How to Solve the Trade Deficit

A Five-Part Essay on the United States Trade Deficit

This essay on solving the trade deficit resulted from a letter I received from a reader. From August 31, 2010 through August 10, 2016, it consisted of six independent posts on the site. As part of the transformation of the site to the new, streamlined template, those six posts were combined into a single post. As a result, practically all of the comments and discussion on this post were made private and unable to be migrated. Though I regret the loss of the wonderful exchanges, the experience should be better this way so I proceeded with the consolidation.

Joshua,

I follow your personal blog, and find your articles very informative, it’s a great reference, and you inspire me, as I feel I am very similar to you, minus the internet business cranking out good money lol. One problem that I am constantly thinking about that this great county is facing is the trade deficit and “free” trade. Our nation really rose to power on the back of an amazing industrial push, and manufacturing played a huge role in this, and up until the 1970s things were going well, then we got fat and lazy it seems. I keep hearing that free trade allows a nation to focus on what it does best, and I am finding it hard to find something that China isn’t trying to do better than we are.

You remember Buffett’s open letter about squanderville vs. thirftville? Quite honestly, I feel our countries most urgent problem (out of all areas, social, economic, etc) is taking part in unfair “free” trade, and a lack of incentives for businesses to keep manufacturing jobs in this country. As I feel this has cause the most pain to our economy over anything else, recession included. It was only the amazing once in a generation internet and Information technology boom that hid the reality of how bad our economy has been. Ironically it was that information technology boom that is allowing jobs to leave to china and a few other nations if you think about it.

As your operating businesses are directly involved in the manufacturing sector, and you seem to have a great cognitive grasp of SMART economic policy, what is your take on this whole issue?

How can a country rely heavily on service jobs? If you trace how money moves through the system, what are the sectors the start the flow? For example, a barber cuts a person hair and gets paid, the person has the money to spend from their job as an ac serviceman, and he gets his money from servicing an AC system of someone who is a real estate agent, who makes their money from providing a service. What entity starts the flow of money to begin with? It would seem that it is unwise to rely heavily on the service industry for jobs.

Buffett’s solution to the trade deficit is to issue “import credits” in the exact amount of our exports, where any importers or overseas manufacturers would have to buy these credits in an open market based system, thus an overnight balancing of trade in theory.

What is your take on Buffett’s solution? What are your thoughts on:

1. The importance of this issue for our country

2. An explanation of the “stealth destruction” that our trade deficit and trade policy is causing as politicians don’t want to confront it, nor do they have a good solution

3. What would you like to see happen to America’s economic policy, and specifically the trade policy issue?I get more upset with our nations policies the more I read about this MAJOR problem, and the idiotic steps we have taken to get to this point. If you look at the job numbers from the mid 90s until now, it is absolutely scary, and I feel people underestimate just how important it is for us to stop sending our wealth out of this country. There is no one who can tell me that the USA compared to China and a few others countries has done better in the last 2 decades, our standard of living in comparison to other nations has CLEARLY gone down, and we are worse off that even our parents were. I feel that globalization and the lack of incentives to keep manufacturing capacity in the US is really bringing us down to other nation’s levels, not raising everyone up as was promised by free trade.

And trust me I know we live in a wonderful time with internet, and iPod holding 25,000 songs etc, but looking past that, how does a nation that is a superpower, properly take measures that will help maintain its superpower status, instead of slowly bleeding to death, as we are doing right before our eyes.

I still believe this is a great country, but I feel that we are letting too many other issues (other political crap) cloud out the most important issue we face to our overall well-being. I think that we have a very small window left in order to enact a policy to reverse the glaring problems with our economic policy. I feel that once the window is closed, that it will be a little too late, as China is setting itself up so well, and doing the exact things that will hog-tie us (holding so much US debt) in the future, that we will have no good solution.

Sorry to write a novel, but I hope that you can spend a little time and respond to me. I am actually so “upset” by our nation’s economic stupidity, I am trying to start a quasi-think tank / public policy institute to hopefully dumb down economics to the point where the typical American can understand and the socially put pressure on our representatives to take evasive action, somehow through the internet and other channels. Too many times economics are too complicated for the average person to understand unless you really dumb it down and provide easy to understand examples, such as Buffett attempted with Sanderville vs. thriftville.

