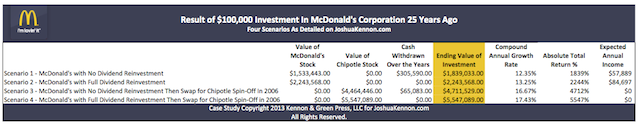

This McDonald’s case study looks at what a $100,000 investment in the restaurant’s common stock would have turned into over a 25 year holding period. It is one of my favorite investment research projects because there are four possible outcomes depending on how you behaved with your shares. It illustrates the importance of finding a portfolio strategy that fits with your own desires, lifestyle, financial needs, and capital allocation philosophy. It took me severals hours, but I think the results are worth it.

Imagine it is January 4th, 1988; the first trading day of the year. You take $100,000 out of your savings and call your broker, purchasing 2,173 shares of McDonald’s Corporation at the average price of the day, which worked out to $46 per share. Ignoring the small commission you would have paid, you plan on parking the stock in a safe deposit box and ignoring it for the next 25 years. How did your investment turn out by the end of your holding period?

Scenario 1: You Do Not Reinvest Dividends and Hold Your McDonald’s Corporation Shares

When you went to open the bank vault shortly after December 31st, 2012, you would have found:

When you went to open the bank vault shortly after December 31st, 2012, you would have found:

- 17,384 shares of McDonald’s Corporation stock at $88.21 per share for a total market value of $1,533,443

- Cash dividends of $305,590 that have been paid to you over the years you held your ownership stake

- Grand Total: $1,839,033

This year, in 2013, McDonald’s Corporation is expected to earn $5.80 in after-tax per share profits, of which your cut would be $100,827. Of this, it is anticipated that approximately $3.33 in per share cash dividends will be mailed to you. That means you should get a check equal to $57,889 and the remaining $42,938 will be retained by the management team at McDonald’s to open new restaurants, develop new menu items, reduce debt, repurchase stock, or any other number of value-enhancing activities. The more successful they are at investing those retained profits, the faster your future wealth grows. If they make mistakes, it is your wealth that is hurt.

[mainbodyad]Putting it more directly, in 25 years, you have not saved a single penny beyond your initial investment. You are sitting on $1,533,443 in stock. You have cashed checks totaling $305,590, which you could have used to furnish your home, send your children or grandchildren to college, travel around the world, purchase expensive clothing, give to your favorite charities, or build your savings. And now, you can sit back and collect an annual income of $57,889; a figure that should continue to grow as long as McDonald’s continues to profitably sell cheeseburgers, french fries, Cokes, shakes, chicken nuggets, cappuccinos, and apple pies!

To achieve all of this, once you had made the initial investment, you had to do nothing more than take an hour each year to read the annual report. Your job was to examine sales, profit margins, net earnings, and dividends, checking to see if they were on track with your expectations by growing much faster than the rate of inflation and in good proportion to the total capital put to work in the enterprise. You have no meetings to attend; no boss to whom you must answer. You had no commute. You had no responsibilities. It was a magnificent deal relative to effort exerted. You would have compounded your original $100,000 by 12.35% for 25 years.

Scenario 2: You Reinvest Your Dividends and Hold Your McDonald’s Corporation Shares

What would your results be after 25 years if you hadn’t spent the $305,590 in cash dividends along the way? What if, instead, you had plowed them back into the dividend reinvestment plan and bought more ownership in the restaurant chain? What would you have found in the safe deposit box upon opening it at the end of last year?

- 25,434.39 shares of McDonald’s Corporation stock at $88.21 per share for a total market value of $2,243,568

- Grand Total: $2,243,568

You have $404,535 more money than you would have had if you chose not to reinvest your dividends. That’s extra wealth came from the shares your dividends bought you, which then in turn generated dividends of their own, which bought more shares, which generated more dividends, ad infinitum.

In other words, for giving up the utility of spending the $305,590 along the way that you could have enjoyed in the first scenario, you not only got to keep the $305,590, you earned an extra $404,535 on top of it.

If McDonald’s dividend projection for 2013 turns out to be accurate, your 25,434.39 shares should result in you getting paid cash dividends of $84,697 this year instead of the $57,889 you would have gotten had you spent your dividends along the way. That $26,808 in extra income represents the dividends on your dividends that are now working for you.

