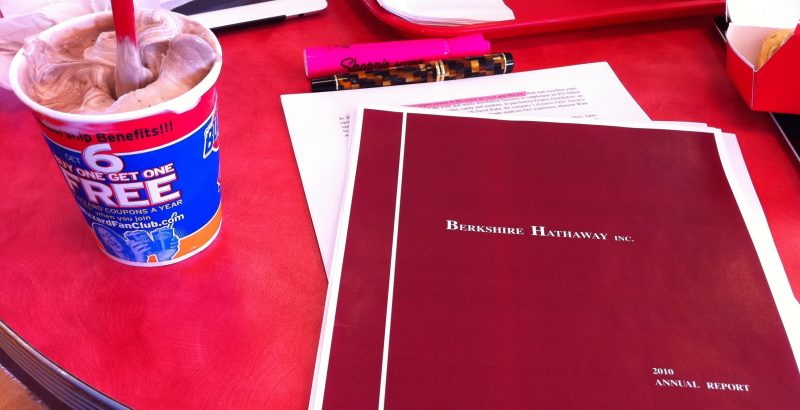

Berkshire Hathaway is the investment holding company of billionaires Warren Buffett and Charlie Munger, through which they hold their operating companies and stocks including positions in GEICO, Dairy Queen, Benjamin Moore, Coca-Cola, American Express, General Re, Acme Brick, and more. This archive displays articles that have been tagged with the phrase Berkshire Hathaway to make navigation easier for you.

Surveying the most recent ten year period, the increase in Berkshire Hathaway’s economic engine has been breathtaking. The Great Recession of 2008-2009 gave it the opportunity to lay out billions upon billions of dollars in cash it had been storing for years prior at terms that were unlike any deals we’ve seen in decades. Convertible preferred stocks, warrants, private buyouts … the firm got its on hands highly lucrative securities, many of which were privately negotiated and offered return enhancers not available to average investors …

The Berkshire Hathaway shareholder discounts at Nebraska Furniture Mart end in a few hours, with the discount at Borsheim’s cutting off tomorrow. The furniture buyer with whom I am working has spent the past week finalizing my spreadsheet, locking me into the enormous savings that are available. [mainbodyad]Taking advantage of the stockholder pricing is one…

Here are some words of wisdom I came across about portfolio management and building wealth from billionaire Charlie Munger. We’ve really made the money out of high-quality businesses. In some cases, we bought the whole business. And in some cases, we just bought a big block of stock. But when you analyze what happened, the…

I’ve told you in the past that Berkshire Hathaway appears to be trading at the lowest valuation in nearly a decade. Recently, Morningstar revised its intrinsic value estimate for the Berkshire Hathaway Class B shares, stating they believe the stock has an intrinsic value of $89 per share (equal to $133,500 per Class A share since it takes 1,500 Class B shares to equal a single Class A share). I find this interesting for several reasons. First, Morningstar’s intrinsic value calculations are often reasonable, in my opinion. On more than one occasion, we’ve been within a single percentage point after I had valued a firm and then cross checked third-party estimates as part of the process to see if there were major disagreements. But in this case, I just think they’re wrong.

I’ve made no secret of the fact I’ve been a net purchaser of Berkshire Hathaway shares for the past year. The valuation seemed (and still seems) absurdly low relative to intrinsic value. Apparently, the Berkshire Hathaway Board of Directors and management agrees.1 The company is now looking at itself as the best use of the firm’s cash.

Berkshire Hathaway shares are now trading at around the lowest valuation relative to earnings and assets that they have since the dot-com bubble in the late 1990s. How is that possible? As the famed holding company of Warren Buffett has added businesses such as Burlington Northern Santa Fe, the stock price has treaded water so each dollar invested at today’s price represents more profit and equity than it did in the past.

Here’s how you can find investment ideas using an example from my own family’s experience running a successful sporting goods store.

The focus value investing strategy is different from traditional, Benjamin Graham value investing strategy because it is based upon the idea of putting money into more of an investor’s “best ideas”, as Warren Buffett put it. Some value investors despise focused investing, while others swear by it. I’m always very hesitant to talk about this particular strategy on Investing for Beginners where I publish my investing articles for total newbies, mostly because some lazy person may not study far enough and realize that focused value investing is only possible when someone has diversified income sources. Done wrong, it can be financially devastating.

The single most important concept in all of investing, according to Benjamin Graham and later confirmed by his star student, Warren Buffett, comes down to three simple words: Margin of Safety. What is the margin of safety? How do you calculate it? How important is it to developing a successful value investing strategy? As you’ll see in a moment, the theory behind value investing is that the ultimate return you earn on your investments will be closely related to the size and quality of the margin of safety you build in to your purchasing decisions, whether you are buying shares of Coca-Cola or building a hotel.

Originally serving as stock broker to the father of value investing, Benjamin Graham, Tweedy, Browne & Company converted to a money management company and eventually launched several highly successful mutual funds that operated with the same value investing style for which they had become renowned. After beating the market by several percentage points for nearly forty years, the firm’s place in the halls of investing greats has been securely established.