I hope to have an open dialogue with intelligent people on this issue, and you are the first person I could think of to ask these questions.

– Adam R.

When American citizens buy more foreign goods (import) than we sell to foreigners (exports), we have to transfer part of our national wealth to foreigners. The amount we have to transfer to foreigners is called the trade deficit.

Think of it like a big, international credit card. When we buy more from the world than we sell it, the world takes our dollar bills and has to invest them. That means they are earning interest, dividends and rents and, over time, own an ever-expanding piece of the nation. This includes our real estate, our corporations, our bonds, our national artworks, and more.

The trade deficit represents a much bigger threat to our long-term domestic tranquility than the budget deficit, which is the national debt the government is incurring by spending more than it makes. The national debt is certainly a problem, but nowhere near as big a concern as the trade deficit to those who understand the implications of global economics.

To make this explanation easier to understand, I am going to approach this by breaking the essay down into five topic areas that we will cover as you work your way through it.

- Part I: Details how 2/3rds of the trade deficit could be solved by fixing a single import.

- Part II: Explains the specific manufacturing tax breaks and other incentives I would want to use to solve the trade deficit and encourage a domestic workforce.

- Part III: The rise of the knowledge worker vs. the manual worker and its implication on the growing gap between the rich and the poor.

- Part IV: Standards of living have not fallen for everyone except one specific category of people: white, straight, protestant, high school educated men. This is due to workplace access now being granted to all citizens, not just those with privilege.

- Part V: In this final section, I answer some of the other questions a reader submitted regarding how to solve the trade deficit.

How to Solve the Trade Deficit – The Short Answer

All this talk about the manufacturing base disappearing and cheap imports from Wal-Mart being responsible for the trade deficit has some truth but it is mostly a carefully crafted lie put out by a few of the most powerful special interest groups on the planet.

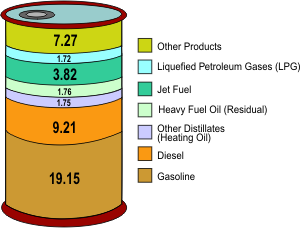

I’m not kidding. We could destroy the trade deficit tomorrow if we fixed one item: Imported petroleum products such as oil.

We Need to Import at Least 14 Million Barrels of Oil a Day to Operate

To keep the lights on, the United States needs roughly 21 million barrels of oil per day, yet our own domestic production only generates 7 million barrels of oil each day. That means we have to import 14 million barrels of oil every 24 hours just to make America run when we turn on a light switch, get in our car, or watch a movie.

This means the trade deficit is directly, and powerfully, influenced by the current price of crude oil and other petroleum products. To simplify, if oil is at $50 per barrel, our total shortfall, or imports, for that day are $700 million. If oil is $100 per barrel, we need to import $1.4 billion every 24 hours . If oil is at $125 a barrel, as it has been in the past, we need to borrow $1.75 billion per day from the rest of the world just to cover the short fall. Most of that money is going to countries and governments that hate us and our way of life.

When there is a recession, the price of oil collapses and the total oil consumed falls, too, which is why the United States trade deficit fell by more than 50% between 2008, when the recession began, and 2009, when the recession was full-blown raging.

In 2009, the United States had a trade deficit of $380.7 billion because we imported $1.9 trillion and exported $1.5 trillion. In effect, it meant that we consumed more than we produced and so we transferred $380.7 billion of our national wealth to foreigners to pay them for stuff we wanted to buy. They used those dollars to buy assets in the United States, meaning they are now collecting dividends, interest and rents on property within our borders that formerly belonged to fellow citizens.

In 2009, we imported almost $254 billion worth of petroleum products from the rest of the world. That means that if we were to become energy independent tomorrow, the trade deficit would have fallen by a staggering 66.7%. It literally solves 2/3rds of the trade deficit, which as you pointed out, Warren Buffett has called a far greater threat to our long-term financial well-being than the current budget deficits.

Politicians that tell you energy independence isn’t possible are either stupid or bought by the lobbies (perhaps both). We built the Eisenhower highway system when people thought it couldn’t be done. If America set her mind to it, we would be running on internally generated power sources within 10 years. Not only would we have the financial benefit of such a move, keeping our money within the American “family”, we also enjoy a national security benefit because we wouldn’t rely on countries halfway around the globe to power our infrastructure.

