I’m a big reader. Huge. My library consists of thousands of titles, mostly all of which are non-fiction (biographies, finance, business, economics, psychology, history, ethics, etc.) If I were to reproduce it, the cost would be somewhere between $12,000 and $30,000 depending on how difficult it was to get your hands on many of the books that are now out of print (I actually added it up a year ago but don’t remember if I mentioned it on the blog or wrote it on a scrap piece of paper somewhere in a file cabinet). But these aren’t an asset on my balance sheet because I’ve destroyed all of the value they have to anyone else.

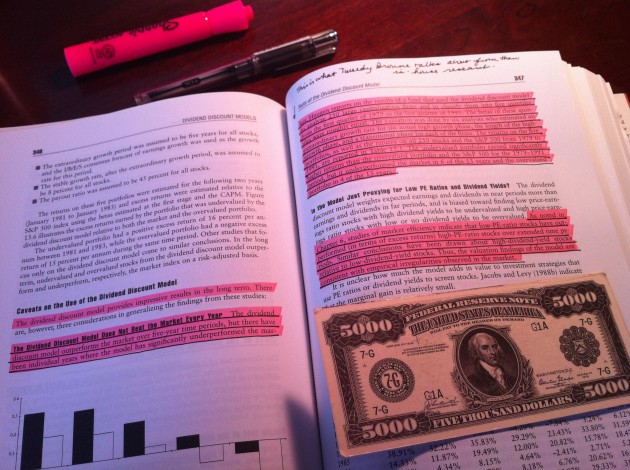

Why? I buy to acquire knowledge. When I purchase a book, my job is not to collect something to display but to purchase a prepackaged bundle of ideas that I can then study, absorb, judge, and, if it is useful, implement in my own life. This means that I normally tear into books with a package of highlighters and pens on hand, read, re-read, and thoroughly abuse the manuscript. I flip them over to keep the page open and break the spine. I destroy all resell value. Gone. No one wants to read someone else’s scribbles, highlights, and underlines. (Don’t panic; there are always the books that I buy for display that aren’t written in but I consider these different – the 1934 edition of Security Analysis, the leather-bound copies of The Wealth of Nations, the signed first editions kept for my office.)

Right now, I’m working my way through a 1,000 page treatise on asset valuation techniques meant for the financial industry. It touches on stocks but discusses everything from appropriate valuation techniques for office buildings to the option to acquire timber rights. (The book is fantastic but some of the techniques people use are just asinine. They think that by giving themselves a false sense of precision they can reduce risk. I prefer the Benjamin Graham test: A man need not know a person’s exact weight to conclude they are fat. Likewise, an investor need not carry an intrinsic value calculation to a few decimal places to conclude an investment is a bargain. If you require that level of detail, it’s too close a call and you should look for greener pastures.)

The book retails for $95.00 at bookstores, so you’re talking around $110.00 after tax. But you can get it on Amazon.com for $55.58. Now that ink has stained the pages, it is effectively worthless to anyone but me. I don’t care. My goal when purchasing books isn’t to invest money. It’s not my agenda or objective.

What does that mean? In another 50 years, I very well could have built a library with first editions bought in stores at the time of their release with a seven-figure value attached to it given how many volumes I add each year. But when I died, they would be auctioned, sold, and liquidated to give a check to my heirs. In any case, I wouldn’t get any utility of it. So I maximize my own personal utility.

Part of this comes down to how my mind is wired. I can recall almost the page range of certain passages in books I read 10 or 15 years ago. It is not unusual for me to be working and think, “I know that [insert name of historical person] once faced this same situation and they structured a solution like this … let me go find that …” The note system I’ve developed over my lifetime helps me quickly flip through and find passages in very short order.

[mainbodyad]