Earlier this year, The Economist did a nice write-up on a topic we discussed in depth back in 2011 in a post called “How much money does it take to be in the top 1% in the United States?“. Although the most recent data available is from 2008, applying a modest inflation factor, it seems safe to say that to rank among the top 1% in income this year might require $400,000 per year, or $33,340 per month. It is at that point you would be generating more money than 99 out of every 100 families.

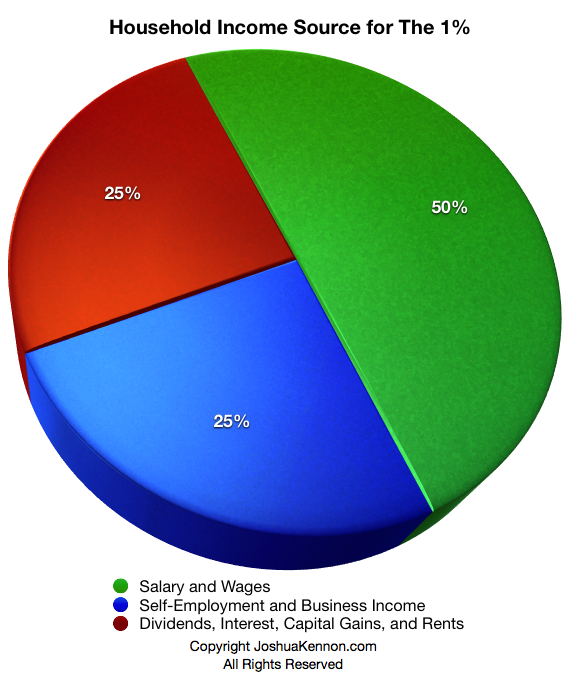

The most important lesson for most of you to learn is that 50¢ out of every dollar the top 1% earns in the United States comes from self-employment income, business profits, dividends, interest, capital gains, and rents. The other 50¢ comes from selling time to an employer for salary and wages. Put in economic language, half of the income the top 1% generates comes from human capital (the value of selling skilled labor for a paycheck) and the other half comes from financial capital (the returns earned on invested money).

Even if you aren’t the 1%, strive to add those other components to your personal household income pie. You need to consider collecting business income and / or dividends, interest, capital gains, and rents. Those sources of income can be producing cash when you are asleep or on vacation. If you are young, it isn’t hard to harness the power of compounding. The difficult part is getting off the consumer treadmill of materialism that enslaves a lot of people so that they spend cash before it has been earned.

[mainbodyad]