I am working on my What is a mutual fund? category at About.com and a thought struck me. I wanted to go back and look at the most recent investing lifetime (the 50 year period between 1960 and 2010). I imagined that an investor could have bought the S&P 500 stock market index (obviously you can’t since an index is just a theoretical construct but you could have built a portfolio to mirror it provided you had enough capital; at least until the rise of the now indispensable index fund). I took the index value and made it a dollar value – that is, the S&P 500 at 58.11 in 1960 would be the same as a share of stock in America, Inc. at $58.11.

[mainbodyad]But it’s not enough to look at historical data in nominal dollars. As investors, we are interested in purchasing power. Warren Buffett called this the cheeseburger test. How many cheeseburgers can you buy today compared to yesterday? It’s purchasing power we’re after; dollars are merely an exchange mechanism to approximate value. But governments print money, so it takes more dollars over time to buy the same goods and services.

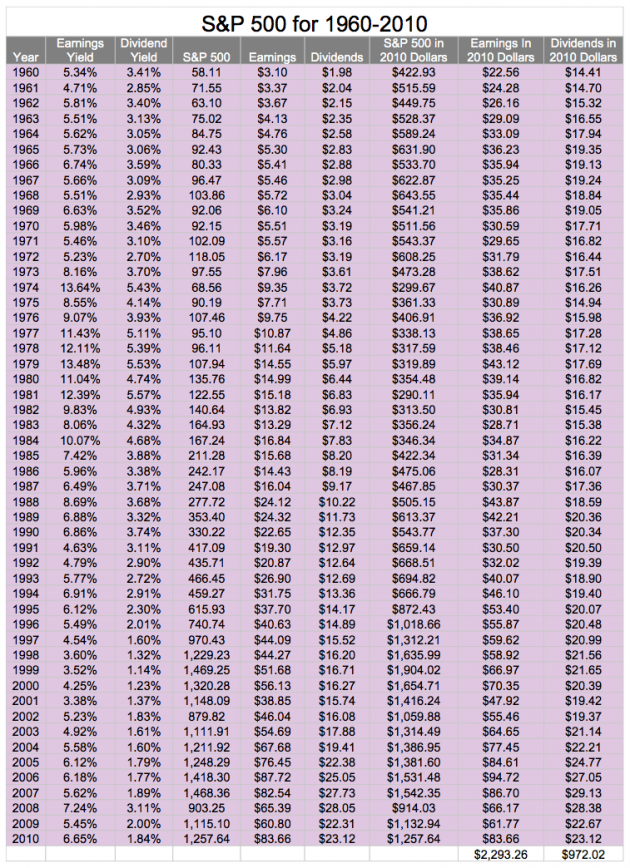

Using the historical change in the consumer price index as a proxy for the inflation rate, I went back and adjusted the S&P 500 level, the S&P 500 earnings, and the S&P 500 dividend rates into 2010 dollars. For now, since this is a very 30,000-foot-altitude view of the market, I ignored transaction costs and taxes. Again, with a large enough portfolio, transaction costs would have been almost non-existent due to low turnover and some sort of tax shelter could have been used, which is especially true going forward in time now that we have seen the rise of the Roth IRA and Roth 401(k) plans. I also didn’t get into specifics with the handling of spin-offs and other special events, just using return information provided by Bloomberg and S&P. These are more akin to notes you’d find scribbled on the inside of a folder in my library than I would publish with my name on them in an academic paper so keep those limitations in mind. I’m only sharing because I thought a few of you might find this interesting for broad policy reasons.

Chart: A Look at Inflation-Adjusted S&P 500 Data for 1960 Through 2010

A chart detailing the most recent "investment lifetime", the 50 year period between 1960 and 2010. It includes 51 years of compounding assuming you began investing on January 1st of 1950 and sold out of your investments on December 31st of 2010. Figures are adjusted to 2010 dollars to provide a better gauge of actual utility. For example, a $1.98 dividend in 1960 is worth a $14.41 dividend in 2010 in terms of purchasing power.

Imagine the year is 1960 and you are 18 years old. On a whim, you purchase a single share of America, Inc. for the equivalent of $422.93 in 2010 dollars. You allow your money to remain invested for 51 full trading years. How did you do? It depends on whether you chose to reinvest your dividends or enjoy them along the way. We’ll look at each scenario.

Scenario 1: Your Returns on the S&P 500 Without Dividends Reinvested

What happened by the end of that period if you decided not to reinvest your dividends? Your $422.93 would have grown to $2,229.66 in real, inflation-adjusted dollars.

[mainbodyad]This return would have come from several sources. First, you would have received the equivalent of $972.02 in the mail from dividend checks that you could have spent on movies, furniture, video games, clothing, bills, vacations, or whatever else you desired. On a retroactive basis, this would average out to 5.6% on your beginning investment, or $23.71 annually. The remaining gain of $1,257.64 would consist of your share of America, Inc, which would have a cost basis of $422.93 and a capital gain of $834.71.

That means your end-of-term value of $2,229.66 would consist of three components:

- $422.93 in returned cost basis for original investment

- $834.71 in capital gain on share of America, Inc.

- $972.02 in cash dividends mailed to you over the years

In inflation-adjusted terms that represents a real gain in purchasing power of 4.14% compounded annually, more than half of which you enjoyed spending along the way.

Side note: Something interesting … the S&P 500 had look-through earnings of $2,293.26 on an inflation-adjusted basis and paid out $972.02 on an inflation-adjusted basis as dividends, resulting in retention of $1,321.24 in inflation-adjusted dollars. In simple terms, if you invested $422.93 and your share subsequently earned $2,293.26, you should have $2,716.19 in wealth. Yet, your total pre-tax proceeds came to only $2,229.66. That is a short-fall of $486.53. It might indicate that corporate management did not, on average and through this investment period, produce $1.00 of market value for every $1.00 in shareholder capital retained. This is why many activists push for increased dividends instead of letting executives hoard cash; it’s almost human nature – they can’t help but do something stupid when easy money flows. But I’d be cautious about relying on that too heavily since I haven’t accounted for spin-offs and other corporate actions.

Scenario 2: Your Returns on the S&P 500 With Dividends Reinvested

If, instead, you had reinvested your dividend checks along the way, your 1 share of America, Inc. would have grown to 4.84 shares by the end of 51 years. With a market value of $1,257.64, your total position would be worth $6,086.98. That is a real, inflation-adjusted return of 6.72% compounded annually on your money. Every $1.00 invested became $14.39 in purchasing power.

To Reinvest Dividends or Not to Reinvest Dividends. That Is the Question

Which would you rather have?

- A $422.93 investment that grows to $1,257.64 but pays out $972.02 in cash dividends to spend along the way; or

- A $422.93 investment that grows to $6,086.98 but pays out no dividends along the way

There is no right or wrong answer. It comes down to personal utility for you and your family. If your goal was to put aside a pile of money for capital accumulation to draw upon during retirement, as I did with the KRIP portfolio, reinvesting the dividends is most definitely a better long-term option. But if you sold a company or an asset, parked the money in diversified investments, and wanted to live off the dividends, interest, and rental income, the utility of being able to fund your lifestyle is more important because, let’s face it, none of us lives forever. The goal of investing is to increase your utility so you can have the life you want. Capital is meant to be used, not hoarded. It’s sole value comes from its ability to improve the quality of the human experience.