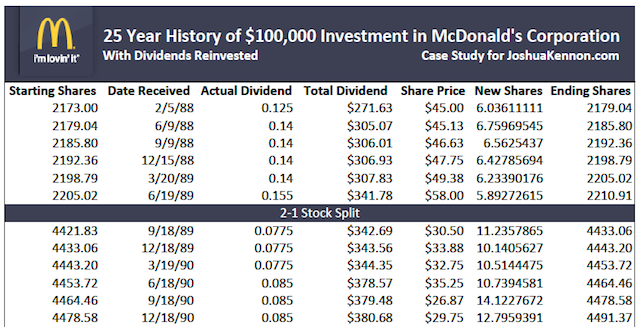

To help you visualize how your reinvested dividends would have added to your ownership stake over time, I created the following spreadsheet that breaks out the transactions. (Notice that McDonald’s switched to annual dividends, instead of quarterly, between 2000 and 2007, leading to a large, single payment per year, instead of four smaller quarterly payments. This creates the appearance of large dividend increases and decreases upon first glance, which is entirely cosmetic.)

You would have compounded your original $100,000 by 13.25% for 25 years.

Click on the spreadsheet to download a detailed Adobe PDF file of the dividend reinvestment results for the 25 Year McDonald’s Corporation case study …

Scenario 3: You Do Not Reinvest Your Dividends and Swap All Of Your Shares of McDonald’s Corporation for Shares In the Chipotle Mexican Grill Spin-Off in October of 2006

In 2006, McDonald’s Corporation decided to spin-off one of its subsidiaries – a burrito chain known as Chipotle Mexican Grill. Stockholders were given an early option to swap 1 share of McDonald’s stock for 0.92 shares of Chipotle, which was a 10% discount to the value of the latter’s business. Those who didn’t take advantage of it were able to later exchange shares for on a 0.8879 ratio. The swap was tax-free. This allowed the McDonald’s corporation to buy back its own shares, and exchange them for a business that was no longer a good fit for the burger chain.

Had you taken advantage of the early split-off in October of 2006, you would have traded your 17,384 shares of McDonald’s Corporation for 15,993 shares of Chipotle.

Had you taken advantage of the early split-off in October of 2006, you would have traded your 17,384 shares of McDonald’s Corporation for 15,993 shares of Chipotle.

When you opened the safe deposit box shortly after December 31st, 2012, you would have found:

- 15,993 shares of Chipotle at $290.53 per share for a total market value of $4,646,446

- Cash dividends of $65,083 that had been paid to you on your McDonald’s shares between 1988 and 2006

- Grand Total: $4,711,529

The results are staggering. Spin-offs can be a great source of wealth creation because smaller businesses are often stacked with strong management teams and given large infusions of capital so the parent company looks good in the long-run (it’s considered an embarrassment if you spin-off a subsidiary and it fails. It also hurts your credibility with both professional and main street investors.)

In the case of Chipotle Mexican Grill, there weren’t a lot of stores in the United States, which allowed the independent company to begin massive rollouts following the same discipline that made McDonald’s a restaurant behemoth. By getting in relatively close to the ground floor of the expansion process, the growth in share price was significant.

Your cost basis on the $290.53 shares of Chipotle Mexican Grill would be $5.29 per share. You’d show $285.24 in capital gains, or 5,400%. Including dividends, you would have compounded your money pre-tax by 16.67% per annum for 25 years.

Scenario 4: You Reinvest Your Dividends and Swap All Of Your Shares of McDonald’s Corporation for Shares In the Chipotle Mexican Grill Spin-Off in October of 2006

In this scenario, you reinvested all of your McDonald’s Corporation dividends until October of 2006, when you were given the option of swapping your McDonald’s shares on a 1-for-0.92 share basis for ownership in the spin-off of Chipotle Mexican Grill. How much money would you have had when you opened the bank vault at the end of fiscal 2012?

- 19,093 shares of Chipotle at $290.53 per share for a total market value of $5,547,089

- Grand Total: $5,547,089

The reason you have so much more money is that you were sitting on 20,753.32 shares of McDonald’s Corporation on the date of the Chipotle swap, not the 17,384 shares you would have had if you’d opted to take your dividends in cash. Those extra 3,369 shares of McDonald’s came from the dividends you plowed back into the firm to buy additional ownership. Each year, the shares bought with dividends paid dividends of their own, kickstarting a virtuous cycle. When it came time to swap your stock for the burrito chain, you received 3,100 more shares of Chipotle than you would have otherwise owned.