What about the other 32.3% of the trade deficit, you ask? It is covered almost entirely by passenger automobiles.

To make it as plain as possible: The trade deficit is a problem of petroleum and cars. Everything else is a tiny drop in the bucket when you look at the trade figures. The thing is, the energy companies don’t want anyone to realize this because they are literally larger, more powerful, and richer than all but a handful of the governments on Earth.

Problems like imported steel and outsourcing are, in many ways, dwarfed by the entrenched trade deficit caused by our addiction to crude. Special interest groups and unions make a point to blame all of their woes on cheap imported goods from China, when the real problem they are facing but are still in denial about – as I will discuss later – is software, automation and computer processing advancement. These forces are making manual work extinct.

How to Solve the Trade Deficit – The Medium Answer

My personal preference for solving the remaining minority of the trade deficit after solving the imported petroleum and oil problem includes rebuilding the manufacturing base. Part of this is a national security consideration. By ensuring we have enough production capability within our borders, we would be able to convert these to facilities in the event of another catastrophic global war. My preference would be:

- Substantial tax credits for manufacturers to diversify the economy and reduce our reliance upon service jobs. This includes things such as:

- Drastically reduced corporate tax rates for manufacturing plants

- Super-aggressive depreciation deductions for manufacturing plants but only for facilities physically located on United States soil in the 50 states and employing at least 95% domestic workforces.

- Huge incentives to repatriate foreign earnings (that is, profits made in foreign countries brought back to the United States) and reinvested on our own soil in domestic jobs. If General Electric can take its profits from Russia and China and put them to work in Indiana without paying a penny in Federal taxes, they will do it to improve returns for shareholders. Now, we have folks in Indianapolis with jobs instead of in Shanghai. Again, even though corporate taxes would be obliterated, you would have better, higher paying jobs and those individual citizens will be paying income taxes, state taxes, property taxes, and sales tax to the Federal, State, and Local governments.)

- A slightly higher tax rate on all profits from manufacturing plants located outside of the United States, including for licenses to manufacturer. If you own the patent to a device like a special hanger sold on television infomercials and you have it made in China instead of the United States, your taxes would be higher on the profits.

- Destroying the current American auto companies and starting over from scratch. The reality is that auto jobs are only going to be mid-tier jobs in the future; you can’t afford to pay someone $65 an hour plus health benefits. The “new” auto workers are those in health care and technology. We need to be able to produce cars for cheaper than Japan and China, no exceptions. If you want a good life, you need to be involved in the fields that are in demand and that can’t be outsourced easily. No one has a “right” to make a middle class living in a field just because their daddy did. When the whales died out, the whalers had to find a new livelihood. We need to make cars affordable and nice enough that anytime someone wants a new vehicle, they choose to buy American because we have the better, cheaper product not because they feel obligated to do so. That means that most of the existing auto workers are out of luck. As I mentioned in Part I, this alone would solve the remainder of the trade deficit.

Some Controversial Suggestions Others Have Proposed for Solving the Trade Deficits

There are a few other options for solving the trade deficit that many people don’t like (including some of which I hate) but they are worth mentioning:

- Trash the United States dollar by running huge fiscal deficits to lower the cost of exports, making our goods more attractive to the world. This is why billionaire bond investor Bill Gross recommended in an open-letter to then-candidate Obama that if he really cared about the middle class and saving the nation from horrible deflation, he would need to run deficits so massive they called him “Trillion Dollar Obama”. There are economists who disagree with this assessment, arguing that the yen has appreciated relative to the dollar yet Japan is still running long-term trade surpluses, so this is a debate for another time. Unfortunately, this pushes massive future tax burdens from interest expense onto the next generation. As a general rule, I’m not a fan of this approach.

- Establishing a bifurcated education system somewhat akin to Germany where teenagers who want to go into manufacturing, craftsmanship, and production based industries would separate off into a different school from those who were going into knowledge based careers and spend time training specifically for their desired occupation as opposed to learning, say, advanced trigonometry, which is useless to them. This may help restore pride to production based jobs and make them attractive to people who otherwise want to avoid the social stigma.

- Put massive tariffs in place to force people to buy American. I will discuss this in a later part of the essay so I don’t want to get into it now but I think, in general, it is a disastrous form of welfare that can kill the economy.

