We’ve had fun over the years answering the question, “How much money does it take to be in the top 1%?” and even looked at the breakdown of how the top 1%, as a class, generates its money. If you enjoyed those posts, hold on to your seat because there is a new report out that details income statistics by state for the purpose of looking at income inequality.

[mainbodyad]While the document itself engages in the sort of dishonesty I talked about in lies, damned lies, and statistics (e.g., looking at the mean, or average, income for the top 1% is for all intents and purposes meaningless because people like Bill Gates and Warren Buffett pull the figure far higher than the typical member of that class experience so the correct figure to use if you were interested in painting an intellectually honest picture would median income) and it is horribly ideological in its motivations (read the opening two sentences – there is absolutely zero attempt to hide the bias here as the authors expect you to take it as a matter of course that income inequality in and of itself is undesirable relative to past levels without providing any of the detailed, nuance analysis that thinkers like Peter Drucker did on the topic when he looked at the economic allocation problems mass automation were likely to cause civilization), it is a fantastic data set to add to your proverbial file cabinet. You can download it here as an Adobe PDF file.

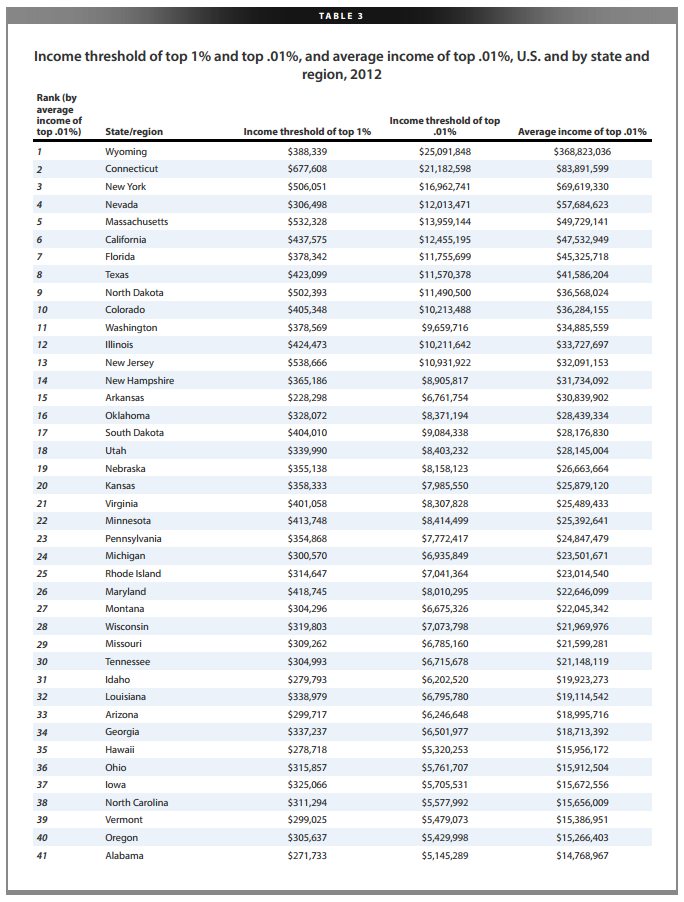

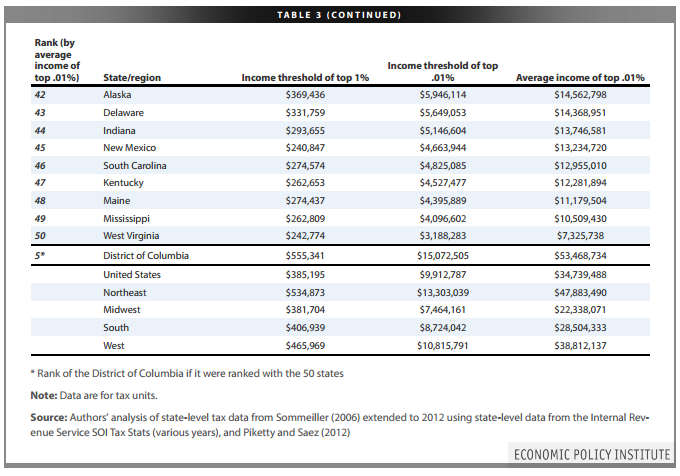

Particularly interesting is Table 3, which provides the income threshold necessary to reach the top 1% of income (not wealth – a very different thing) in your state, as well as the top 0.01%. (In the off-chance you haven’t dealt with percentages in a long time, in practical terms, the top 1% gives your household a higher income than 99 out of every 100 of your fellow citizens, while the top 0.01% gives your household a higher income than 9,999 out of every 10,000 of your fellow citizens.)

