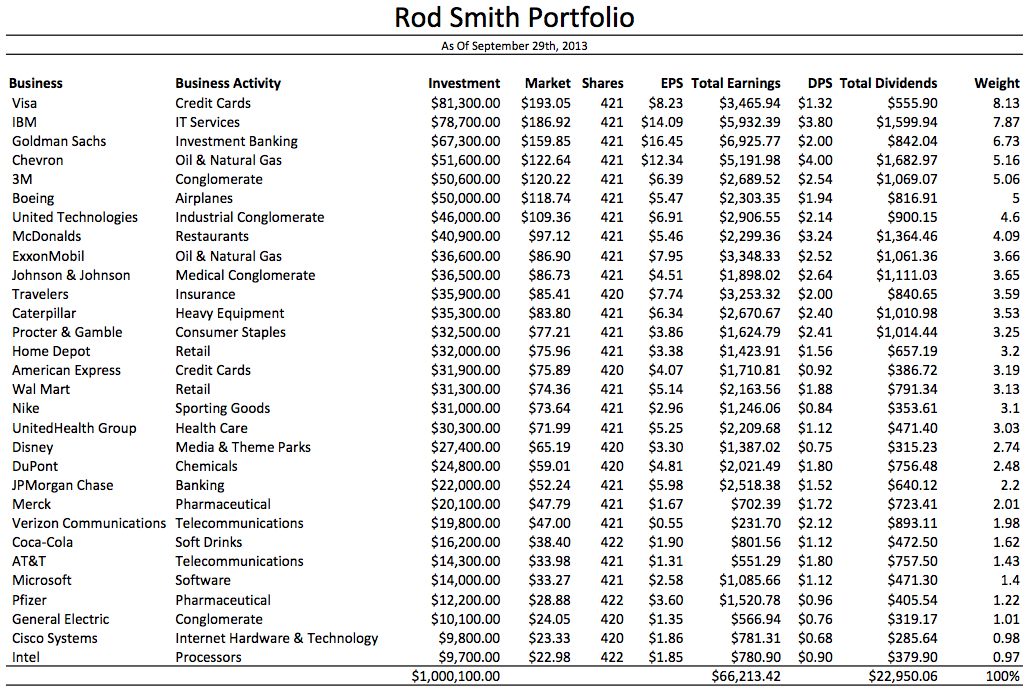

Imagine that you have a new neighbor. We’ll call him Rod Smith. One day, he shows you his portfolio. He has a little over $1,000,000 in common stocks. “I have this great idea!”, he tells you, excitedly. “I decided to buy a list of companies I like and pick up around 421 shares of each. That’s my investing strategy. What do you think?”

You look at him kind of funny as you process what he just said. “You’re … just going to buy 421 shares of everything? Or roughly that? That’s your genius plan?”

“Yep!” He says, very proud of himself. “This is bound to work!”

“My God, man. Isn’t that asinine? By definition, it means if one company has a $100 stock price, and another a $10 stock price, you’ll invest 10x as much in the one with the higher share price, even though it’s entirely cosmetic. After all, the first company may just not like splitting its stock very much. It could be smaller and less profitable than the latter. ”

Rod thinks for a moment. “Well, yeah. But I’ll make a little modifications so stock splits don’t have that distorting effect. But other than that, you’re right. The higher the stock price, on average, the more money I’ll invest in the company.”

You kind of sigh. Rod’s a nice guy so you take the paper to look over his list of investments despite this batty way of thinking. You’re impressed. His list of stocks is a good one. It’s made up of quite a few wonderful businesses, and a handful of okay ones. His share of the net earnings is $66,213.42 per year, of which $22,950.06 is paid out as cash dividends. That’s very attractive compared to U.S. Treasury bond yields. By all accounts, if the past century or two can be trusted, at his present cost basis, and current earnings level, he could expect about an 8% to 10% nominal return, assuming inflation runs 3% to 4% per annum, on average. Sure, it will be a bumpy ride – up 20% this year, down 30% the next – but that’s the nature of equity investing.

Over the years, Rod does fairly well because he very rarely buys or sells anything. It’s the same system his father and grandfather used. He pays no management fee on his portfolio. He sits on his backside and watches his money compound, year after year, while collecting cash in the mail. Sure, there is some judgment involved. He may decide he doesn’t like one of the companies and sell it, adding another in its place. He’s disciplined, though, so it isn’t common. He does screw up from time to time. He still gets upset about the fact that his dad and grandpa kicked IBM off his list of stocks years ago, and then, later, after it had recovered, Rod added it back to his list. Had it never been removed in the first place, his portfolio would be worth more than twice its current value. But, whatever. He’s done well enough. Life is good.

In fact, despite being perfectly average, not doing much, and having this crazy methodology, Rod beats a significant majority of amateur and professional investors. They are constantly hyper trading, driving up commissions. They are constantly paying high fees or other costs. They never get to take advantage of the leverage effect of deferred taxes. Rod, on the other hand, does nothing and collects his share of the business results. You still think his idea of roughly 421 shares in each business is stupid and arbitrary, but his other behavior, and the list of companies he owns, makes up for it.

Is Rod Behaving Rationally When It Comes To His Investments?

How do you feel about this? Would you be ready to jump on Rod’s way of thinking? Would you be reaching for your checkbook?

Why or why not?

Would you constantly compare your portfolio against Rod’s? Would you lose sleep if your portfolio was doing a worse than his?

Why or why not?

If you answered, “No” to any of those questions, then here is the next logical inquiry you should answer: Why do you care about the Dow Jones Industrial Average?

Rod’s portfolio is the DJIA as of last Saturday.

Rod is the editorial board of The Wall Street Journal that picks the list of stocks.

That’s the thing. There’s nothing inherently magical about the particular list Rod owns, or the weightings he selected. The S&P 500 is barely any better in its own brand of bonkers thinking – it weights the holdings by the size of the market capitalization of the common stock creating an odd situation where, though there are nominally 500 companies in the portfolio, it is far less diversified than one would think and has a significant overlap with the Dow Jones Industrial Average.

Rather, the real value from Rod’s portfolio comes from the low-activity, long-term behavior, rock-bottom costs, and focus on a mix of businesses that happen to be far more profitable than average.

That’s why I think indexing the most rational strategy for practically everyone who can’t value a business, doesn’t want to think about financial statements, doesn’t enjoy the allocation process, isn’t rich enough to hire a top-notch advisor (who can often provide tax, estate planning, or asset protection strategies that more than makeup for the fee differential on a large enough portfolio), or doesn’t have emotional control. It captures almost all of the good, as long as the underlying index is at least somewhat sound, while protecting against a lot of the foolishness. It’s a fundamentally satisfactory approach that is the golden ticket for a lot of people.

Of course, there is the obvious paradox that indexing would cease to work the moment it was adopted by a significant percentage of investors due to its distortion of the market as the index components were driven up far above their intrinsic value and there would no longer be individuals or institutions making non-index positions to correct, or revert it, back to the mean. Nobody worries about that, though, because it’s highly unlikely indexing will ever come to represent a supermajority of investable assets.