I love a morning when I get to start the day by talking about DuPont Return on Equity analysis, and Barilla’s not-so-subtle strategy to avoid reporting market share losses in the midst of its public relations meltdown is intelligent from an accounting and psychology perspective. This discussion will probably be interesting to the financial wonks out there, but if you run a business or are involved in management, it’s is relevant to you. One hopes you never have to use it, but, sometimes, it’s nice to know what weapons are at your disposal. This technique was frequently used back in the Robber Baron days of Andrew Carnegie, John D. Rockefeller, and J.P. Morgan.

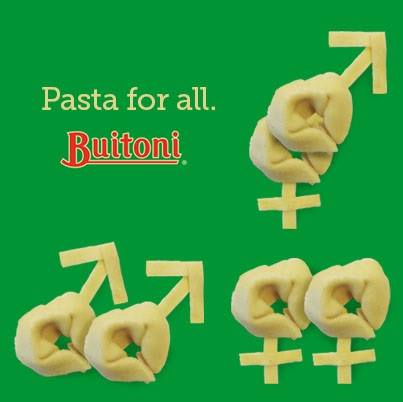

Nestlé declared war on Barilla last night by having its North American pasta brand, Buitoni, begin releasing marketing material that directly addresses the controversy. This followed Unilever’s attack on Barilla yesterday.

I’m guessing Nestlé wasn’t going to sit idly by while Unilever, a $100+ billion company itself, attempted to grab Barilla’s market share. That’s why these things have a tendency to escalate. You saw this same phenomenon back in the 1980’s with leveraged buyouts. Nobody wants to be left out of what looks like a profitable opportunity.

The Mathematics of Barilla’s Defense Strategy

Though the company hasn’t officially acknowledged it, last night, Barilla began massive market downs on its products in the Western world. When I heard the rumors, I did an image search and found people starting to post about the sales. The actual specifics vary by geographic territory and retailer. For example, Target had a “Free with Purchase” deal. In my area, the Barilla aisles are now covered in huge red signs with bold announcements of a “Red Tag” event, where all boxes of pasta, regardless of variety, are a flat $1 per box.

[mainbodyad]This may seem dumb at first – after all, if its destroys profits, why do it? It’s not. It’s quite smart. Barilla realizes if they show any significant decline in revenue or market share, their business will be seen as structurally vulnerable. They’d be like a bleeding swimmer in an ocean full of sharks. Competitors would be willing to destabilize the market, risking equilibrium and profitability for the chance at the brass ring, which is already happening. The pasta market, like the cereal market, has been fairly stable historically. Each competitor is content to make his or her good returns on capital, get richer with each passing year, and try not to upset the boat. That’s why the 72-hour pasta war is so riveting. It shows you can have decades of stability, and then, overnight, something can happen that reshuffles the board.

By selling at radically below ordinary retail, or doing a buy-one-get-one-free offer, Barilla accomplishes two things:

- It will be able to show that unit shipments stayed steady or actually increased

- It is playing a game with the DuPont ROE formula, hoping that the increase in unit volume, at a far lower price, is sufficient to offset the per unit revenue loss

As Barilla is a private business, they don’t have to report their profits. That means they can – and, in my opinion, should – be willing to break even or even lose money, perhaps a lot of money, to temporarily drive as much revenue through the income statement as possible so the industry analysts reporting on its brand equity will have to conclude, “All this anger and newsprint must not be hurting them that much.” If people think it isn’t working, they are likely to give up or move onto the next story. Barilla needs to be able to report either higher unit sales, higher revenue, or both. If it means losing money to do that, so be it.

From a profit perspective, such an action might take several years to result in full recovery, but it can save the long-term value and earning power of the enterprise.

This is why every business owner needs to understand everything about that DuPont formula. It contains every possible path to generating earnings, and every time you take an action or make a capital investment, by running down the checklist, you can say, “I am doing this because I believe it will increase [insert DuPont variable here]”, and then measure whether you were correct later. It cuts to the spirit of things and shows you how a business is making its money. It also lets you strip out the effects of debt and compare apples-to-apples the underlying cash generating power of two firms. In this case, Barilla is lowering the margin variable and stepping pedal-to-the-metal on the turnover variable. It’s the smartest move it could make given what it is facing at the moment.

Were I teaching a course at a university, this entire on-going situation would provide so many lessons. It’s rare you get to see it all concentrated, out in the wild, happening in real time. Marketing, psychology, DuPont ROE, mere association, margins, turnover, retailer strategy and responses to wholesaler problems, targeted international ad campaigns based on the culture of the underlying company, industries run by a handful of firms with sudden destabilization … it’s a goldmine.

[mainbodyad]