How to Solve the Trade Deficit – Knowledge Workers vs. Manual Workers

In many ways, your question about the trade deficit has very little to do with global trade policies and everything to do with the rise of the “knowledge worker” class that Peter Drucker predicted in 1959.

Drucker, the management guru who is to executives what Warren Buffett is to investors, realized decades before most of his contemporaries that rapid gains in technology would eventually result in blue collar jobs disappearing and causing somewhat of a crisis in the population. Drucker hypothesized that the economy would split into several major classes of employees: “knowledge workers”, “production workers” and “manual workers,” just to name a few.

What Is a Knowledge Worker?

A knowledge worker is someone who has a set of skills that cannot be easily replicated or automated. A heart surgeon, a nurse, a nuclear engineer, a chemist, and a lawyer are examples of knowledge workers. No matter who employs them, they are, for all intents and purposes, their own business.

A nurse can move across the country and find work at another hospital far easier than someone who flips burgers for a living because the competition for the fast food job is much more intense (after all, almost anyone can flip burgers but not everyone has the years of medical knowledge necessary to save people’s lives in a hospital setting). Likewise, an attorney can put up a shingle and go into business for himself, getting clients to pay him on a case-by-case basis.

Take someone who creates video games as an example of a knowledge worker. Based upon the skills he or she has, they probably think of themselves less as an “EA Games” person or a “Square Enix” person and more as a “video game” person. They are their own business. Their skills are portable. They can work for someone else, work for themselves by freelancing, or raise money and start their own company. If they can create an iPad or iPhone game and sell 100,000 copies for a $4 profit each after Apple’s cut, they earn the $400,000. Knowledge workers own their own means of production, which is the information and skills they have acquired through years of work, training, schooling and / or experience.

Every Advance In Technology Helps Further Destroy the Manual Worker

Software and automation are making it possible for machines to increase productivity so significantly that menial jobs will cease to exist at some point. For example, there are chemists that have created materials for subways that are capable of literally eating germs so the walls would never need to be cleaned. That means a much more pleasant subway experience but far fewer janitorial jobs. Robotics technology exists that would make it entirely possible for shopping carts to push themselves in from the parking lot, doing away with low-level retail jobs. Huge data servers at major banks can now do the work that would have taken thousands of bank clerks a century ago.

Regardless of whether or not global trade existed, these forces are constantly warring against the lowest skill jobs in the economy. In many ways, that is good because if that weren’t true, we would all still be living on farms we managed ourselves with many of us starving to death each winter. It was the tractor and farm machinery that allowed us to increase crop yields to the point that 99% of farmers went out of business (and into other industries). Self-checkout systems are another example of how productivity rises due to technology are making manual workers unnecessary. A machine can work 24 hours a day, 7 days a week, 365 days a year, and will never ask for a raise or a coffee break. This means less jobs, but on a macro scale, it frees up human labor and brain power for more important industries such as health care and technology if – and this is a big if – we don’t let governments and unions force us to keep these now-unnecessary positions for the sake of maintaining the status quo.

Every technological advancement that improves human life also kills a job and frees up society’s mental assets to focus elsewhere. Take the lowly blender. Think about how much longer it took to prepare certain recipes before it was created. Between it, better stoves, microwaves, cooking tools and training, it takes fewer people in a restaurant to produce food than it did a century ago. Those people are now free to try and become doctors, scientists, geologists, engineers, or professors.

Normally, this is good. When it becomes bad is when you have the mindset of people who take their emotional value from their work. They are an auto worker or they are a steelworker. Then, instead of “going west” like our ancestors did to pioneer new fields and retrain themselves, they dig in and become hateful, spiteful and useless to society. Sometimes, these people devolve into a neo-Luddite nutcases.

In fact, Drucker wrote, “The manual workers in the developed countries today have little self-respect. This inevitably makes them bitter, suspicious, distrustful of themselves, as well as of organization and management, and resentful.” Drucker goes on to say that the reason manual workers are watching their standard of living collapse is because they have yet to realize the real class warfare is not between the poor and the rich, but between the manual workers and the knowledge workers. That is the real story that no one has figured out, yet.

Let me give you an example of what that means …

The Pillow Factory Worker vs. The Software Designer

Imagine that you and your spouse work at a pillow factory for $50,000 a year each, or $100,000 total. This pillow factory is called Great American Pilllows, Inc. You adore the business because it allows you to make a great living, have fantastic health benefits and enjoy your job, even if it is a little boring. Your employer’s biggest client is Wal-Mart Stores, which carries the pillows you make with pride in thousands of its retail locations throughout the world.

