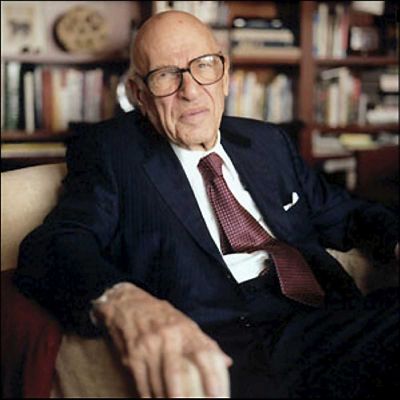

Mr. Market – Benjamin Graham’s Famous Value Investing Allegory

In his classic treatise, The Intelligent Investor, Benjamin Graham, the father of value investing, created an allegory to help new investors understand how to think about stock prices and value investing in general. By using it, you can help protect yourself from overpaying for a stock, panicking when the market crashes, or doing foolish things resulting from emotional reactions to the nightly news. Along with the margin of safety concept, Mr. Market is a cornerstone of the value investing strategy.