It’s time we talk about the debt ceiling and what a debt ceiling default would mean for the United States. I’ve avoided this conversation because I was hopeful we would never end up here, again, after the last round of stupidity. I’ve also avoided discussing the on-going shutdown of the Federal Government, despite some strong implorations from those of you who have written through the contact form asking me to share my thoughts on it. The shutdown will have to be put off for another day because it pales in comparisons to the implications of a debt ceiling breach, which you need to understand. Even if you don’t own a single asset, it holds the potential devastate your life in a way few other events can.

[mainbodyad]Before I can explain to you what the debt ceiling is, why it is important, and what Congress is threatening to do, I need to provide a bit of back explanation about the process for spending money in the Federal Government. For those of you who already know this, it will be old hat, but some folks might need a refresher in high school civics, or live outside the country and not be aware of how the system is designed.

Before We Get Into the Debt Ceiling, You Need to Understand How the Federal Government Spends Money

The United States legislature is split into two parts. When talking about them, together, it is referred to as “Congress”:

- The House of Representatives – Consists of 435 elected representatives voted into office by local districts throughout the country, allocated based on population. Each representative is elected for a term of 2 years, meaning the United States people can, in a real sense, elect to overthrow their government every 24 months if they wish, starting over from scratch, if the political will is there to accomplish it. States with large populations, like California and New York, have many more representatives.

- The Senate – Consists of 100 elected representatives, with each State in the Union receiving 2 Senators, regardless of population. Senators are elected for a term of 6 years, are meant to provide stability and serve as “the cooling saucer” of the Republic. It is the place the founders intended for legislation to go to die, so no radical changes could happen overnight.

These two parts of the legislature, each forming their own body with their own rules and terms, work in the U.S. Capitol building.

The United States Congress works in this building. The House of Representatives has one wing and the Senate has the other wing.

For a bill to become law, both the House and the Senate must pass identical versions of it, and then send it to the President of the United States, who is elected to a term of 4 years. If the President vetoes the bill, it goes back to Congress, where it either dies, or gets a new vote. If the new vote results in 2/3rds of both the House and Senate supporting the bill, the President’s veto is overridden and the bill becomes law. Historically, less than 10% of all Presidential vetoes are successfully overridden by the legislature. This was also by design, as a proposal must be very popular to garner that kind of support.

If the President signs the bill, it becomes a law. Otherwise, it goes back to Congress, which can override him with a 2/3rds majority vote of both the House and the Senate. Historically, less than 10% of vetoed bills are passed into law this way.

If a person or company believes the new law violates his/her/its Constitutional rights, the law goes through a process that I’ve already described, ultimately ending up in the Supreme Court, which has the power to strike it down, in whole or part. The judges are supposed to provide the most stability, taking the long-view. They are nominated by the President, and appointed by the Senate, to lifetime terms. They will only vacate their bench if they die, are removed by the legislature through the impeachment process, or resign. Their primary job is to hear cases in which legal and constitutional disputes are raised, and make binding decisions.

If a law is unconstitutional, it will end up in front of the United States Supreme Court, which has the power to strike it down in whole or part. Their job is to protect the Constitution from overreaching governmental power and resolve constitutional conflicts between lower courts.

The founders knew that Congress would be prone to overspend, so it gave the House of Representatives a special power. It said that all laws requiring money have to start in the House, then go over to the Senate. This way, the legislature couldn’t bankrupt the country without the people’s consent as they can throw everyone out every two years. They also knew that the House would be prone to short-term thinking, so they gave the Senate the power to appoint, upon the President’s nomination, ambassadors and judges, as well as approve sovereign treaties with other nations.

The Process After Congress Authorizes the Spending of Money

Imagine that the House of Representatives passes a bill authorizing the spending of money. It then goes to the Senate. It passes there, and gets sent to the President. He signs it. It becomes law. The money is now legally authorized and the United States is on the hook for it.

The United States Treasury Department is sort of like the cash manager in the background who has to make sure all of the funds are ready and available to be used. It works with the IRS to have people’s taxes deposited into an account it can access. When Congress spends more cash than the government brings in through taxes and other sources, the amount of the shortfall (called “the deficit”) is raised by the Treasury going to investors and issuing I.O.U.’s in the form of bills, bonds, and notes. This even includes your humble savings bonds! Just as when you use a credit card to cover a deficit in your own life, the amount gets added to your overall debt figures. When you begin running surpluses, again, you pay off that debt. Meanwhile, you pay interest.

United States Treasury Department in Washington, D.C. has to make sure the cash is where it needs to be when Congress authorizes spending.

