The past day or so, some prominent bloggers have been attacking Mitt Romney for using something known as a charitable remainder trust as a way to lower his tax bill. As someone who is voting for President Obama, let me tell you flatly: This is nonsense. The people demonizing Mitt Romney for his use of this financial special type of trust fund are showing their ignorance by discussing a topic they don’t understand. To write as if he (Romney) were doing something unethical is, in my opinion, intellectual dishonesty and sham journalism.

A charitable remainder trust can do enormous good for a non-profit, generate income upon which you can live, avoid taxes, and even generate tax write-offs.

There is nothing wrong with using a charitable remainder trust as a way to provide income for your family, lower your taxes, and give to worthy causes. In fact, nearly every major university, church, and charity in the nation actively seeks them as part of their planned giving activities. I’m crazy about what they can do for everyone involved, when properly structured, and have even looked into setting up a few for some of my family members. It is a virtual certainty that if the rules remain the same, they will be part of my household estate planning.

Three Benefits of Using Charitable Remainder Trusts

A charitable remainder trust is a special type of trust fund that achieves three things:

- It generates income for a beneficiary of the trust fund to live upon

- It results in a significant gift to a non-profit charitable institution at the end of a set amount of year or when the beneficiary dies

- It lets the person making the donation avoid capital gains taxes on appreciated investments, resulting in more money for both the beneficiary and the charitable institution

Basically, the person making the donation gets to avoid capital gain taxes on an appreciated investment, the beneficiary gets to receive checks (often for life or a term up to 20 years), and the non-profit gets to receive a large lump sum donation in the future in exchange for “renting” its tax-free status, as some in the media have described the process.

[mainbodyad]Many people name themselves as the income beneficiary, but that isn’t a requirement. You could name children, grandchildren, aging parents, random beneficiaries you wanted to help, or a starving artist to whom you wanted to serve as patron.

The Two Types of Charitable Remainder Trusts

There are two different ways you can structure your charitable annuity trust. The big difference has to do with the check the income beneficiary receives. One is fixed based on the initial value of the trust, the other is variable and will fluctuate with the net worth of the trust.

- Charitable Remainder Unitrust (also called CRUT for short): When you choose this structure, you make a donation and the income beneficiary will receive a percentage of the total value of the trust fund, which will fluctuate with the value of the underlying investments. If you donate $500,000 and the beneficiary payout is set to 5%, he or she will receive $25,000 in the first year. If, the next year, the trust fund has grown to $1,000,000, he or she will receive $50,000.

- Charitable Remainder Annuity (also called CRAT for short): When you choose this structure, you make a donation and the beneficiary will receive a fixed amount of money based upon the total donation at the time the trust fund was established. For example, if you donated $500,000 and your beneficiary was going to receive 5% per year, they would receive $25,000 per year regardless of the value of the trust fund itself.

In all cases, the IRS demands that the payout be no less than 5% and no more than 50% per annum. It also requires that the charitable organization receive at least 10% of the fair market value of any gifts made to the trust, at which point the checks would stop being sent to the income beneficiary.

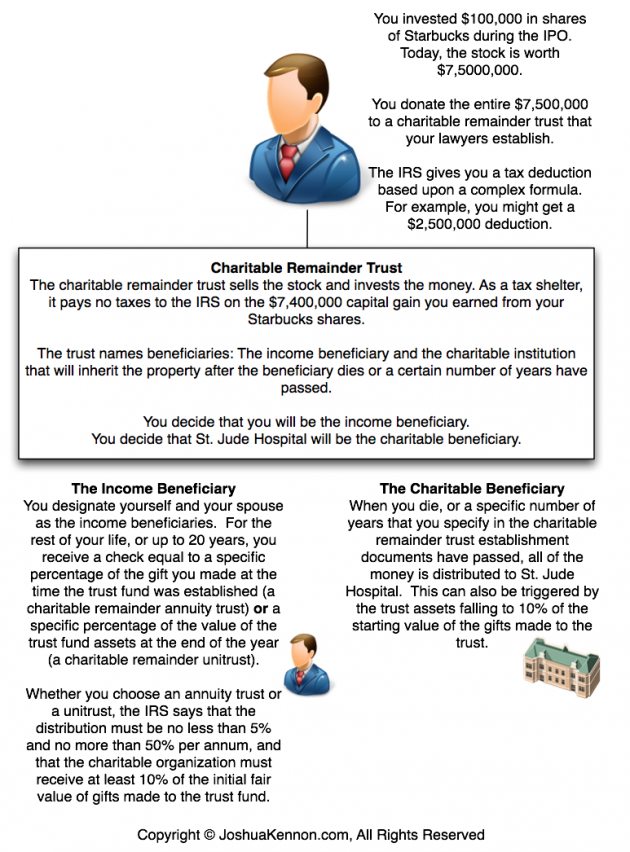

A Visual Look at How a Charitable Remainder Trust Might Work

Remember our case study of the Starbucks IPO? Imagine that had been your life and you put $100,000 into the stock back then, only to find yourself now sitting on $7,500,000 worth of shares in the coffee empire. If you sell your stock and give the proceeds to charity, you are going to owe more than $1,100,000 in capital gains. Using a charitable remainder trust, you can set it up so that the charity gets the entire $7,500,000, the IRS gets no capital gains taxes, and you still get to collect dividends, interests, and rents on the money.

This diagram should help you visualize the process:

In both cases, if you chose a 5% payout, the income beneficiary (you) would get a check for $375,000 at the end of year one ($7,500,000 x 5% = $375,000). If you went with the annuity plan, that is the check you’d get every year. If you went with the unitrust plan, the figure would fluctuate based on the trust value. That is the money you could use to live on for the rest of your life, creating a de facto pension plan for yourself.

Why Non-Profits Love Charitable Remainder Trusts

From churches to universities, opera houses to hospitals, charities love charitable remainder trusts because the gifts are irrevocable. Although the charitable beneficiary can be changed in some situations, once assets are transferred into a CRT, that money is destined for the non-profit world. It makes planning long-term projects easier, as well. If you are a school, and you know that your institution is the charitable beneficiary of charitable remainder trust with $10,000,000 in assets, it isn’t hard to calculate the life expectancy of the income beneficiary to match up your capital budget plans.

You Can Setup a Charitable Remainder Trust With As Little as $50,000 to $250,000 In Assets

Different non-profits set their own limits, but you can setup charitable remainder trusts with most places for as little as $50,000, in the case of annuity trusts, or $100,000 in the case of unitrusts. Sometimes, the limits can be higher for illiquid assets, such as real estate or shares of a private company.

As horrible as it sounds, using this sort of planning tool can also be a way to prevent family members you don’t like from receiving an inheritance. The assets held in a charitable remainder trust aren’t included in your estate. That means not only do you get to exclude the money for gift tax purposes, if you do your planning right, you wouldn’t even have to notify your heirs that it existed.

The coolest use of charitable remainder trust funds? You can use the income from the trust to buy a life insurance policy equal to the original gift, and essentially have your heirs get the money back tax-free via the insurance proceeds, while giving a large amount to charity. In essence, your kids and the non-profit get to keep everything and the IRS gets very little. That is how Congress wrote the rules. This sort of thing would require good attorneys and tax accountants, though.

[mainbodyad]