[vc_row][vc_column][vc_column_text css_animation=”none”] [/vc_column_text]

[/vc_column_text]

I’ve been thinking about the next 25 to 50 years; mapping out plans for my personal life, my family, the firm, and, to some degree, certain societal changes that I think are important and worthy of significant political and financial investment. Part of this involves estate planning and how we think about leaving money to our future children.

Johnson & Johnson is one of the most successful businesses in global history but its rise to preeminence resulted in an ugly family battle that left a wake of victims behind the misbehavior of two deeply flawed brothers.

My morning was spent reading the New Hampshire Bar Journal, Winter 2010 edition because I was interested in a piece by Joseph F. McDonald, III called Migrating Trusts to New Hampshire: The “Why” and the “How”. New Hampshire, along with a very few other states, allows the existence of something known as a “silent trust” or “quiet trust”. It made me realize: I think a person could use these to drive a truck through the college financial aid process.

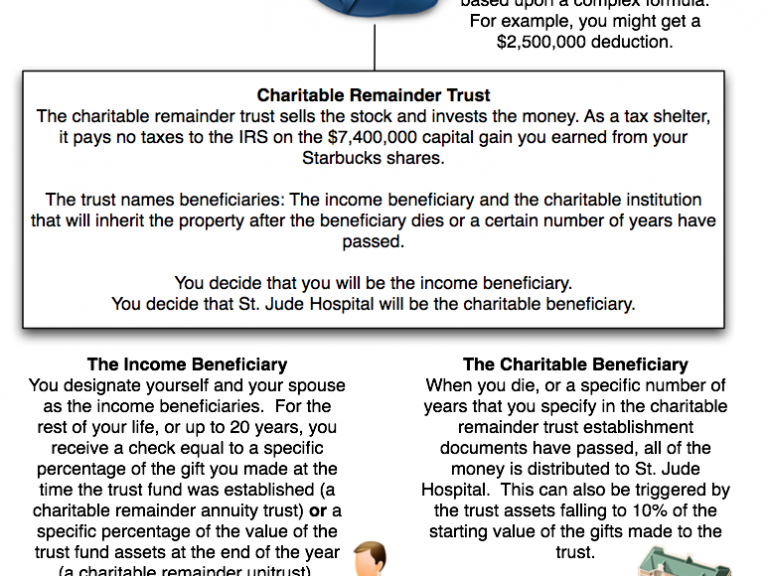

The past day or so, some prominent bloggers have been attacking Mitt Romney for using something known as a charitable remainder trust as a way to lower his tax bill. As someone who is voting for President Obama, let me tell you flatly: This is nonsense. The people demonizing Mitt Romney for his use of…

I have talked to you about ways to you can use trust funds to build wealth, and even talked to you about some of the interesting trust funds we saw in college. I recently encountered a young man who, upon turning 18 this year, found himself with a trust fund. The fund contains between $1,500,000…

I’ve been talking a lot about trust funds lately. I calculated that if someone put $50,000 in a trust fund today, 70 years from now, they could have a dynasty trust paying each of their heirs a $25,000 cash check (in today’s dollars, net of taxes) at Christmas. There are a lot of assumptions that may not pan out in that figure, but it’s a decent guess.

Trust funds are terribly misunderstood. They are one of the most flexible planning tools to nurture, create, and pass on wealth ever known to man. They can be as rigid or as flexible as you desire. Even more importantly, you don’t have to be rich to use trust funds. These structures are not relegated to the realm of the Rockefeller and Walton families.

[vc_empty_space][vc_column_text css_animation=”none”]

[/vc_column_text][/vc_column][/vc_row]