Mail Bag: How to Read Large Numbers on Financial Statements

A question about reading numbers on financial statements …

My seemingly dumb business administration 102 professor has made what I think is a huge error on grading my last midterm, my question is as follows. On a balance sheet that is stated in terms of millions there is the number $74,000 (according to her) that number is equal to 74,000,000 dollars. Is this correct? My previous understanding was that $74,000 on a balance sheet in millions would be equivalent to 74,000,000,000.

[Name and University Redacted]

You are right. She is wrong.

The number $74,000 on a financial statement expressed in millions is $74,000,000,000, or $74 billion. For future reference, remember:

- Financial statements expressed in millions = Multiply by 1,000,000

- Financial statements express in thousands = Multiply by 1,000

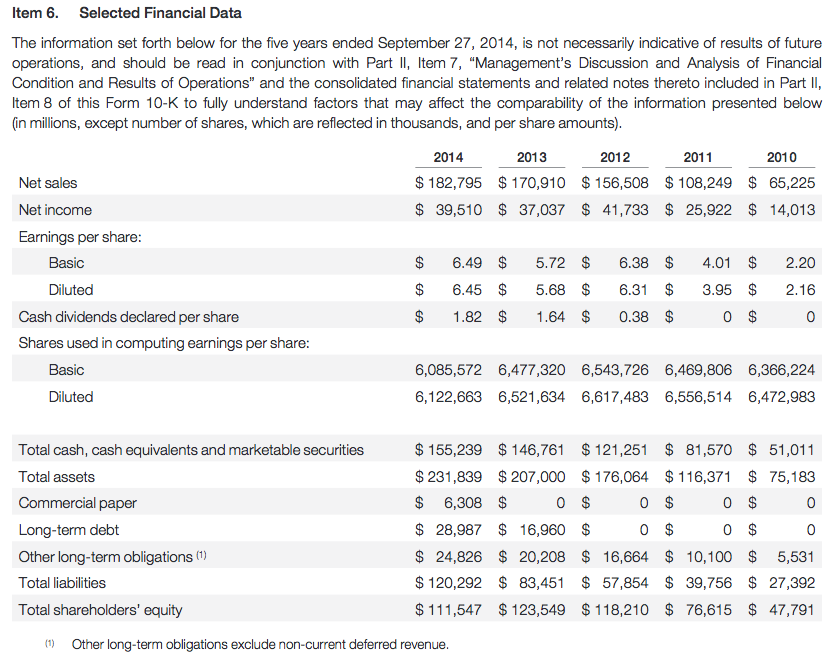

Let’s look at some real-world examples. We’ll start with the most valuable publicly traded company in the world, Apple, Inc. Pulling its most recent 10-K filing with the SEC, we get this:

Notice the disclaimer that figures are “in millions, except number of shares, which are reflected in thousands, and per share amounts”.

Notice the disclaimer that figures are “in millions, except number of shares, which are reflected in thousands, and per share amounts”.

The $39,510 shown on net income is $39,510,000,000. That is $39.51 billion in net profit. Apple has a market capitalization of almost $725 billion. That puts it at around 18.3x last year’s earnings.

(If your professor were correct, it would have earned only $39,510,000, or $39.51 million. That would mean investors are valuing the business at a price-to-earnings ratio of 18,350. Since the last time I checked, hell had neither frozen over nor had pigs begun to fly, she should be able to spot her error if you point that fact out to her. If, God help us all, you are saying she has already looked at it and insisted her way is correct, that it wasn’t just an honest mistake in a moment of being tired, I’d take it to the dean and perhaps even file a formal complaint with the teachers’ union. It would be educational malpractice and a sign she doesn’t have a clue what she is doing. She should not be teaching a course but it’s hard for me to imagine anyone like that having a job, especially at a university with a world-class reputation like the one you attend, because this is basic, fundamental mathematics you learn in fourth grade. It’s not like she misinterpreted an IFRS or GAAP regulation or something, which might at least be understandable.)

