I had a hard time waking up this morning so I stayed behind in the room to drink some coffee, take a shower, and study a company I’ve been researching lately. I met everyone over at the Animal Kingdom theme park for our lunch reservations at Yak and Yeti. What has been on my mind lately is that I realize I didn’t have the tax treaties of the major European countries completely memorized, which shocked me. I was right within a ballpark range but I was guesstimating too much for my comfort. This is the sort of thing I should know at the drop of a hat.

For example, if you buy shares of a British firm, the treaty between the United States and the United Kingdom can allow you to side step foreign taxes so that you pay your home country, instead. The same cannot be said of France, where you will be subject to a 25% dividend withholding tax. If you hold that stock in a taxable brokerage account, you can regain the money indirectly by filing a claim of foreign taxes paid with the IRS, which will lower your tax bill in other places. If you have the stock held in a tax-advantaged accounts, such as an IRA or pension, there is no recovery. You just lost 1/4th of your dividend income.

[mainbodyad]The consequences are obvious: Even with identical earnings, the intrinsic value of French stocks must be lower than of an identical company in another country. You cannot pay the same multiple for €1 of profit.

Switzerland is a staggering 35%, but the United Arab Emirates is 0%. Canada is 15% but India is 0%. Germany is an oddly specific 26.4%, which seems precise enough to fit the Germans. Italy is 27%. Korea is 27.5%. These are things I should just know, not have to look up. I’m trying to get the current rules so they are available at instant recall, or at least the major economies (England, France, Italy, Germany, Japan, Switzerland, Hong Kong, Canada, Australia, Ireland). It’s time to do some studying. The Great Recession made me focused on the United States too much; great blue chip companies were trading at next to nothing, so for years, with only a few, notable exceptions, I kept all my investment money here at home, while the economic maelstrom raged around the globe. That, and the focus on private businesses these past few years has trumped my securities purchasing. I’d rather buy other businesses outright or start something new because the payoffs are much, much larger. Plus, I get to control 100% of the cash, which is what brings me joy.

I am still not sure of what to make of the tax situation playing out in France. There are some French stocks that really look attractive but it does not good if the socialist end up stealing the savings of families and businesses through the threat of government force. It is making it impossible to calculate the future intrinsic value of certain cash flows, which means ‘investing’ isn’t so much possible as is a form of intelligent gambling. The uncertainty is making me lean toward picking up some British stocks, instead. I want my money in nations that appreciate the investment I’m making when I could have, instead, spent the money here at home in the United States.

