This Is the Kind of Business Behavior That Disgusts Me

How can people do this and live with themselves? This is the sort of thing that if I were running a company, I don’t care if we made millions of dollars a year in profit doing it, I’d shut it down. I believe it is immoral. Sure, it breaks no laws that I know of but it strikes me as ethically wrong. It is the reason we need stronger consumer protection laws in the United States. I believe it preys on the ignorant; the people who don’t know any better and who are trying to secure their future.

The Franklin Mint is selling 1 ounce American Eagle Gold bullion coins for $3,529, saying in the description:

Typically only available from bullion dealers American Eagle gold bullion coins are not easily obtained by the general public. These gold bullion coins are now available for those who wish to acquire gold in the form of legal tender coins whose content and purity is guaranteed by the United States Government.

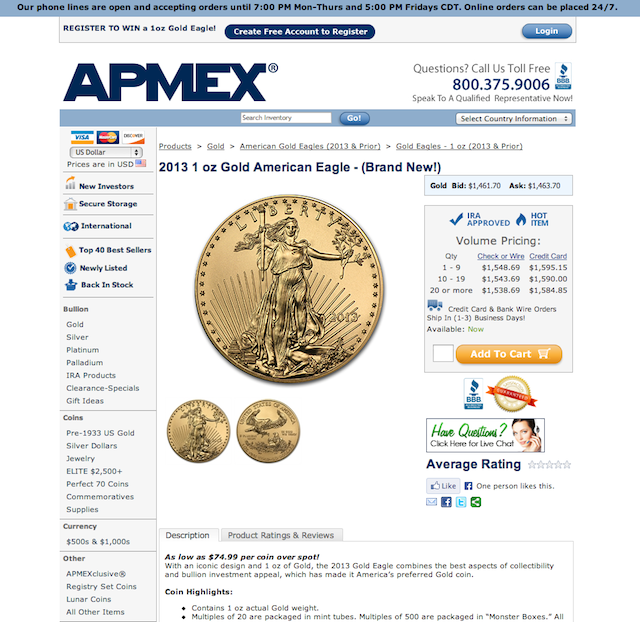

To prove it, here is a screenshot of the evidence, taken on Friday, April 26, 2013 at 3:57 p.m, CST:

A screenshot of the evidence taken on Friday, April 26, 2013 at 3:57 p.m, CST for proof.

Anyone who is even remotely familiar with the bullion industry knows you can go to a perfectly fine reputable dealer, such as Apmex, and buy the exact same product for a little over the spot price of gold. You can have it delivered to your door in no time and it is about as easy as ordering any other product over the Internet. As of this afternoon, the coins are only $1,548.69.

Those coins trade for only a little over spot at reputable dealers at less than half the price the Franklin Mint is selling them for right now. As of this afternoon, the exact same product could be purchased at a business like Apmex for only $1,548.69.

That means the Franklin Mint is marking up gold coins by almost 128% over intrinsic value. It makes me angry. I can picture little old women in their farmhouses thinking they are making a good investment, not realizing what is happening to them, or elderly war veterans using their Social Security checks to fund their purchases. I wish I were the Attorney General of a state in which one of these coins had been sold. I would have found a way to highlight this to the general public in a very real way so that it was blasted all over television, the Internet, and newspapers.

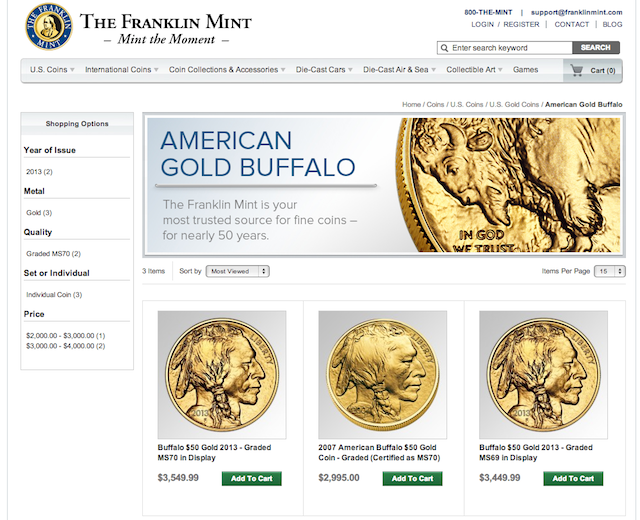

The Franklin Mint is doing the same thing for other coins, too, including the American Gold Buffalo, calling themselves “your most trusted source for fine coins – for nearly 50 years”. Here is another screenshot of that evidence:

Another screenshot taken for evidence at the same time showing the same mispricing of American Buffalo gold coins.

It’s disgusting behavior. This is the kind of conduct that makes people no longer trust your business. The fact that Benjamin Franklin is their namesake and logo makes it even worse.

Don’t be like this. Every penny you have should be honorably earned so that you can feel proud of your accomplishments, knowing you made the world a better place and gave people the products and services they wanted on fair terms. I cannot believe some executive in a meeting didn’t put a stop to this. How many levels of approval were necessary for this to be such a featured product? How are regulators in the Treasury not trying to use their power to stop it under some obscure rule? Where are the Teddy Roosevelt’s of the world?

This is far more egregious, in my opinion, than selling non-registered securities to a non-sophisticated investor, which is against securities laws. Here, the loss is immediate and guaranteed. How can we not be regulating this?! What is Congress doing!? What is the Treasury doing? What are the state attorney generals doing? What is the consumer protection bureau doing? What are the trade industry associations doing? Someone has to stop this.

Update: I did a little digging and it turns out this has been written about in The Herald-News, part of the Chicago Sun-Times. A man wrote this letter:

Dear Mr. Berko: During the past 25 years, I purchased more than $47,000 in collectible silver coins and beautiful non-silver coins from the Franklin Mint for my retirement because I thought the scarcity and limited-edition minting of these coins would drive up their value over the years and because I believed the silver content in the silver coins would also increase in value. Now I’m 64 and decided to sell these coins to a coin dealer who offered me $2,500 for the whole lot. He told me most of the coins were worthless, and the only coins that had any value were those with silver in them. I was devastated because when I was buying all those coins, the people at the Franklin Mint told me these coins were minted in limited production and would be more valuable to collectors in the future. I called two coin dealers in Detroit (these coins are too bulky to carry around) and both said they had no interest in Franklin Mint coins and said they don’t know any dealers who would buy them from me. My son told me to write you because he said you might know of buyers for them, and at this point I’d be very happy to get at least half of what I paid for them if possible. Please help me if you can. And if you cannot help me, do you think I can sue the Franklin Mint and recover my cost? And could you recommend a lawyer for me to sue them?

DA

It makes me feel queasy just reading it. The response to the question, while honest, makes it worse. This is why we have regulations in place. This is the entire purpose of regulation. To quote a U.S. Senator, we would never allow an American to buy a toaster that would blow up and harm her, but we will let her buy financial products we know are toxic, preying on their ignorance.

Maybe I could try and get a law passed in Missouri. It wouldn’t be that hard.

Update II: Apparently the new owners of the Franklin Mint are in a huge legal battle with old owners. I’m going to have to study all of this.