One day, Wal-Mart informs Great American Pillows, Inc. that it can buy pillows from The Guatemalan Pillow Factory, Ltd. for only $2 wholesale instead of the $5 they are currently paying. That $3 savings will go directly to the billions of people who shop at Wal-Mart stores each year, in keeping with the company’s business model that requires passing savings on to the end customer. Unfortunately, Great American Pillows just can’t match that cost level and so it closes its doors and goes bankrupt.

Now, someone in Guatemala has your job but he can actually feed his family. You and your spouse are unemployed and there is no way you can earn $100,000 with only a high school diploma. But the real “transfer of wealth” is that everyone else in your home country can now buy pillows for cheaper. Every dollar they save is another dollar sitting in their bank account to be spent on something else.

In other words, a 22-year-old software designer making $70,000 per year working from his house by creating solutions for businesses now gets to keep more of his paycheck. He benefits in a very real way, as do millions of other Americans as well as the folks in Latin America. It just sucks for you, the former pillow maker.

In other words, the $100,000 salary you and your spouse made didn’t disappear. It is now being split by all American consumers and the Guatemalan work force.

It may be hard to understand because people are genetically wired to notice concentration; you don’t realize you are saving $3 on a pillow, but you do see the line of unemployed pillow makers outside the government benefits office. This is why research firms such as Global Insight have shown that the mere existence of Wal-Mart results in the average American family saving $2,500 per year on groceries and other items yet none of us seem to appreciate it because it comes $3 here and $1.20 there, not in one big check. This is another example of the psychology of human misjudgment Charlie Munger tells us to avoid.

It Comes Down to Knowledge Workers vs. Manual Workers – Not Just Americans. vs. Foreigners

Think about the implications of the last paragraph.

Put simply: We could, theoretically, save the auto jobs, the steel jobs, and the pillow jobs, protecting them from free market forces. But if the average American family is saving $2,500 per year from Wal-Mart importing low inflation (which is what it is really doing), prices would have to rise again so that each American family would have, on average, $2,500 less per year.

In effect, throwing up large trade tariffs would form a type of transfer tax that moved money from knowledge workers to manual workers. We would be taking money out of the pockets of the software designer, retirees and doctors and putting it into the paycheck of manual workers because we felt they were entitled to earn a certain wage from a certain type of labor.

As social policy, we may decide collectively that is fine (that is the nature of a Constitutional Republic with democratic underpinnings). But it also means it isn’t as simple as Guatemalan workers vs. American workers. It is also American manual workers versus American knowledge workers because if we save the steel worker jobs, the nurses and lawyers are going to pay more for pillows. There is no getting around that. It means they will have less money to spend on other goods and services.

Economically, the results are comparable to taxing someone who is employed to provide welfare entitlements for someone who refuses to work.

This basic economic force is going to inevitably lead to a one-world economy because the knowledge worker is going to be interested in what is best for his family. He probably isn’t going to care that someone in Guatemala is making more money at your expense. Why should he prefer you just because you are American? This will lead to a global class of knowledge workers and a global class of manual workers. People will identify more with where they fall in the economic system as a global citizen than their nationality.

The Rising Gap Between the Rich and the Poor

On the flip side of the coin, the transfer of money from manual workers to knowledge workers as a result of technology, automation and global trade working together in a powerful trinity is partly responsible for the rising gap between the rich and the poor (the other major cause has to do with the move to defined contribution retirement accounts instead of defined benefit retirement accounts but that would require a few thousand word essay and is far beyond the scope of this article).

As a society, this over-reliance upon the rich for economic growth can be disastrous because it results in far quicker swings between expansion and contraction compared to a system where money is more widely distributed. In fact, a strong middle class is, in many ways, the best system even for the rich because it provides them an insurance policy against a French Revolution style uprising (after all, most people don’t want palaces, they want to enjoy friends and family, good food, travel, and be entertained; there is nothing wrong with this).

The Increased Competition for Jobs Is Domestic, As Well

You mention that standards of living have fallen, despite gains in things like iPods with 25,000 songs and the ability to connect instantly through the Internet. The thing is: In many respects, it isn’t true – standards of living haven’t fallen – unless you fit one specific demographic, which we’ll talk about in a minute.

