Using Wal-Mart Stores as an Example of Earnings Yields vs. Treasury Bond Yields

I was up until 5 a.m. this morning reading through the past few years’ of Wal-Mart Stores, Inc. annual reports, filings with the SEC, analyst reports, transcripts, and other documents. It is about time to have the businesses make another contribution to one of my personal retirement plans, as it does several times throughout the year, and I’m thinking about expanding the blue chip holdings for the long-term stocks that I hardly touch. Unlike most of the capital under my management, these “reserves” are meant to serve as a stupid insurance fund, which I have explained several times, that will inevitably compound at a lower rate but offer a backup to the other investments.

As I read, I realized that some of you might benefit from seeing a very basic overview of how an investor might approach buying into a business. Plus, I’ve written about Walton Enterprises and even the ethics of Wal-Mart in the past so many of you have a familiarity with how I look at the company; this seemed like a good opportunity to explain earnings yields vs. treasury bond yields as a valuation metric for very quick back-of-the-envelope analysis. It’s not really appropriate for a beginner, who probably owns index funds through a 401(k) plan and shouldn’t be picking individual stocks.

Also, keep in mind that this discussion of earnings yield is overly simplistic. I briefly touched on the topic in an article called A Technique for Comparing the Intrinsic Value of Two Stocks but using earnings yield is not a surefire way to value a company because it doesn’t account for assets, liabilities, business model risk, capital expenditure maintenance requirements, working capital needs, and a host of other things that absolutely should be included in any conservative calculation of intrinsic value. Earnings yield is also subject to the peak earnings trap. But it is a good first-pass tool to have in the back of your mind if you are looking at a broad portfolio of stocks and trying to determine if they might be overvalued or undervalued.

A Look at Wal-Mart Stores in 2001 vs. 2011

Go back in time a decade. The year is 2001. I was graduating high school and heading off to college. That same year, a share of Wal-Mart generated $1.49 in profit, of which 28¢ was sent to the owner as a cash dividend. How much should an investor have been willing to pay to purchase that share? Remember what I’ve taught you – investing is the process of buying profits; the less you pay for those profits, the higher your return. The more you pay, the lower your return.

One very quick-and-dirty-back-of-the-envelope stock market valuation technique is to compare the earnings yield on a stock or on the entire stock market to the 30-year Treasury bond yield.

To come up with a reasonable estimate, we have to look at the opportunity cost. In 2001, an investor could have parked his or her money in 30-year Treasury bonds and earned a 5.49% yield from the interest income. Clearly, an intelligent investor is going to demand at least 5.49% plus an equity risk premium for taking on the fluctuations of the stock market and the risks of an individual business. Plus, they should require some sort of additional inflation kicker. That would result in a hurdle rate of at least 11.5% or so before someone should commit to parting with cash. The missing variable in the valuation formula would be the expected growth in Wal-Mart’s earnings per share. You would need to estimate this in order to arrive at the correct price-to-earnings ratio.

What did investors actually pay for the company? At the highest point of the year in 2001, Wal-Mart Stores traded at $58.75 per share. That means that someone, at some point, placed an order on The New York Stock Exchange and paid that price for their ownership of the business. In exchange, they received the $1.49 per share earnings. This represented an earnings yield of 2.54%. That was less that half the return an investor could have earned by parking his money in Treasury bonds. It didn’t account for the taxes that would be owed if dividends were distributed outside of a tax-advantaged account such as a Roth IRA. It was less than the rate of inflation as measured by the Consumer Price Index.

The only way such a valuation could have been justified would have been if Wal-Mart were growing at breakneck speeds, expanding rapidly and taking over the world. In 2001, it was already the world’s largest retailer! Nearly every community in the United States had a Wal-Mart. The idea that it was going to grow like a start-up was absurd.

It doesn’t take a very intelligent person to realize results are going to be terrible with those kind of economics. All else being equal, if you pay $10 for $1 in profit, you are going to make twice as much money than if you pay $20 for that same $1 in profit.

Today, a share of Wal-Mart can be bought for $54.36. It generates $4.58 in per share earnings, of which $1.46 are mailed out as a cash dividend. This represents an earnings yield of 8.43%. In comparison, the 30-year Treasury bond is yielding 4.20%. That means that Wal-Mart is offering roughly 2x the return on a current earnings yield basis as Treasury bonds, plus it has the opportunity to grow earnings unlike a bond yield, which is fixed.

Think About Equity Bonds vs. Treasury Bonds

To summarize what we’ve already discussed:

- In 2001, Wal-Mart offered an earnings yield of 2.54% vs. a 5.49% Treasury bond yield

- In 2011, Wal-Mart offered an earnings yield of 8.43% vs. a 4.20% Treasury bond yield.

As long as the underlying business is still healthy, it doesn’t take a brain surgeon to figure out that short of a catastrophic global meltdown, an investor in shares of Wal-Mart is going to do far better over the long-term in the 2011 scenario than he would in the 2001 scenario.

Wal-Mart Stores, Inc. generates $426 billion in annual sales and $25.5 billion in pre-tax operating profits.

