A couple of weeks ago, Kwame sent me a question. I’ll paraphrase here:

Joshua you made a statement, “The people who continue to compound, like those who end up on the Forbes list, are motivated by building something rather than cash”. Many times I have read about great business people and one thing I hear, which so far seems to be common to all of them, is “Don’t do it just for the money”. Sometimes I wonder if that is completely true.

Joshua, I consider you a great business person and I would like to put the question to you. Would you advise someone not to get into business just for the money? And what really motivated you to get into business was it just about increasing your personal wealth or just your deep love for the whole process of building businesses?

I ask all of this because as a child seeing MATERIAL WEALTH was what always got me excited and was what caused me to start my journey to seek knowledge on succeeding in business up till this very day.

There is nothing wrong with being motivated by material wealth. In fact, that was my great motivator when I first started out my journey to master investing, finance and business. Just because I’m frugal doesn’t mean I live like a pauper. I don’t want to give you that impression at all. It just means I live well below my means and what I could buy.

[mainbodyad]You don’t have to become a slave to investing. When I decided to stop renting and acquire my first house at 26, I spent just over $300,000 in a neighborhood where the lawn is mowed and the snow is shoveled (in Kansas City, this is the equivalent of maybe a $650,000 Toll Brothers house in Lawrenceville or Princeton, New Jersey, near where I went to college), I drive a Jaguar, I give myself an unlimited book and video game budget each year, I have $200 to $300 custom made shirts in my closet, cashmere sweaters (and blankets for winter), and a few thousand dollars worth of Creed fragrance. At my office, I have any gadget I want from the Apple store (a few years ago, Aaron and I decided we both wanted dual 30″ HD monitors so we went into the Country Club Plaza store in Kansas City and paid $8,000 for four of them), $1,200 fountain pens I use when reading annual reports, etc.

The point is, when these things were purchased, they were well within our budget and didn’t take away from the money we wanted to be putting into our long-term investments and plowing back in to the business for expansion. When we were first starting out and had no money, we lived like paupers on purpose. That is an important distinction. Frugality is measured relative to your own resources. That is, you cannot live out of another person’s pocketbook. You have to look to your own treasury to decide what is best for your situation.

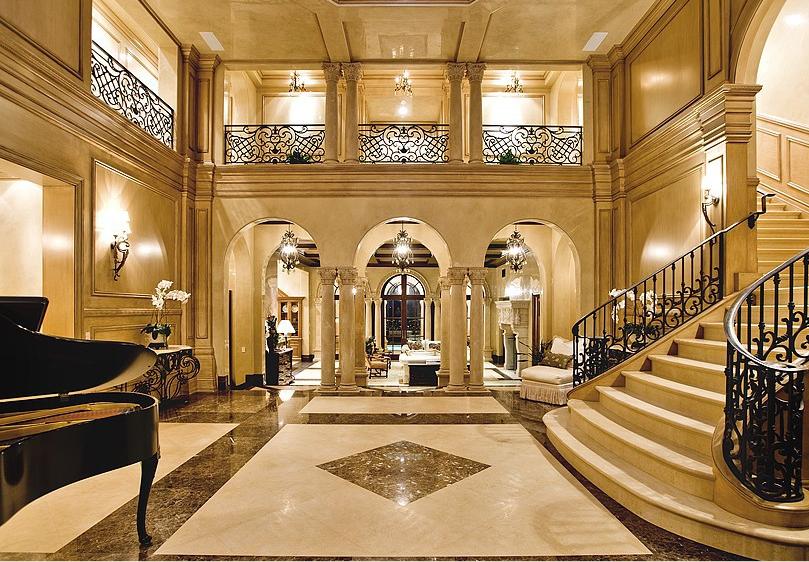

As a result, I don’t live nearly as well as I’d like. If I had reached “my number”, I’d have a Net Jet membership, a third house in Newport Coast, and a six-figure wardrobe from Saville Row without thinking about the cost. Why don’t I do it? Someday, I want a Gulfstream IV jet and the ability to buy control of entire businesses with my excess cash balance. That means sacrifices early in life. If my ambition were to live well, there would be nothing wrong with me having kids tomorrow, spending 90% of what I make, and playing golf all day. The thing is, that isn’t me. I’d be miserable because I want to build something huge by the time I’m old. If, God forbid, I passed away younger, most of my investments would go to my charitable foundation so I would still feel good about how I lived my life.