I pointed out a few months ago:

- Research that showed Americans alive today have more free time that any group of humans that have ever lived in history (you can read about it here). What do they do with that free time? Watch television. No, literally, the research showed that people used all of those extra hours to sit on the couch in front of the TV.

- Teen pregnancy and abortion rates are collapsing, which is promising for future poverty rates because having a child before the age of 25 is more likely to result in lifetime poverty.

- We live longer than any civilization in history.

- We have better pain management than any humans who have ever lived.

- We can cure more diseases than any humans who have ever lived.

- We can travel anywhere on the planet in under 20 hours.

- We consider full-home air conditioning and heat a basic human right when, only 90 years ago, the richest men on the planet suffered the heat just like the poorest worker.

Plus, you must consider that 50 years ago, blacks, Jews, gays, women, and anyone over 55 weren’t viable competitors in the work force because they were either paid a fraction of their white, male protestant counterparts, fired, or not even considered for positions. Unless you happened to fit into that one lucky genetic “lottery ticket” you were screwed.

Now, we are increasingly a meritocracy. In today’s workforce, you are far more likely to have your ideas compete with a much wider range of people. This is good for the civilization.

To put it bluntly: When you say things are getting worse from a standard of living perspective than they were several decades ago, the unspoken fact is that this is only true if you are a straight, white, male, protestant, high school graduate who wants to make a living without years of specialized training.

It is, in other words, only getting worse for those who were trained by society for generations to feel “entitled” to a job just by virtue of who they were, not what they knew. This is why you see so many older, white working class folks miserable and angry, screaming things like “I Want My Country Back!” or “Take My Country Back!”

For everyone else, standards of living are exponentially better than they were back in the so-called “golden years” but people’s expectations are higher. That is where the unhappiness originates. Even our “horrific” “unthinkable” unemployment of 10% would be the envy of most of the world, not just now but throughout all of history! But we consider it unacceptable because we have high expectations. We are the proverbial rich, spoiled brats who have no idea how good we have it. It is unfortunate, unpleasant but true. Somewhere along the line, we forgot just how blessed we are.

In other words, we stopped thinking of America as the land of opportunity where we had a shot at becoming successful and started thinking of it as a land of entitlement where we have a right to live how we want.

Competition for Jobs Is the Real Culprit, Not Just the Trade Deficit

Women are closer than ever to earnings parity with men. African Americans now sit in board rooms across the country. Nobody on Wall Street cares if you are Jewish any more. And, with the exception of the military, the United States government doesn’t fire people for being gay. That means more men and women are competing for jobs in the work force, which results in more meritocracy and competition for high paying jobs.

On a net civilization basis, we all benefit because the better quality people at work for us the better the chance we have at competing globally. After all, think about this: China has so many people that the top 20% of students, those who are smarter than 4 out of 5 of their peers, outnumber the entire United States population.

But make no mistake: The day of the “good ole boy” who wants to get married at 18, get a job at the factory, and raise his kids on a paycheck is over. It is never returning. I think a lot of the psychology of movements like the Tea Party, which have a good goal (lower government spending) is rooted in the desire to see the days return when people could feel secure. But I’ve told you that job security is, and always was, an illusion. It is never coming back; those who survive in the future economic world will have to be entrepreneurial, even if they are employees. That is the new standard. You must be your own business.

There are members of my own family who are younger than I am who still haven’t figured this out and they are going to end up broke, miserable and bitter by their mid-thirties. They have low reading comprehension, dress like they walked out of the inner city, and think it’s cute to wear their pants halfway off their ass. Forty years ago, they would have still gotten the job at the factory over a well-dressed, punctual, intelligent and hard working woman or African American man. Today, that isn’t the case. And, as much as I love them as family, I have to say this is a positive improvement for our culture and civilization.

Let’s recap: Now, a working class white man has to compete not just with his peers for “good jobs” but with people who are:

- Female

- African American

- Hispanic

- Gay

- Lesbian

- Jewish

- Muslim

- Hindu

- Transgender

- Non-American

Thus, the plight of the working class is not just a story of the trade deficit alone but an unraveling of the entitlement privileged system that gave them first shot at jobs and opportunities at the expense of everyone else in the world. Those days are over. Gone. They are never returning. Nah nah nah nah, nah nah nah nah, hey, hey … Goodbye.