Investors often feel very safe with these bonds because the 14th Amendment of the Constitution states, “The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned.” That means the entire taxing power of the United States Government is behind those bonds and that the government does not have the constitutional authority to default.

When a bond is issued, the Treasury takes the cash from the investor, adds it to the cash raised from taxes, and makes sure it is sent to the places that Congress authorized in its laws. If $100 million goes to this national park, or $10 billion goes to weapons systems from the military, the Treasury gets the money into the accounts of the Department of the Interior, overseeing the park service, or the Department of Defense, overseeing the branches of the military, who then use their own internal accountants to allocate as they are authorized to by law.

Of course, the Treasury Department has to keep track of all of this debt because it needs to make sure the interest payments are sent to investors. Whenever it issues a new bond, it adds the figure to the national debt so Congress and the President know how much needs to be repaid or refinanced in the future. (There is actually another department that tracks all of this, but I’m keeping it simple so you get the basics.)

What Interest Rate Does the Treasury Department Set on the Treasury Bonds It Issues?

What interest rate does the Treasury Department pay? It’s set by auction. Although the Federal Reserve can attempt to manipulate this in the short-run to help ease the pain of recessions or depressions, or suppress inflation when it gets out of control, over the long-term, the interest rate on the Treasury bonds is set by the price investors are willing to bid when they place orders to buy bonds. That means if a lot of investors are demanding bonds, the interest rate is set lower. If fewer investors want the bonds, the Treasury has to raise the interest rate to attract more money. You can see the current Treasury bond rates updated daily.

(Side story: For more than 200 years, up until a decade or two ago, in fact, the entire United States Treasury bond process was handled by a handful of “authorized dealers” on Wall Street, which aggregated orders from countless individuals, brokerage houses, and other financial institutions, then wrote their overall order on a slip of paper and dropped the bid for Treasury bonds into a little wooden box. The Treasury officials then opened the box, added up the results of the auction, issued the bonds, and took the cash from the dealers to move to the government’s account. The dealers would divvy up the bonds it had been issued to the various investors on whose behalf it had been bidding, and make a nice little profit on this activity, though it was mostly about the prestige as it made it easier to be taken seriously in the investment banking industry. It was so old-school, it was beautiful. Back before electronic deposits were possible, all of this movement was facilitated, in part, by the use of $100,000 bills that the Federal Reserve system would move between its member banks as capital was transferred in the system. Today, this bill would have an inflation-adjusted value equal to around $1,745,351. Now, back to the regularly scheduled program and discussion of the debt ceiling.)

Ordinarily, the Treasury gets very good rates on its money. The lower the interest rate is pays, the better for taxpayers because it’s less cash that gets added to the national debt. How can the Treasury borrow so cheaply? It is because Treasury bills, bonds, and notes are considered the safest fixed income asset in the world due to the fact the United States controls $217,623,159,381,449 of the world’s $707,726,307,170,996 in assets (the latest figures available are from 2005; if you are interested in seeing the breakdown yourself, go to The World Bank – The Changing Wealth of Nations resource and download the Wealth of Nations (XLS 655KB) excel spreadsheet in the right hand column. It is so specific, it even gets into estimated natural gas, coal, and timber reserves), despite having only 5% of the global population. We hold a vastly disproportionate amount of wealth, most of which was created due to human capital as our economic system and free society rewards innovation. It’s not that we’re perfect – it’s just that many other places on the planet actively suppress and destroy their own human capital. How, after all, can a country expect to compete with us when they stone rape victims or imprison free thinkers? When they indoctrinate rather than educate? It’s not hard to win against someone who is willingly destroying their own best chance at progress.

If everything falls apart, the taxing power behind the Treasury is enormous, so it is highly likely that investors will be repaid, especially given the Constitutional assurance that the debt must be honored.

Nearly Every Asset Is Tied, Directly or Indirectly, To Treasury Bond Yields

This means that nearly every asset in the world, and certainly every asset in the United States, is tied either directly or indirectly to the Treasury bond rate. It sets the opportunity cost. It is the rate at which you could park your money, do nothing, and earn x% on your money. If Treasury bond rates increase, then stocks and old bonds will decrease so they offer higher earnings yields and interest yields to compete with the new, more lucrative Treasury bonds. If Treasury bond rates decrease, then stocks and old bonds will increase because they are now more attractive than Treasury bonds, so rational investors move their money. It’s basic mathematics.

