With the talk of investing in Walt Disney shares as part of my souvenir program during my weekend trip to Disneyland in California, I thought it would be fun to go back and do a case study of the Walt Disney IPO. I originally got the idea the last time we were in Walt Disney World, and had started the draft but never finished it. I took some time this afternoon to wrap it up and hit the publish button.

The history of the firm is an interesting one, not just from a commercial perspective, but because Walt Disney literally exported American art to the world and helped it become more powerful than any nation since Rome and Great Britain through a form of cultural imperialism. Were life a game of Civilization, Walt Disney was a “Great Artist” that could lead you to a cultural victory, make your people happy, and help you make money through increased productivity. Here is how he did it.

Disney Brothers Cartoon Studio was founded on October 16th, 1923 by brothers Walt and Roy Disney. (The company’s famous mascot, Mickey Mouse, wouldn’t be created for another five years after a painful episode involving the loss of one of Walt’s first successful characters, Oswald the Lucky Rabbit. Walt Disney himself did the voice of Mickey all the way through 1946, when he had to relinquish it due to a combination of the time constrains of managing the ever-growing studio and the toll his smoking habit had taken on his vocal chords).

[mainbodyad]In 1937, Disney released its first full-length animated feature, Snow White and the Seven Dwarves, which singlehandedly made animation a respected form of art, won Academy Awards, and filled the coffers with cash. It was that money that Walt Disney and his brother used to buy the land in Burbank on which the much-expanded Disney studios would be built. It was the internal cash generator that then threw off capital for everything else, as Donald, Goofy, Uncle Scrooge, and the rest of the characters developed.

It is, poetically, the reason the Walt Disney Company headquarters is held up by the seven dwarves. It was on their backs that the entire empire was built. It’s one of my favorite examples of emotionally and historically relevant allegory in architecture.

The Walt Disney Company Headquarters reflects the fact that the business was only possible due to the enormous financial and critical success of Snow White and the Seven Dwarves.

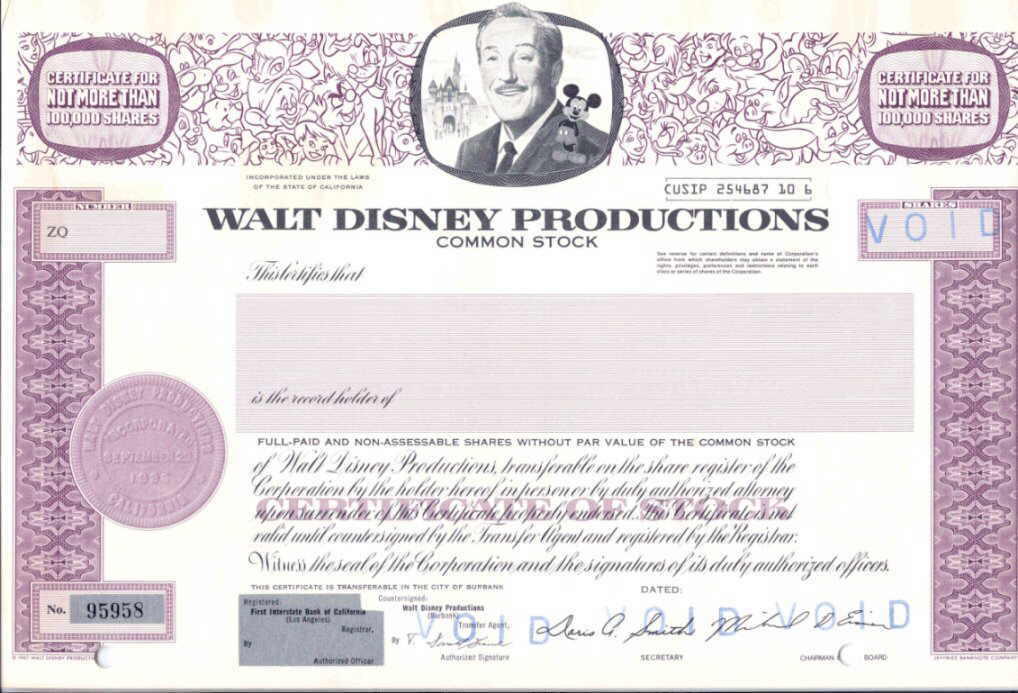

Years passed, Walt Disney continued to expand, and thirty four years after its start, in 1957, the company went public in an IPO. The shares were sold to new investors who wanted an ownership stake in the animation firm at $13.88 each. The business was called Walt Disney Productions and had been used as a way to consolidate several other businesses that Walt had setup over the years under a single umbrella. WDP had been trading over-the-counter as a closely held, private company for years, and had even tapped the capital markets before when it issued 155,000 shares of 6% cumulative convertible preferred stock in the OTC market on April 2nd, 1940. The firm didn’t change its name to The Walt Disney Company until 1986, when the Board of Directors decided it wanted to honor the founder and reflect that the business was more than a movie studio, having expanded into television, theme parks, radio, and more.

Walt Disney Productions, later renamed The Walt Disney Company, went public in 1957. It had traded on the over-the-counter market for years prior to this move.

Quite controversial, especially to his brother Roy Disney, was the fact that alongside this publicly traded business, Walt Disney ran a private family holding company originally called Walt Disney, Inc., then renamed WED Enterprises, then renamed Retlaw Enterprises, that he used to redirect money to his own family and heirs using techniques Roy found disgusting. For example, Walt built the Monorail and Railroad and Disneyland, but made sure his private company owned it so that Walt Disney Productions, the public business, had to pay his family for the right to use it. Between 1955 and 1981, the public business sent the private company $75 million, that came right out of stockholders’ pockets! I wrote an extensive overview of how he pulled this off, which you can read here.