How Do We Fix the Situation?

The question, then, remains: How do we fix the trade deficit? I already told you: Oil and automobiles does it. Add in the tax incentives for manufacturing and I think you’re there. But let’s discuss some of the options that people seem fond of throwing up whenever solving the trade deficit is discussed:

Trade Tariffs: If we throw up huge trade tariffs, we already know that other countries will retaliate, our exports will drop off a cliff, and the price of everything will rise because tariffs are a transfer tax from the general population to specific employees in specific industries. Trade tariffs are a form of targeted welfare. As a nation, if we put a tariff on foreign steel, we are indirectly saying that we believe steel workers should be entitled to a certain wage even if the free market disagrees so we are going to tax everyone else in the form of higher prices to support this belief. I told you earlier tariffs are a transfer tax (welfare) from knowledge workers to manual workers.

Increased Entitlement Benefits: Drucker said that socialistic tax rates might very well become reality to avoid a French Revolution style disaster but it would cause significant problems for society for several reasons:

- If a man feels like he has no value and is living off the system, his despondency may grow to hopelessness, violence, suicide or disengagement from helping build the civilization

- Those who are still gainfully employed as knowledge workers are going to grow resentful and spiteful of those who accept the government benefits because they will find it insulting they had to go to school for so many years, at such great cost, only to turn around and give part of their paycheck to people they perceive as lazy.

- People like me would join in the “capital flight” and invest our money in other countries, perhaps even moving outside of the United States. If we can’t do what we love and earn a good return, we aren’t going to stick around just to get badmouthed and beat up all the time.

An Import / Export Credit System: This is what Buffett proposed, although Munger didn’t like it. I believe the import / export credit system suffers from the same drawbacks of trade tariffs, in my opinion, because if the Japanese make a better car for a lower price, limiting the availability of that product to consumers is indirectly a tax forcing them to buy an inferior product at a higher price simply for the sake of supporting their neighbors.

It is a form of welfare transfer, something not “earned” by providing a service or product people want to buy freely. I want America to win but only if it makes products people want. If the Japanese are beating us because they have better goods, better service, and better technology, it irks my sense of fairness to punish them and consumers by forcing everyone to buy from someone who happens to be American but makes inferior goods.

I buy French perfumes because Creed is one of the best products in the world. But when it comes to pianos, I adore Steinway & Sons, which has a factory in Queens, New York (with my second favorite brand being Bosendorfer from Vienna, Austria). My car of choice is a Jaguar. Aaron’s car of choice is a Lexus. We both contributed to the trade deficit in that regard. But the reality is, none of the other makes and models we looked at when making our car decisions came close to the quality and price that we received for those two automobiles. The idea that I must buy a Ford because Americans make it really offends my sense of fair play. A Cadillac is nice but a Lexus is better.

How about the domestic car companies stop complaining about that fact and create a product I want to buy more than a Lexus?

(Oh, and please don’t get me started on those idiots who have bumper stickers like: “Take my American flag off your foreign car.” What they are really saying is, “I know we didn’t make a product you want to buy. I know it doesn’t compete in quality or price with other companies such as Toyota or Mercedes. But, damn it, I feel entitled to force you to buy what I sell and you are a crappy person for disagreeing with me because I know how you should spend your money better than you do.”)

I believe in meritocracy and that the best products and services should win. That means that even though I want America to win, I don’t think she has a right to win if we don’t do what is necessary to secure the victory.

You asked, “What starts the initial flow of money in an economy?“

As I wrote a few days ago, money doesn’t actually exist. It is an idea – a concept we use as humans to describe an exchange mechanism to trade one thing we have for something else that we want. In fact, the United States has an estimated household net worth of more than $50 trillion, yet less than 1% of that exists in actual pieces of paper that the Treasury department prints … well, technically it is the Bureau of Engraving and Printing but you get the point.

Using your example: If I offer to sweep a barber’s floor (give up my labor and time) for a hair cut (his time and skills), in the period between when I finish the job and he cuts my hair, we have created money because I have a claim check on his services. It could take the form of his word (a promise) or a symbol (a slip of paper, sea shells, or metal coins).