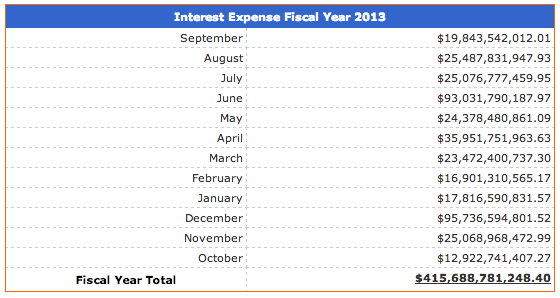

Even with low rates, though, more debt means more interest. In the past 12 months, the Treasury has had to pay $415,688,781,248.40 in interest to its bond investors. That is $415+ billion that could have been used for education, infrastructure, defense, health care, tax breaks, anti-poverty programs, scientific research projects, and any number of other things.

Many of you out there are probably thinking, “Uh … we are living at the lowest interest rates in history, so what happens when all of that debt needs to be refinanced? Even if the budget were balanced, when rates inevitably increase, doesn’t that mean there are going to have to be massive tax increases or huge cuts to entitlement programs unless the population increases significantly to offset the much higher interest expense?”

Ding, ding, ding! Congratulations! You’re exactly right. The people in Washington know this so they are taking a diversified approach. One involves making immigration much easier, to bring in far more foreigners and make them citizens.

Another involves working to actively lengthen the outstanding maturity of Treasury bills, bonds, and notes so those low rates are locked in for a very long time. Sadly, that won’t save us. It would buy a little bit of time, but not nearly enough. The weighted average maturity of U.S. Treasury debt over the past 30+ years has been around 58 months. That means, were interest rates to skyrocket, the costs would begin showing up in the national budget over 4-5 years as the old bonds came up for refinancing and investors demanded much higher rates to part with their money. In fact, the Treasury keeps detailed maturity profiles in nice, informative, colorful charts to keep tabs on its cash flow needs.

What Does All Of This Have To Do With The Debt Ceiling?

Glad you asked. When a bill becomes law, and the money is authorized to be spent, the Treasury Department has to come up with the money by issuing bills, bonds, and notes and combining it with tax revenue. That much you already know. However, Congress, as insane as it sounds, decided to add a second procedure, where it had to pass a law authorizing the Treasury to pay the bills that it already legally owed! This second step where it gives the Treasury the authority to pay bills the U.S. has already incurred and the Treasury has been ordered to pay, is called “raising the debt ceiling”.

Do you see the problem?

The Treasury Department is issuing bonds to raise cash for spending that Congress already approved and to pay interest on Treasury bonds that are already outstanding and in the hands of investors.

In a functioning democratic republic, this should not be a problem because Congress would be rational. And it wasn’t until back in 2009, when a group of Democrats used the debt ceiling as a negotiating tactic. It was a dangerous precedent. Now, a faction of the Republican Party, which holds a majority of the seats within the House of Representatives, convinced the leadership of the House, which controls the flow of legislation, to threaten to refuse to extend the debt ceiling if the Senate and the President don’t agree to their demands on future spending legislation.

It’s the political equivalent of saying you think your child shouldn’t be playing with guns so if the other parent doesn’t restrict access to firearms, you’re going to blow the kid’s brains out in retaliation. It is insanity. Everybody loses. There is no salvaging it. The “cure” is worse than the disease.

What Might Happen If The Debt Ceiling Is Breached?

If any group in Congress is ever successful at causing a default (meaning the Treasury isn’t able to pay its bills when they are due), and investors lose faith in the ability or willingness of the Federal Government to honor its obligations, there is a very good chance that:

- The deficit will skyrocket

- The national debt will explode

- Widespread panic and unemployment will result

- The economy would go off a cliff

That may seem a bit odd, at first, if you don’t understand economics. How could refusing to pay the bills that are owed increase the debt? It’s not like a student loan, where you have penalties. What gives?

Let me walk you through the process.

When You Are a Bad Risk, Your Interest Rate Increases Because People Demand More Compensation Before They’ll Lend You Cash

Imagine what would happen if millions of investors, covering trillions of aggregate maturities, suddenly found out that the safest asset on the planet defaulted. The interest that was supposed to be deposited into their brokerage accounts, bank accounts, or accrued on their fixed income securities was suddenly not there. Even if you don’t think you own Treasury bills, bonds, and notes, you do. It represents the cash reserves of nearly every major corporation in the S&P 500 as well as most major mutual funds. It makes up part of your pension plan that sends you checks every month. The Treasury makes sure your Social Security payments get sent (side note: For political reasons, I have a sneaking suspicion that were a debt ceiling default to happen, the Treasury would prioritize its cash outflows and honor Social Security payments above all others to avoid political unrest. Payroll taxes alone should be sufficient to cover current benefits. If it doesn’t, it would accelerate the economic collapse as most Social Security money is spent quickly by retirees on things like food, shelter, and medical expenses, going right back into the economy. The problem? This isn’t legal. The Treasury has no authority to decide that it can honor certain bills and not others. And even if it were allowed, the Treasury Department doesn’t have the technology to handle it as it pays each bill due on a first-come, first-serve basis. Meanwhile, credit rating agency Moody’s, on the other hand, insists it will happen based on what appears to be blind faith).

