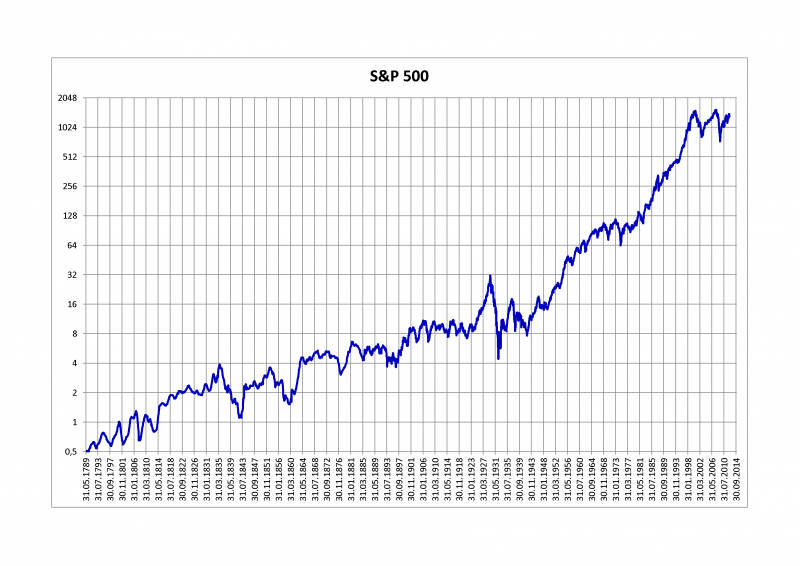

The S&P 500’s Dirty Little Secret

Over the past couple of decades, quiet, subtle, barely-noticed changes in the methodology of the S&P 500 have resulted in the index barely resembling the one that produced the historical returns investors now seem to implicitly assume they will earn in the future.