To make the point, if I decided that I didn’t want a hair cut, I could go across the street to the farmer and offer to trade him the hair cut the barber owed me for a basket of apples. Now, we have an entire economy going. Multiply this by 6 or 7 billion people and that is how it happens.

Any time two people agree to exchange something for something else, and there is a period between when that exchange occurs, money has been created. It is happening every day, all day. It is more like a circular, self-sustaining chemical reaction than a flow chart of cause and effect.

Whether or not an economy can exist solely on a service model depends upon human needs. If we get to the point that automation is so advanced we can make virtually any product for next to nothing then, of course it can, because it comes down to creating claim checks for future goods or services. We aren’t at that point, yet, and are probably centuries away from achieving it. For that reason, from a purely strategic and national defense perspective, I would prefer to have a strong domestic manufacturing and agricultural base.

You asked, “How is a nation that is a superpower, properly take measures that will help maintain its superpower status?”

We already have the military might – once your nation goes nuclear you don’t need to worry about getting wiped off the map – but in terms of economics, the United States is destined to play second fiddle to China and India. That isn’t a depressing fact because what matters isn’t our size relative to the rest of the world but, rather, the absolute standard of living for the average American family.

Money doesn’t actually exist. It is an idea … a claim check on society that lets you cash it in for goods or services. There are all types of “money” including sexual capital, whereby an attractive man or woman can get a diamond watch by sleeping with a wealthy sugar daddy or mama, or intellectual capital with which someone who is intelligent can trade soy bean futures and make money to buy a house. The printed pieces of paper we carry in our wallets are just symbols. It is faith that these symbols are worth something that makes the world go ’round.

As I said earlier, the top 20% of brain power in China exceeds the entire population of the United States. Now that the sleeping giant has awaken, it owns the next century. This shouldn’t concern you. All you should focus on is, again, the absolute standard of living for the average American family. To somehow be emotionally or intellectually miserable that we aren’t the most powerful nation on earth in terms of money is idiotic. It’s like two trust fund brats fighting and being depressed because one of them has a few extra million than the other. If both of their families can afford the same lifestyle, the numbers are meaningless. The Chinese economy will be larger than the American economy at some point. To deny that point is to either ignore reality or to wish that the Chinese people continue to exist on only a few thousand dollars a year, which is cruel. (For more information, read Why the Chinese Economy Is Destined to Be Larger than the Economy of the United States and What a Chinese Superpower Means to the United States.)

Consider the Netherlands, Finland, Denmark, Sweden, and Norway, which always crush the United States in happiness and standard of living surveys. Our economic size hasn’t caused them to sink into depression. They keep producing companies like Shell Oil, Unilever, and ING, making money each year and striving to make life better for the average citizen.

Personally, I’d like to see America become the equivalent of Silicon Valley. It is a significant, though not overpowering, segment of the global economy. Yet, it is incredibly respected and creates products and services that revolutionize the world and make life better. That should be the American business model. We are the best innovators on the planet. The Germans manufacture better and with more precision than we do. The Japanese can take complex systems and make them simple.

This, however, goes back to our knowledge worker vs. manual worker struggle. To show up at the office, wear a cashmere sweater, code some lines with Mac Cocoa, and then collect royalties on the product you imagined and produced requires years of specialized knowledge. If you are growing up in the inner city, worrying about getting shot on the way to school or don’t have access to computer systems, it is infinitely more difficult to go into a lucrative career such as technology because by the time you are 18 years old, you are already a decade behind the folks who attended private schools or lived in wealthy upper-middle-class suburbs.

This structural inequality creates a permanent underclass that only a handful of people escape each year.

The Final Recap on How to Solve the Trade Deficit

To review, to solve the trade deficit, I would:

- Force energy independence through whatever means necessary, even if it meant taxing gasoline at $100 a gallon but warning American consumers that it wouldn’t go into effect for 3 to 4 years, giving the free market enough time to come up with a solution.

- Providing massive tax breaks for domestic manufacturing businesses that have at least 95% domestic workforces, as well as for any repatriated foreign earnings that are put to work back here at home in the United States.

- Creating better training programs through schools designed for the knowledge worker economy. High schools are still turning out manufacturing-oriented workers. They are dinosaurs that teach people to produce rather than to think, create and solve problems.

The first two items alone would fix the trade deficit in almost no time without resorting to tariffs, which are nothing but a transfer tax achieving targeted welfare.

[mainbodyad]