[vc_row][vc_column][vc_column_text css_animation=”none”] [/vc_column_text]

[/vc_column_text]

There is an apocryphal story about Warren Buffett that I always found useful. [mainbodyad]Years ago, when he was supposedly touring Heart Castle, the gargantuan San Simeon, California estate of American newspaper tycoon William Randolph Hearst, the tour guide spent hours highlighting the enormous scale and no-expense-spared luxuries. He talked about how much money was spent…

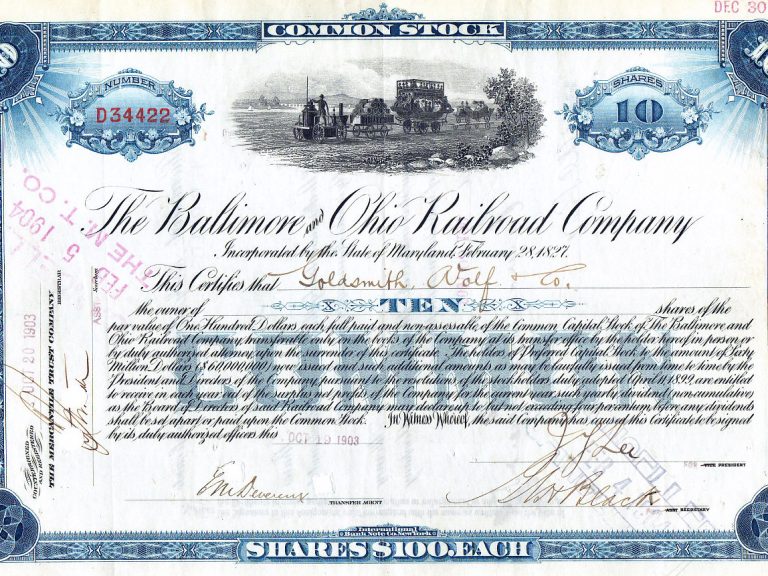

One way to begin making money is to create and own synthetic equity in other companies. This technique is one that Aaron and I used early in our career and was very lucrative for us, providing a stream of profit and cash for us to fund our other investments.

I found some of our old tax filings from last decade! It turns out that around our college days, living together in the apartment complex next to the Quakerbridge Mall in Princeton, New Jersey, our combined household income was somewhere between $80,000 and $100,000 even though neither of us had full-time jobs and we were both students attending school on music scholarships. (This is the same apartment that I showed you a few months ago.) The difference between the two figures depends on whether you count unrealized capital gains as “income” since our net worth was increasing but it didn’t reflect in our taxes at the time.

Years ago, I vaguely remember hearing someone comment that it was interesting how differently we measure wealth today compared to British society at the end of the 19th century. This made me realize that most people don’t even know there is a difference; that there are primarily two ways you can think about measuring your wealth and which you choose for your own household will influence how you behave, the capital structure you employ, and even how you think about risk.

I’ve written a lot about the economics of household income over at Investing for Beginners at About.com, a division of The New York Times. [mainbodyad]Most economic data, as I explained there, comes in the form of regular households that are easily understandable to the average worker. For example, to be in the top 5% of household…

Reuters just published an awesome article about songwriter Franke Previte, who lives in New Jersey, and wrote the hit songs “Time of My Life” and “Hungry Eyes” for the movie Dirty Dancing. The copyrights have turned out to be a lottery ticket for the composer, providing him with a substantial stream of profits upon which…

The AP had great news about credit card debt today: Consumer borrowing increased in September for the first time since January even though the category that includes credit cards dropped for a record 25th straight month. The rise in credit came from the category that includes student loans. That means that consumer debt rose a…

A couple of weeks ago, Kwame sent me a question. I’ll paraphrase here: Joshua you made a statement, “The people who continue to compound, like those who end up on the Forbes list, are motivated by building something rather than cash”. Many times I have read about great business people and one thing I hear,…

Although credit card debt is a relatively new phenomenon, it is the spiritual descendant of consumer debt, which has been around with us forever. Consider the words of the bestselling Napoleon Hill in his book, The Law of Success, which was originally published in 1928 as part of an eight-part series: [mainbodyad] It is a…

There was an article three weeks ago in The New York Times that began with the following paragraph: Nobody likes unpleasant surprises, but when Allison Brooke Eastman’s fiancé found out four months ago just how high her student loan debt was, he had a particularly strong reaction: he broke off the engagement within three days.…

[vc_empty_space][vc_column_text css_animation=”none”]

[/vc_column_text][/vc_column][/vc_row]