I Believe USA Today’s Money Section Is the Worst Run Financial Publication in the United States

I had such a wonderful day today, visiting with old friends, that I hesitate to write about something as droll as bad financial journalism but this is too good of a case study for the budding investors out there to pass up if you really want to hone your skills.

Hands down, I am strongly convinced the single most incompetent source of regularly published financial advice or business information of any major newspaper in the United States is the money section of USA Today. The conclusions are often outright wrong, the understanding of accounting and economics vapid, and the headlines written to achieve nothing more than clicks without leaving the reader better informed than he or she was in the beginning. It is the fiscal equivalent of fluff, only worse because fluff can be fun without leaving an inaccurate impression on something as important as national economic policy.

It’s not a fluke thing, either, as it regularly churns out worthless content year after year. There was an article so bad during the recent trip to California that I saved it for the blog but it was lost in the airport somewhere, which I hated because it was a brilliant case study of how bad some public information can be.

This week proves no exception. After the post about Lies, Damn Lies, and Statistics and the one on the sorry state of financial journalism, I managed to come across an article that embodies both perfectly. It’s called “20 big profitable U.S. companies paid no taxes“. Anyone with a modicum of investing, accounting, finance, business, or tax experience will be screaming at the stupidity by the time they reach halfway down the content. It’s so deceptive, and so poorly written, I’d go so far as to call it professional malpractice.

Read it, if you dare.

Want just a few objections? Really, just a handful?

How about that the USA Today article includes Real Estate Investment Trusts, or REITs, such as AvalonBay Communities under the list of the indicted, right alongside C-Corporations? REITs, as almost all investors know, are pass-through entities, not ordinary corporations, meaning the profits are distributed to owners and the owners then have to pay ordinary marginal rates on whatever taxes are due on their personal tax filing, which are sometimes higher than corporate tax rates! To suggest that somehow the profits from these real estate portfolios are escaping taxes because the individual owners must pay them, rather than the corporation paying them on their behalf, is deceptive to the point out of outright lying. I’d fire the reporter over it. These entities have been around for more than half a century ever since President Eisenhower passed the Cigar Excise Tax Extension of 1960 as a way for small investors to organize and fund larger projects to build the nation’s real estate infrastructure. There is no story here. Nothing has changed. They are the same boring, highly regulated, plain-vanilla securities they have always been. They are paying no more, or less, taxes than they have in the past.

How about the author highlighting Merck’s “0% rate” for the quarter? Yes, you read that right, for the quarter. Even though a measurement period that small is worthless, if one were to bother reading the Securities and Exchange Commission filings, and if one knew how GAAP differed from statutory tax accounting rules, he would realize that the “negative” tax paid in the quarter was really a GAAP adjustment to the deferred tax balance on the balance sheet to account for the result of an option exercise by AstraZeneca on an investment position in a joint project known as AstraZeneca, LP. It was a cleanup accounting change necessary to close a position that involved a series of capital structure modifications.

That, however, requires paying attention in accounting class. It’s much easier to just run a report on S&P Capital IQ and have the computer spit out a list of businesses without any understanding of what the numbers actually mean. No thinking required. Instant content ready to go for the public. It’s shameful.