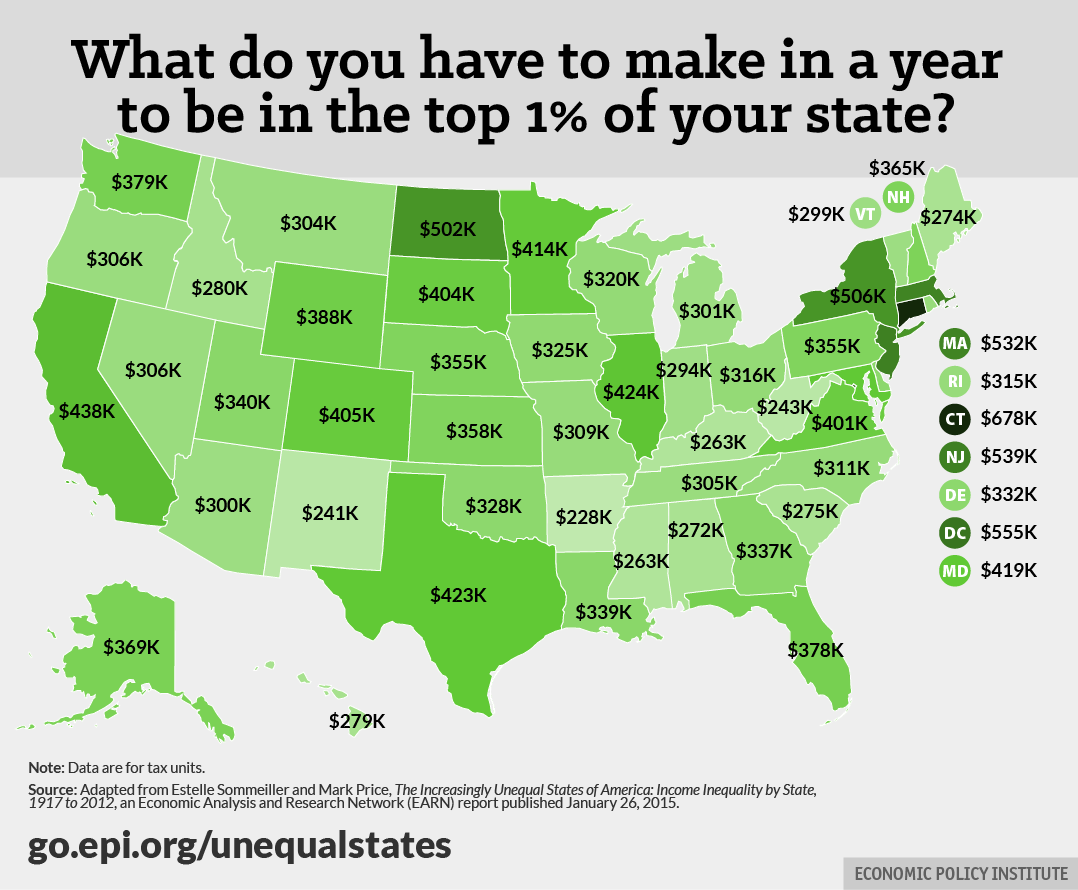

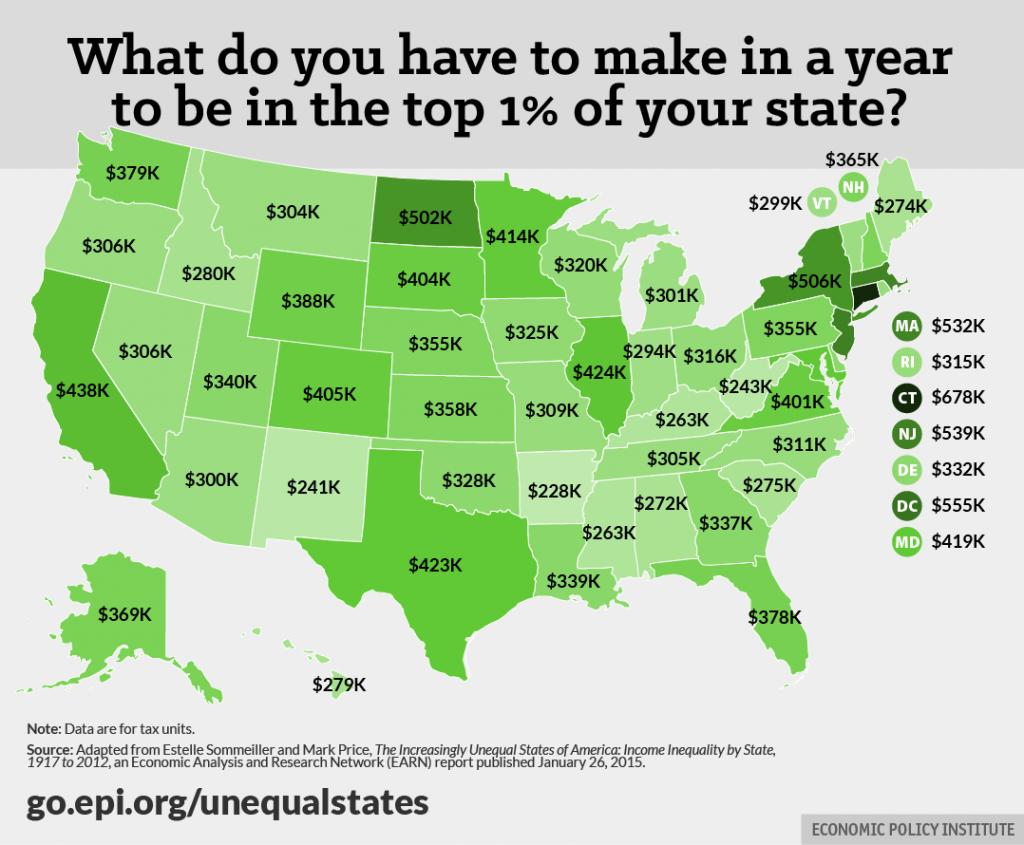

This data is broken down, and was even republished in The Wall Street Journal, in this convenient map:

In my home state of Missouri, for example, you need to make $25,750 before taxes per month to earn more than 99 out of every 100 of your fellow citizens’ households. Meanwhile, in New York, it’s $42,167 per month because there is a lot more aggregate wealth and your cost of living is substantially higher. In Tennessee, it’s a mere $21,917 per month (plus you don’t have to pay state income tax on any of that money unless it comes from dividends and interest, allowing you to keep a much bigger percentage). Connecticut obliterates the rest of the list where it takes $56,500 per month to rank in the top 1% of household income.

[mainbodyad]Even that is somewhat misleading as every state has its own trade-offs. A person in the top 1% in New York can live comfortably but certainly not extravagantly. In exchange, he or she can walk outside of the apartment building and experience world class music, shopping, dining, sporting events, and cultural experiences. A person in the top 1% in Texas who has spent most of his or her career saving and investing can live like a member of the royal family if the cards are played intelligently enough; e.g., live outside a major city with most of its advantages, including being near an international airport for global travel, while lording over an 8,000+ square foot mansion on a multi-acre estate driving a Maserati and wearing $6,000 Brioni overcoats if that’s your cup of tea.

For fun, cross reference this with the interactive feature The New York Times put together on the top 1% households to find out the type of work the class does. If you want to be in the top 1%, consider becoming a physician. Roughly 1 out of every 3.68 doctors in the United States are also in top 