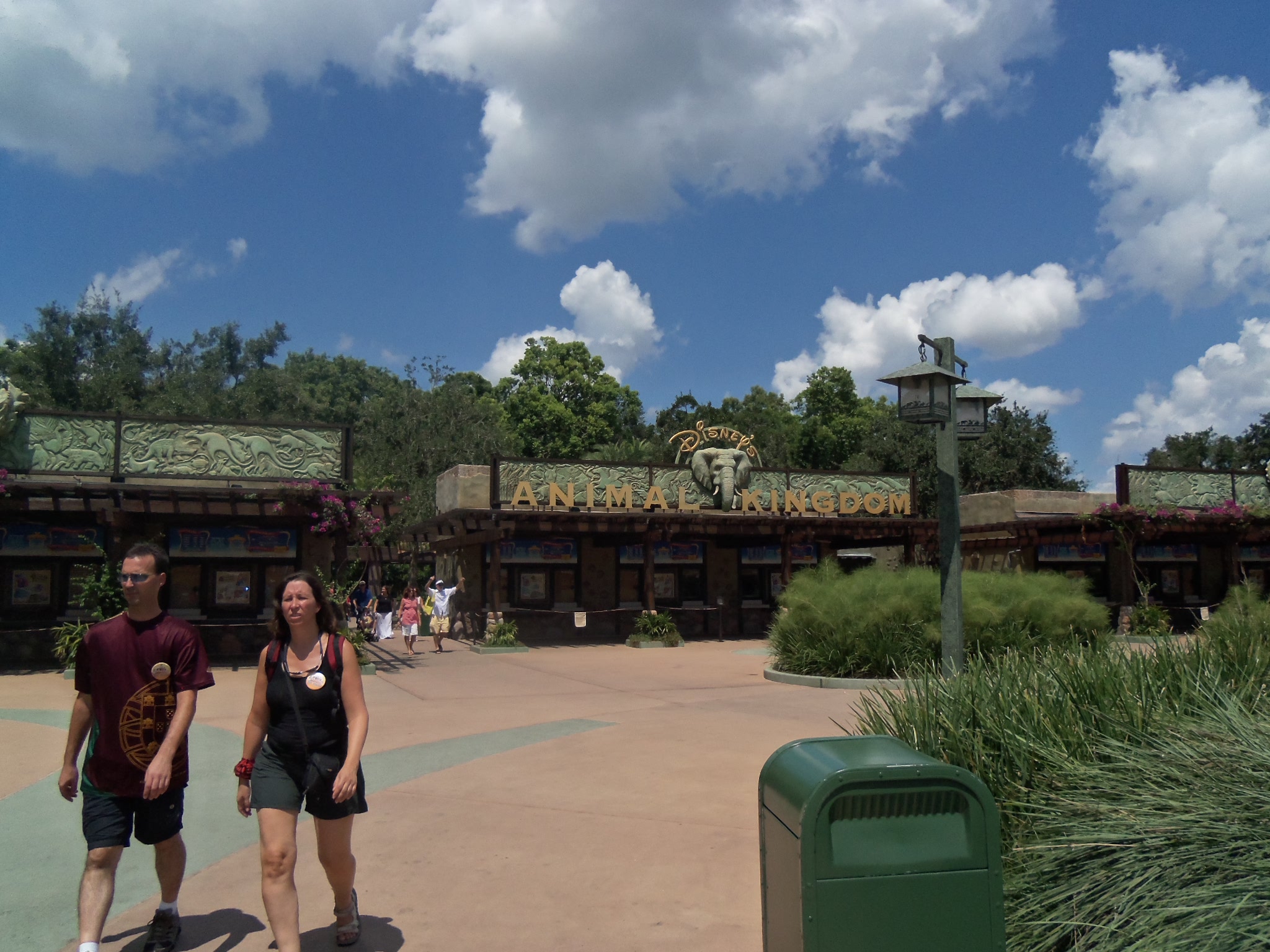

I’m off topic and rambling now. We’re are at the Animal Kingdom. I’m enjoying it but I’m pensive, focusing and working through the European situation in my mind. I can’t get any clarity into it. I’m enjoying going through the scenarios so it isn’t work, but I would like to be sitting in the lobby of one of the resorts, with a pen, pad, calculator, and newspaper, writing out my thoughts.

Before lunch, several people rode Expedition Everest (the mountain you see in the background). I had planned on it, but I ended up watching the kids instead, while everyone else did it. I rode it last year so it made sense. I planned on going back to ride it but never got around to it. Maybe we’ll go back this Christmas or next year. This is one of the only rollercoasters I can stand. Normally, I hate them.

This is one of those days that all 11 of the people on the trip are meeting at a restaurant to make sure we get to see everyone. As this is the Animal Kingdom park day, the venue is the Yak and Yeti … home to the famous fried wontons, that are the sixth best rated dessert in the entire 44 square miles of resort.

We sat right above the window during lunch … when I turned around, this is the view I saw. It is really hot today but Florida is definitely beautiful.

After lunch, we did the safari to see the wildlife preserve. My group didn’t have a chance to do the walkthrough again because we had to be somewhere else but that is okay because we did it last year.

I am off to do a private tour of the Golden Oak real estate development Walt Disney World is undertaking here on the property. I need to back at the resort to get picked up, then probably head into the Magic Kingdom until our dinner reservation in nine hours.

[mainbodyad]