John S. Lemon, President of Tootle-Lemon National Bank in St. Joseph, Missouri (the city near the farm town where I grew up before moving to the East Coast at the end of my teenage years), died on March 17th, 1905. According to Volume LXX January to June 1905 of The Bankers’ Magazine:

“He was born at Shepherdsville, Ky., in August, 1833, and at the age of nineteen went west, and finally located at Saint Joseph, where he first became clerk in a store and later was taken into partnership. In 1884 he became President of the Merchants’ Bank, of which he had been a director for some time previously. In 1890, with Milton Tootle, Jr., and Thomas E. Tootle, he established the private bank of Tootle, Lemon & Co., which was successfully conducted for three years and then was merged into the present Tootle-Lemon National Bank, of which Mr. Lemon became President. He was a fine type of a successful self-made business man, and had amassed a fortune estimated at about $1,000,000.

[mainbodyad]Today, that is a fortune adjusted for inflation of approximately $24,250,000. He was 72 years old. Perhaps more impressively, his brothers and other family members also had significant investments in the bank and other businesses, meaning that the Lemon family, as a group, was incredibly prosperous for the time after starting with nothing. Like stories of the Walton family through Walton Enterprises LLC, I always love hearing stories of families starting with nothing then growing rich together, and separately, so that as a group they have far more power. They built an empire from St. Joseph in the decades following the civil war. Each branch of the family was prosperous and rich in every sense of the word.

History is filled with men like John S. Lemon and his Tootle-Lemon Bank. They never have the name recognition of the Rockefellers or Carnegies but they are the ones who built the nation. Their kids attend the same schools, they have many of the same toys, and they engage in the same activity. Becoming as rich as a John S. Lemon is attainable for most people if they start young enough, manage risk, and let compounding do the rest. You may not make the history books, but your life will be spent in Mercedes, cashmere sweaters, fine dinners, a respected member of your community, giving generously to charity, and the having ability to afford your favorite hobbies and indulgences, whether that means tickets to every Super Bowl and World Series game or seats in the Academy Awards ceremony.

Tootle-Lemon National Bank Formed

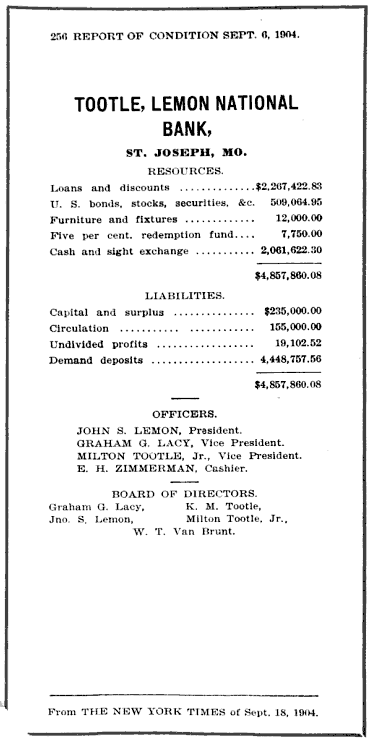

According to Volume LXIV January to June 1902 of The Bankers’ Magazine, on June 2nd of that year, the Tootle-Lemon National Bank was formed, becoming the successor of the well-known private banking firm of Tootle, Lemon & Co. According to the source, “A considerable amount of the stock was taken by E.H. Harriman, of New York, Chairman of the Union Pacific and Southern Pacific Railways.” The bank had capital of $200,000 at the formation, representing just shy of $5,000,000 today. The bank President was John S. Lemon, and the Vice Presidents were Milton Tootle, Jr. and Graham G. Lacy. The cashier was E.H. Zimmerman and the assistant cashier was W.A. Evans.

The bank was well known and regarded from New York to San Francisco. In fact, reports from the Tootle-Lemon bank and its successors appeared with some frequency in The New York Times. This was because, in a day long before FDIC insurance, the Tootle-Lemon bank had never experienced a panic and the men who ran it were the founders, with their own money at stake.

What If You Wanted To Be as Rich as John S. Lemon?

What if you wanted the same fortune as Mr. John S. Lemon? A net worth of $24,250,000 by the time you were 72 would probably generate somewhere around $200,000 in income per month if properly managed, while still remaining debt-free. That is a nice chunk of change for your heirs. Of course, someone like the shareholders of the Tootle-Lemon bank were living much better than this because, along the way, they built mansions and owned a lot of nice things. They were anything but misers and loved quality because, in many cases, their residences and buildings stand a century later.

What if you wanted the same fortune as Mr. John S. Lemon? A net worth of $24,250,000 by the time you were 72 would probably generate somewhere around $200,000 in income per month if properly managed, while still remaining debt-free. That is a nice chunk of change for your heirs. Of course, someone like the shareholders of the Tootle-Lemon bank were living much better than this because, along the way, they built mansions and owned a lot of nice things. They were anything but misers and loved quality because, in many cases, their residences and buildings stand a century later.

There are two ways of approaching a problem like this: Saving or Capitalizing.

1. Saving

The first is that of a banker, where you calculate compounding, savings rates, etc. Using this approach, and thinking about it backward, if you are 25 years old right now, for you to have the same wealth, you could do it any of these ways:

- Earn 7% after inflation and taxes, you’d have to save $6,139 per month every month for the rest of your life. That would require a roughly 10%, given the current 3% inflation rate, on your money.

- Earn 10% after inflation and taxes (your business would have to be slightly above average, which is 12% in the United States on book value – you’re never going to get this with the stock market so it would have to be an operating company, like Lemon owed) and save $2,318 per month for the rest of your life. By the time you reached 72, you’d have the same net worth.

- Earn 15% after inflation and taxes (you would need a very good business like Nebraska Furniture Mart under Rose Blumkin because it is impossible for virtually all people to earn a return that high in any publicly traded securities market) and you would only need to save $426 per month for the rest of your life.

2. Capitalizing

The second approach is that of a tycoon or a founder: capitalized earnings. If you build a business that generates $2,500,000 in pre-tax profits annually, you could probably sell the firm for 12x operating profit, or $30,000,000. You pay your taxes and viola! You are left with $24,250,000 or thereabouts. This is probably the easier of the two alternatives if you have any operating skill.

Most great wealth comes from business ownership and capitalized earnings. This has to do with human lifespans. If you can build a business and sell it for $10 million at 35 years old, you suddenly have decades to compound using method #1, Saving, on that much larger capital base.

Whatever Happened to the Tootle-Lemon Bank?

[mainbodyad]For the most part, the Tootle-Lemon Bank is now part of U.S. Bancorp. It think it is cool that I’m sitting here owning shares in a business that controls the assets of the former Tootle-Lemon & Co. bank.

When I collect my dividends from U.S. Bancorp, part of it comes from what John S. Lemon built.

When my family member – the one who was buying shares of U.S. Bancorp instead of paying off his mortgage early – collects the dividends on the direct stock purchase account, those earnings are coming from John S. Lemon’s life work.

There is something incredibly poetic about it. I feel about that like most people do about Romeo & Juliet.