Saving Money Is Personal – You Have to Decide for Yourself

Building your net worth doesn't mean you have to spend your whole life like Oliver Twist beginning for gruel.

That is why I constantly repeat the refrain: Only you can make the decision about what is right in your life. If happiness to you is having $50,000 per month in income (which is $600,000 per year and would require a net worth of approximately $10,000,000 to generate from dividends and interest), there would be nothing wrong should you decide to spend or give away every single penny you earned each year. You would have reached the point where additional money didn’t have any utility but the stuff it could buy did. I know one retired woman who has $1,000,000 in the bank and with social security, earns about $70,000 a year. She has no debt, spends almost all of her money gambling at the casino, getting her hair done, and donating to charity. She is thrilled with her life. It would make no sense to tell her to stop spending and start investing so she had more money. She’s reached the maximum utility of funds.

Part of this is age. Remember that a single $1 bill invested for 50 years is worth $117 at 10%, $1,083 at 15% and $9,100 at 20%. If you are 70 years old, you aren’t going to be alive in another 50 years so your opportunity cost of spending, rather than investing, is lower. If I were that old right now, I wouldn’t bother saving anymore. I’d just put my money into high dividend stocks, municipal bonds, and real estate and live off the income each year.

When I stop myself from spending thousands of dollars on a new set of Mauviel copper pots it is because I would rather be putting that money back into our business so ten years from now, I can buy a six-figure Clive Christian kitchen with the money I would have spent. Material wealth is a motivating factor. Don’t think it isn’t.

Material Wealth Cannot Be the ONLY Motivating Factor

Make no mistake that someday owning a $25 million estate overlooking the ocean is motivation for me. It is just that if the only way to do it was to wake up each morning and go to a job I hated, I wouldn't bother. In Warren Buffett's word, doing something you hate for money is like, "Saving up sex for old age. By the time you get there, you'll be too exhausted to enjoy it." The great thing is, in a free and capitalistic society, everyone can determine for themselves what it is they want to do. My brother would hate to invest for a living, like me. But I would hate to jump out of planes, like him. We can both end up rich.

What I, and I think most successful people, are saying when we harp on the fact you shouldn’t work for money, is that it cannot be the only thing that drives you otherwise you will lose. Think about investing. I chose investing as my vehicle for making money because I love studying companies and collecting profits and dividends from them. But if I hated accounting and loved chemistry, I would have instead done something in science – maybe start a line of perfumes and launch a fragrance house.

In both cases, my goal could have been material wealth but the odds are good that I will be most successful if I am doing something I love every morning. Right now, if someone offered me $10 million to play a year in the NFL, I’d turn it down without a moment’s hesitation. I’d hate my life. The constant traveling, the getting hit by 350 pound men, the delusion that winning that particular game is the most important thing in the world. I couldn’t make myself do it. How could I ever hope to beat someone who practices 24 hours a day, 7 days a week because he loves the game? I couldn’t.

If you try to make money in an industry or field that you hate, you are handicapping yourself because the guy who loves what he is doing is always going to beat you. While you are “escaping” from work, he is still thinking about ways to improve and make more money because he loves the process.

[mainbodyad]You have to find a way to get rich that plays to a process you love. Look at the Forbes list! Almost no two people are alike. There is almost no consistency in how people got rich – timber, oil, banking, investments, retail, publishing, clothing, movies, video games, real estate – I mean, if Warren Buffett had tried to get on the Forbes list by making movies a la Stephen Spielberg, how successful do you think he would have been? Likewise, if Stephen Spielberg had tried to go into investing, instead of movies, to make a lot of money, do you think he’d be worth billions like he is today? Both men had natural strengths and they played to them.

Someone who works only for money would be like a young Stephen Spielberg giving up movie making to go into investment banking because it paid better in the early years. That is the mistake we are trying to get you to avoid. You can make money doing anything if – and this is vital – you can figure out how to give people something they want. Create a product or service that satisfies a demand and you can exchange it for cash that you can then use to keep yourself stocked in Charvet shirts.