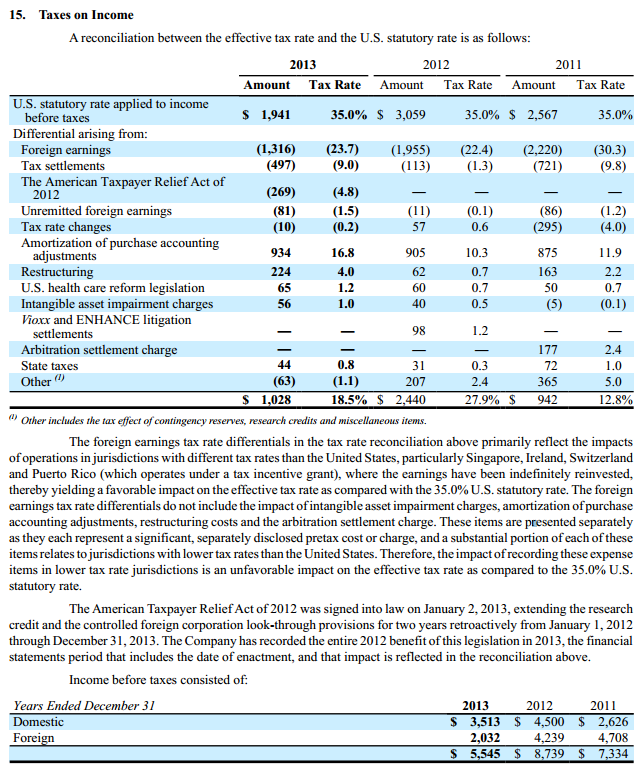

You can tell because a thinking reporter would have wanted to get to the bottom of Merck’s tax rate to discover how much it actually paid over the past few fiscal years. Was Merck, in other words, paying less than its fair share to the U.S. Government on its U.S. based profits? To answer this, the reporter could have simply found it on page 121, Section 15 “Taxes on Income” of the 10-K filing for fiscal year 2013 with the Securities and Exchange Commission. It would have taken thirty seconds, at most. As always, it shows that the U.S. taxed its profits at the full 35%, with a small deduction President Obama signed into law to encourage domestic pharmaceutical research, as well as a few other items.

What about that huge deduction for foreign earnings? That’s because profits earned in the United Kingdom are taxed by the Crown; profits earned in Germany are taxed by the German government; profits earned in Switzerland are taxed by the Swiss Government, etc. Each of those countries taxes corporate profits at far lower rates than the United States does, so the 35% rate has nothing to do with anything. The United States is not now, nor has it ever been, entitled to tax money earned in a foreign country, by a foreign business, run by foreign employees. No one is saying the United Kingdom is taxing profits too highly. No one is saying that Germany is taxing profits too highly. No one is saying that Switzerland is taxing profits too highly. The argument is that corporations are encouraged to build new factories in these other countries because they are much more attractive and the numbers demonstrate this is exactly what is happening.

Put another way, it’s a math trick. Fourth grade mathematics tells you that if the entire planet, for the most part, offers substantially lower corporate tax rates, any multinational is virtually always going to have an average lower effective tax rate over time than the domestic marginal rate. Yet, the reporter acts as if this were some sort of revelation, subtly alluding to the notion that this perverse situation in which our domestic companies are being encouraged to move their operations overseas is somehow proof that the U.S. tax rate is not nearly as troublesome as corporations want you to believe! “See, they aren’t paying the marginal rate of 35% so tax rates are perfectly fine”, he seems to indicate. It’s the exact opposite conclusion at which any financially literate person would arrive.

This kind of stupidity, right here, is the sort of thing that drives corporate inversions.

You can keep going down the list. Nearly every firm on it has some sort of perfectly reasonable explanation for what was happening it has nothing to do with somehow cheating on it’s U.S. taxes. Meanwhile, the really shocking, immoral behavior never gets mentioned. The behavior of certain for-profit “colleges”, which I’ve touched on in the past; the lobbying activity or tax shelters available to certain oil giants; the special prohibitions against certain types of price negotiations on pharmaceuticals. Those are scandals. This? This is not. This is just a reporter who is writing about a topic he doesn’t understand.

That seems to be the common theme at USA Today Money. Maybe I’d be able to stomach it if I thought the motivation was simply that the truth was boring and doesn’t generate clicks or newspaper sales (probably not, but at least they’d be aware of what they were doing). Instead, every time I read one of their headline money stories, I become more and more convinced that the people they’ve hired to write the financial content simply have no idea what the hell they’re talking about. I want to take over the entire thing, fire the staff, and hire accountants and economists to explain basic concepts the entire country needs to learn. The public may not get a falsely earned sense of righteous anger but, by God, I’ll make sure they understand what the trade deficit is and why it is a concern.

Your homework: Go through the USA Today article, go down the list of all 20 businesses, pull the SEC 10-K filings, and determine if you think the company is really paying less than it should in taxes by examining a multi-year period. Your investment skills will be much improved after the exercise and you’ll be better equipped to come to your own conclusions. By the end of the exercise, you should know how to examine claims regarding real levels of taxation for all domestic, public companies, never against requiring you to trust the word of someone else when it comes to what is happening on corporate taxes.