In 1966, Walt Disney died from lung cancer and twenty years later. In 1991, Disney was added to the Dow Jones Industrial Average as one of the thirty component stocks.

Investing In The Walt Disney IPO Would Have Made Your Family Very Rich

Imagine that you had purchased 1,000 shares on the day of the IPO, writing a check for $13,880 plus commissions to your stock broker. You stuck the shares in a vault, and ignored them for the past 56 years. How many shares would you have today? To calculate that, we need to look at the stock splits.

- October 26, 1967 2-1 split = 2,000 shares

- February 4th, 1971 2-1 split = 4,000 shares

- December 6th, 1972 2-1 split = 8,000 shares

- February 10th, 1986 4-1 split = 32,000 shares

- April 20th, 1992 4-1 split = 128,000 shares

- June 19th, 1998 3-1 split = 384,000 shares

As of today, Walt Disney Company stock is selling for $63.51 per share. Your $13,880 position would now be worth:

- 384,000 shares of Walt Disney Company stock with a market value of $24,387,840

- Cash dividends, before taxes and inflation adjustments, worth approximately $2,284,800. This significantly understates the dividend income because $1 in dividend income in the past had far more purchasing power than $1 in dividend income today.

- 29,491 shares of Citadel Broadcasting Corporation, which was spun-off in 2007 and opened for trading at $20.75 per share. Had you sold on the day of the IPO, you would have pocketed $611,938 or so before taxes. Had you held, you would have watched the company get driven into the ground by mismanagement before filing bankruptcy. Thus, how much you ended up with from the former ABC Radio assets depends on how quickly you were willing to liquidate the shares that were deposited into your brokerage account or mailed to you. Given that the business was losing more than $1 billion dollars per year at the time of the spinoff, and had been barely profitable in the past, I’d have dumped it. You know my philosophy: Investing is the process of buying profits and dividends. A company that can’t provide those at a reasonable price isn’t an investment. I have no interest in owning it outside of a speculation portfolio.

It is difficult to say how much you would have made had you invested in the Walt Disney IPO but one thing is certain: You grew very rich. Mickey Mouse took your dollar bills and multiplied them at an exponential rate so extraordinary it makes the story of the second miracle of Jesus Christ using 7 loaves of bread and 2 fishes to feed five thousand people look positively amateurish. And that is without dividend reinvestment! Had you reinvested your dividends, you would have ended up with even more wealth; to see the power of how crazy it can be, look at the difference between reinvestment and not reinvestment for Coca-Cola over roughly the same time period.

[mainbodyad]If you had to ballpark it, depending on how you held your shares (tax shelters), whether you reinvested your dividends, whether you sold your spinoff stock or not, if you did sell, whether you used the proceeds to pour it back into the parent Walt Disney Company, et cetera, the 1,000 shares you bought for $13,800 back at the IPO would now be worth somewhere between $26,672,640 and $40,000,000. It’s up there with the all-time greatest hits of capitalism. Walt Disney’s idea of moving picture drawings earned him a place among titans such as John D. Rockefeller and Bill Gates. Had he not passed away at such a relatively young age from lung cancer caused by his smoking, who knows how wealthy he would have become, personally. When he died in 1966, he left behind $100 million for his heirs, which is about $700 million now, but he was about to open what he called “the Florida project”, and what we now refer to as Walt Disney World. Had he still been around at Warren Buffett or Charlie Munger’s age, the man would have been a multi-billionaire.

The reason the shares have been so unappealing for the past 15 years is the dot-com boom resulted in Disney, which had its Go Media Network back in those days, skyrocketing to absurd valuations. It took a long time for the underlying earnings to catch up with the inflated market value. Back in 1999, for example, investors were willing to pay an average of $46 to buy $1 of profit from Disney. Today, they are willing to pay a much more reasonable $18 for every $1 in profit (and the profit is far better diversified with a much broader range of intellectual assets). This resulted in net profits rising from 66¢ per share to $3.13 per share, increasing by 474%+ but the stock only increasing by 100% or so as the valuation multiple compressed. It would have probably been better for the stock to crash and get it all out of the system overnight, but that was not to be. Disney shares continued to happily float along for more than a decade as the underlying profits caught up to reality.

A Lesson from the Walt Disney Company and Warren Buffett

When asked about the single greatest investing mistake he ever made, Warren Buffett often says it is a mistake of omission, rather than commission. In the 1960’s, he used his investment partnership to buy 5% of what is now The Walt Disney Company. He paid $4 million for his stake, and sold it twelve months later for $6 million, pocketing a cool $2 million. As he said in one speech to students back in 1991, that was a lot of money in those days and he felt wonderful about how smart he was.

Had he held on to the stock, as of the afternoon, it would be worth something like $8.5 billion today, with dividends included. His cost basis would have been virtually non-existant; a rounding error. He knew how good the business was. He personally met Walt Disney at the time he bought his shares and Disney walked him around the Disneyland park in Anaheim, showing him the Pirates of the Caribbean ride that was being installed. Instead of letting the wonderful company work its magic, he was focused on finding something cheap.

Buffett later repeated the same mistake with Wal-Mart. The lesson? You can, and will, have screw-ups in your career. You are going to do dumb things at some point. Forgive yourself. Move on. Keep focus on what it is you are trying to accomplish. Don’t dwell on the past, but learn from it so you don’t repeat the suboptimal behavior. You don’t have to hit a homerun every time you are at the plate to live a very successful life. You just have to be consistent and make sure that every day you are closer to your goals by the time you lay your head on the pillow than you were when you got out of bed that morning.