Including dividends, you would have compounded your initial $100,000 by 17.43% for 25 years.

Lessons from the McDonald’s Corporation Investment Case Study

Each of the four scenarios resulted in very different results for the owner. Some drown you in cash while you saw your shares rise over time. Some resulted in more shares accumulating with each passing year, creating richer capital gains and future dividends. To see the breakdown, download this Adobe PDF chart:

It should be evident that there is no right or wrong answer. Regardless of where you fell on that chart, the results were more than satisfactory. You crushed inflation. You crushed gold. You crushed bonds. You crushed most real estate. At the time you bought your stake, McDonald’s was already the largest restaurant in the world; a giant multi-national that produced bushels of money every second as people from California to Siberia had their morning coffee or their late afternoon sweet tea and chicken sandwich. This was not some risky start-up. It was already among the bluest of the blue chips.

For a lot of people, I think Scenario 1 is the preferable course of action. Turning $100,000 into $1,533,443 in stock, generating a $57,889 annual income, and collecting cash of $305,590 over the course of 25 years combines the three things that matter to your finances: 1.) wealth creation, 2.) utility of spending money in the present, and 3.) the safety of a private income so you don’t have to rely on a job. Anyone who looks at that and says, “I should have opted for Scenario 4” is behaving foolishly. Not necessarily. Your life is different. Your priorities are different. Your needs are different.

For a lot of people, I think Scenario 1 is the preferable course of action. Turning $100,000 into $1,533,443 in stock, generating a $57,889 annual income, and collecting cash of $305,590 over the course of 25 years combines the three things that matter to your finances: 1.) wealth creation, 2.) utility of spending money in the present, and 3.) the safety of a private income so you don’t have to rely on a job. Anyone who looks at that and says, “I should have opted for Scenario 4” is behaving foolishly. Not necessarily. Your life is different. Your priorities are different. Your needs are different.

Going back to our examination of the Eastman Kodak bankruptcy, you should now see how a reasonably diversified portfolio can take a lot of damage. Even with the wipeout of the Kodak shares, a portfolio split evenly between these two firms, even in the lowest returning Scenario 1, would have enjoyed nice long-term results.

Another interesting thing to note: For almost the entire 25 year holding period, McDonald’s common stock never appeared to move outside of the $25 to $50 per share range. That is why you can’t pick up a newspaper or glance at a stock quote to tell what is going on with a business. There are splits. There are dividends. There are spin-offs.

The big question you should be asking yourself: We’ve performed case study after case study on the most famous businesses in the world, including some that have failed. Generally, the returns have been good. Why aren’t investors enjoying these returns? What is the problem? The answer can be found in The Intelligent Investor. To quote Benjamin Graham: “The investor’s chief problem — and even his worst enemy — is likely to be himself.“

Yet another Morningstar study has shown that investors lag even the municipal bond funds they hold! As the author points out, munis are among the least volatile asset classes in the world. That underscores the extent of the problem. Ordinary people cannot select good assets and then sit back, letting time to do the rest. They constantly buy and sell, moving from one stock to another, this fund to that fund, trying to be smart. The source of your wealth creation comes from the underlying profits of the businesses you own. Buy more profits, make more money. A long-term holder of McDonald’s made money because the earnings per share kept growing ever higher, year after year, “pounding out more and more money”. Those who weren’t interested in McDonald’s stock, but rather McDonald’s business, and paid a fair price for their ownership stake, knocked it out of the park.

Footnotes:

Note that for the sake of brevity, there are some rounding adjustments that make the figures less precise than would be ideal in an academic environment. They are, however, very close to the end results and work to illustrate the power of compounding. After three hours of calculations and research, a little imprecision is what you are getting for a free blog post published on my personal site.

[mainbodyad]Taxes would have exerted a significant influence on the rate of your return. The scenario analysis assumes that you held your stock in a tax-shelter of some sort, such as a retirement plan. Had you invested in a brokerage account with no special protection from Federal and state taxation, your results could have been materially lower depending upon a myriad of factors including the existence of any other tax credits such as carry-forward losses or your tax bracket. Transaction costs could have been minimized as most brokerage firms offer free dividend reinvestment, or you could take advantage of the dividend reinvestment plan.