Yet, you hear journalists and idiots constantly harping on how “the stock market is fixed!” and “the bankers at Goldman Sachs are ripping off the country!”. What is really going on is some people apply a disciplined, rational approach to allocating the capital they have and other people treat assets and businesses like lottery tickets without paying attention to the fundamental economics of the transaction. That is why one of my favorite maxims of all time comes from Benjamin Graham, who recommended an investor always ask himself, “on what terms, and at what price?” when it came to putting money to work.

One tool I think is useful is the concept of stocks as “equity bonds”, which was popularized by Warren Buffett. Someone buying a share of Wal-Mart today receives a “coupon” of $4.41 that has the potential to grow. If you expect earnings per share to rise at 5%, plus you are reinvesting your dividends at the current market level in a tax-free account, which would add another 2.79% ($1.46 cash dividend reinvested at 8.43% earnings yield = 12.3¢ extra return each year on top of $4.41 base), that would indicate the $4.41 coupon has a decent chance to grow at 7.79% over the coming decade (5% internal growth + 2.79% reinvested dividends growth).

Which would you rather have?

- A Treasury bond that will pay you 4.20% for 30 years and can never rise or,

- An “equity bond” that will pay you 8.43% in earnings yield and might increase the coupon rate by roughly 7.79% per year with dividends reinvested. The cost of this potential growth is the risk that you might turn out to be wrong and lose all of your money, and it is highly probable you will have to see the paper value of your investment fluctuate by 50% or more in any given year.

Of course, you can’t guarantee that you can reinvest your dividends at the current earnings yield level. This is known as “reinvestment risk” and is a particular problem for companies and businesses that hold large reserves of fixed-income investments.

As a result of share repurchases, the Walton family has recently seen its ownership of Wal-Mart pass the 50% threshold.

How I Approach Valuation Problems Such as Wal-Mart’s Earnings Yield

My guess? You all know I don’t make stock recommendations and continue to disavow any responsibility for your actions. With that said, if you forced me to estimate, I think someone who owned the shares through a tax-free retirement account and reinvested the dividends could have a decent shot at turning $10,000 into around $26,000 a decade from now. If inflation ran 4%, that would have the same purchasing power as $17,600 today so you’d have added 76% to your purchasing power (e.g,. “how many cheeseburgers you could buy”). It is a good bet that there would be a few years in there where the stock was up or down 50% but we’re talking long-term business ownership.

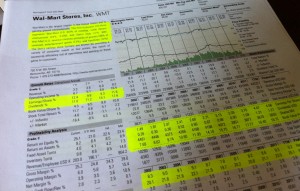

Over the past decade, Wal-Mart Stores has grown earnings per share from $1.49 to $4.47, increased dividends from $0.28 to $1.27 per share, reduced shares outstanding from 4.481 billion to 3.603 billion, increased book value from $7.69 per share to $18.40 per share, and increased return on assets from 8.3% to 9.3%.

If management could grow earnings per share by the same 11.6% rate it did over the past decade, which will be a lot more difficult due to domestic saturation but could happen internationally, I think you’d be foolish to bet on anything more than $34,000 a decade from now (again, with your dividends reinvested), which would have purchasing power of around $23,000 today.

Thus, the shares don’t make a lot of sense for someone who wants to get rich quickly, but if you were sitting on billions of dollars in insurance float, needed a company that could absorb huge sums of capital and put it to work quickly, and were paying next to nothing for that money, it would be a very useful security to have in the arsenal. Everyone has different opportunity costs. That is why I hate the question, “Is [xyz] a good stock?” It depends.

Likewise, someone who regularly saved tens of thousands of dollars a year and found companies like this would end up retiring very rich if they did their job correctly, maintained sufficient diversification, and let the time component of the time value of money do the heavy lifting.

There is also risk. There are a lot of risks. Kmart was once the dominant retailer on the planet and mismanagement forced it into bankruptcy court. Could something like that happen to Wal-Mart? Of course. It would take decades, most likely, but at some point, it will be run by people who never knew Sam Walton and the shares will be in the hands of third and fourth generation family members who weren’t around during the startup days. That is going to make it more difficult to keep them bought into the need to steward the legacy and traditions that helped make the firm successful.

What if the United States went into a crippling deflation, like the Great Depression? In that case, the stock might lose 80% of its value because of 25% unemployment and investors being forced to liquidate their holdings at any price to feed their families. I don’t think it’s likely but we live in a strange world. Who would have thought half of Wall Street would cease to exist in a few months, like it did in 2008? There are no guarantees in life and Wal-Mart Stores might lose its work force to unions, be undone by rivals, and atrophy into nothing. Or it might not. It is not my job to think for you. You have to analyze the situation on your own, be an adult, and make a decision about what risks you are willing to take with your hard earned savings. You cannot outsource responsibility for your own life.

The Effect of Inflation on Earnings Yield of a Stock vs. Treasury Bond Yields

The more astute among you have figured something out, already. “What happens if Treasury yields rise substantially as the inflation rate accelerates as a result of the government deficits?” That deserves its own essay.