Morningstar Is Getting Closer On Its Intrinsic Value Figure for Berkshire Hathaway

It’s been 1-2 years since we talked about the intrinsic value of Berkshire Hathaway. The last time I publicly commented in any meaningful way was to say that I thought Morningstar was wrong in its model. This put me in the interesting position that rarely happens: I thought intrinsic value was higher than the analysts who were publicly writing about it. Normally, I’m the one exclaiming that the estimates and variables used were too rosy.

Back then, Morningstar said it believed Berkshire Hathaway Class B shares were worth $89 each. If the company had broken up by unit, the insurance businesses were worth $49, the manufacturing, service, and retail businesses were worth $16, the railroad, energy, and utility businesses were worth $20, and the financial business was worth $4. I pegged intrinsic value between $100 and $115 per share with a maximum justifiable valuation at $132 per share (e.g., you were going to buy a very large block for a very long time or take control of the business).

I spent much of 2011 and, if I recall, 2012, buying additional shares of Berkshire Hathaway for my own accounts, as well as those of my family members; though I did have to sell a block of shares at one point to help come up with the cash necessary to buyout the other members of one of my limited liability companies, which offered far higher returns than even a cheap Berkshire Hathaway ever could. In September of 2011, the stock hit a low of 1.075x book value, which is the most undervalued it has ever been in my lifetime. It’s since rebounded a bit, and trades at $96 per share against a book value of $76 or so.

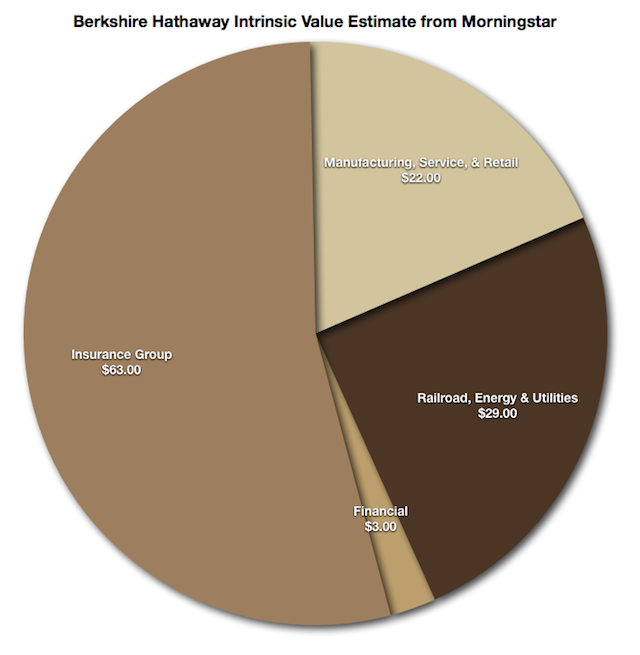

The new model for Berkshire Hathaway’s intrinsic value seems much more reasonable, though I still think they are a bit too low. Morningstar argues that, were it split into four different companies, the sum-of-the-parts valuation would be as follows: That is a grand total of $117 per Class B share for the conglomerate itself.

That is a grand total of $117 per Class B share for the conglomerate itself.

I think the intrinsic value is between $125 and $130 per share, myself, compared to the $96 stock price. If the company is fairly valued 10 years from now – and there is no guarantee that it will be or that some horrific disaster won’t befall the firm or the nation – in a normal, ordinary blue-sky world of an average range of returns, the stock should have an intrinsic value of $250 to $500 per Class B share were there no dividend distributions. (Large dividend distributions, or even the introduction of an on-going dividend policy, would change that figure as less capital would pile up for management to invest.)

I’m content to stick with the no-dividend policy at present. I have shares on my balance sheet that were bought at a fraction of current market value and intrinsic value, paid for back when I was a student. I’m not really fond of the idea of selling unless it is for portfolio reasons (e.g., too high a concentration due to other factors), even if the stock became overvalued. The moment Warren Buffett and Charlie Munger are gone, however, I will probably be one of those in the chorus of people demanding some sort of reasonable distribution policy. The successors can’t poorly allocate that which has already been sent to the owners and empirical study after empirical study has shown that dividend policies force discipline onto management. Buffett and Munger don’t need discipline; they have it in spades.

Were Berkshire Hathaway to ever reach the limits of its size, and turn on the spigot, it would fundamentally transform my public stockholdings. There would be money coming in from nearly every account and in amounts that would significantly increase the cash I had to redeploy from common stock investments. I have one personal retirement fund where roughly half the assets are in low-cost Berkshire Hathaway shares bought over time. Even a small 2% to 3% annual dividend would radically change the characteristics of that plan. That wasn’t by design – I just bought what was cheap at the time and was appropriate for a very long-term, low-risk collection of assets.

This is on my mind today because I’m doing my first quarter review of all of our holdings; where the money is, how it is invested, what the correlated risks are, et cetera, and I happened to mention it in the post of Coca-Cola earlier.