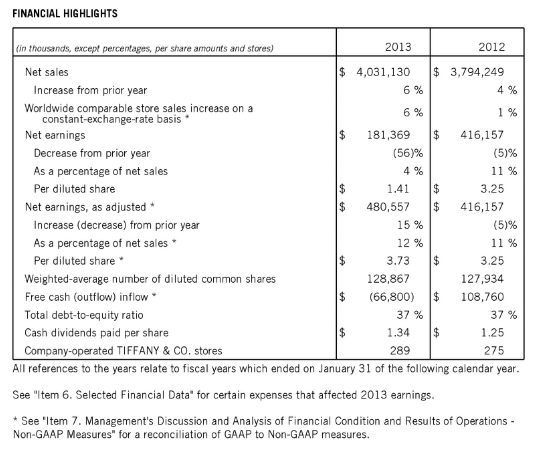

For your own reference, some companies will short-hand in thousands but they disclaim this explicitly on the financial statements. Let’s look at Tiffany & Company, which shows “$181,369” in net earnings. Obviously, Tiffany & Company didn’t make more than Apple despite a bigger number on its financial highlight page but since it says figures are in thousands, except percentages, per share amounts, and the number of retail stores, we know we have to make an adjustment, adding only three zeros, instead of six. After-tax profits were $181,369,000, or $181.369 million.

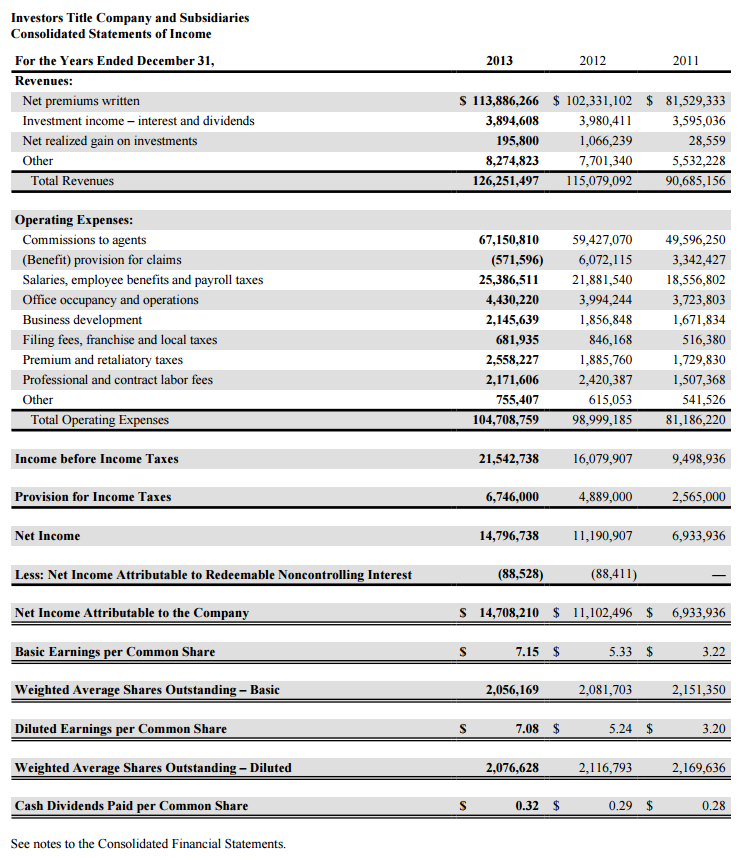

Meanwhile, Investors Title Company, one of the first small companies I could find on short notice that follows such a practice, doesn’t abbreviate its income statement at all. The $14,796,738 in net income is just shy of $14.8 million.

Meanwhile, Investors Title Company, one of the first small companies I could find on short notice that follows such a practice, doesn’t abbreviate its income statement at all. The $14,796,738 in net income is just shy of $14.8 million.