1% households. That is statistically meaningful. Compare that to chefs and cooks, where only 1 out of every 333 make the top 1%. If a high standard of living is your primary objective, tilt the probabilities in your favor by going into a field capable of disproportionately producing affluence and that matches your interest and skill set.

What is really fun, though, is if you look at some other data that we’ve also talked about in the past. While only 1 in 50 or 1 in 100 engineers end up in the top 1% of income (which is the focus of this data set), they disproportionately end up in the top 1% of wealth. How do engineers achieve this? It seems it comes down to their dexterity with numbers, which is all money is: A financial construct expressed in numerical terms. They tend to focus on things like life-cycle cost (e.g., cost per use rather than initial sticker price), gaining all these economies of scales and tax efficiencies that add up to something meaningful due to the power of compounding. Dr. Stanley at the University of Georgia quantified this ten or twelve years ago when he found that for every $1 in income an engineer earned, he or she transformed it into a vastly disproportionate amount of wealth compared to $1 in income earned by, say, a doctor. That is, the engineer might earn less than a surgeon (which is relative here as engineering is a great field, dominating the list of best paying college degree investments), but he or she is able to much more efficiently convert household income into net worth. In other words, the engineer is the guy who might end up making $80,000 or $100,000 a year, drives a Toyota, but retires with $5,000,000 worth of oil and bank stocks pumping out $250,000 a year in tax-free dividends which he gets to spend but that never show up on his income tax filing because of the way the asset is held in a combination of self-directed Roth IRAs and Roth 401(k) plans.