[mainbodyad]Panic will ensue. Frightened investors, particularly retirees, will sell off their Treasury bonds, driving the price down and the interest rates through the roof. When the crisis does pass, the Treasury will be unable to borrow at low rates as investors won’t trust them, anymore. (To illustrate: A Treasury bond paying $5 in interest selling for $100 will yield 5%, but if investors panic and drive it down to $50, it’s now yielding 10%. That means if the Treasury wants to refinance at maturity or raise new money in the future, it will be competing with its own, old bonds, and have to issue them at 10%.)

Even worse, this will likely ripple through the banking system. Insurance companies would go bankrupt as their risk-adjusted capital ratios would crumble. ATMs would likely run out of money. Banks would probably have to close for extended periods of time. Workers would not get their paychecks. The secondary cash equivalents markets, such as commercial paper, would begin drying up overnight. And, unfortunately, given that the entire global monetary system is built on Treasury bills, bonds, and notes, the effects, globally, would be swift. It wouldn’t take long for it to show up in London, Tokyo, Paris, Berlin, Beijing, Bern, Ottawa, and everywhere else.

So at the very same time the Treasury faced rapidly escalating interest rates on the debt, the economy would be collapsing and generating less tax receipts. It would be brutal.

Most profoundly, I doubt any of the other major global economies would trust the U.S. dollar again, meaning they would setup other reserve currencies, taking away a significant competitive advantage we have.

Given the Damage It Would Cause, Why Would a Person Support Not Raising the Debt Ceiling?

So we know the consequences of allowing a debt ceiling default, insofar as it can be projected. It would radically increase the deficit, add to the national debt, result in widespread unemployment, hurt the United States competitively for generations, and bankrupt millions of families who don’t even realize how tied their fortunes are to the Treasury bond (car dealers, construction workers, electricians, restaurants, theme park operators, etc.).

How, then, can anyone advocate for allowing it to actually happen? There are only two reasons:

- They are literally too dumb or ignorant to know how the financial system works

- They have a death wish for the United States and want to see it fail

That’s it. There is no other rational explanation for what amounts to economic suicide, which is precisely what it is. (It seems necessary to clarify that most members of Congress who have in the past, or are in the present, engaging in this bad behavior do not, in fact, advocate for actual default. They are posturing to attempt to win political points with no plans of carrying through on their threats as they understand the devastation it would cause. Politicians vote against raising it all the time as a symbolic measure, knowing full well it has the votes to pass. Even Obama himself did this during his time in the Senate! Unfortunately, there is a significant minority of Americans who do not realize this. They actually believe going into default would be a good thing for the country. Last month, a Wall Street Journal poll indicated that 44 out of 100 Americans opposed raising the debt ceiling!)

Emergency Measures Would Have To Be Taken to Prevent the Debt Ceiling from Being Breached

Under no condition can the United States Government be permitted to default. There is some serious discussion about whether the Treasury could simply ignore Congress and the law given the constitutional requirement to honor the debt. There is also a much easier, and less aggressive, work-around that the Obama administration reportedly rejected, but I think would return to the table almost instantly if a real default were on the horizon, which involves minting a couple of trillion-dollar platinum coins and having the mint, using the expanded monetary base which wouldn’t require Congressional authorities, deposit it directly with the Treasury, which could then use the money to get through the crisis.

It Might Be Okay If Investors Thought the Default Was Temporary and Political, Not Financial

The upshot? Warren Buffett has a very good point: If the default lasts for a very short amount of time, and people in the market believe it is entirely due to stupidity that will be rectified shortly, they may remain rational and prevent the whole thing from melting down by pretending like it’s all okay until it actually is all okay.

In other words: We don’t have a clue given the present variables on the table. The only thing that is for certain is it’s a stupid, non-necessary risk taken entirely for political reasons that the American people should consider inexcusable.

That’s what makes it so terrifying to people who understand economics. We can guess all day, just as we could as to the exact implications of hurling a steel basketball into a jet turbine during flight, but the actual results are not knowable until they happen. At which point it’s too late.