[vc_row][vc_column][vc_column_text css_animation=”none”] [/vc_column_text]

[/vc_column_text]

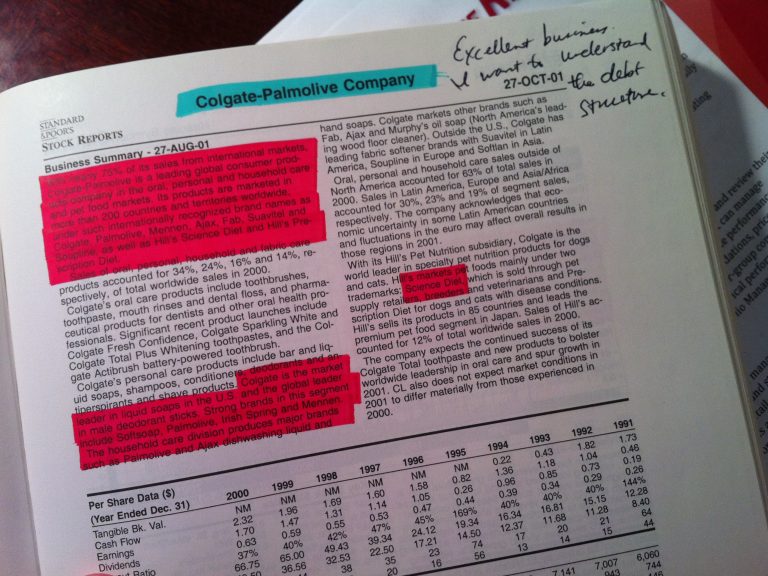

After writing about the 20 year performance of Colgate-Palmolive stock, my Aunt Donna asked me about Dawn dish soap, which is owned by Procter & Gamble. I broke out the historical dividend charts and went to work to create a comparison of how an investor would have fared had they parked money in P&G twenty…

I’m still running several weeks behind but one of the things I’ve been working on is a response to a few of the questions submitted by FratMan, whom you’ve seen in some of the mail bag sections I believe. He’s mentioned a few times, such as in the comments sections here and here, that he likes…

Using Wal-Mart Stores as an Example of Earnings Yields vs. Treasury Bond Yields I was up until 5 a.m. this morning reading through the past few years’ of Wal-Mart Stores, Inc. annual reports, filings with the SEC, analyst reports, transcripts, and other documents. It is about time to have the businesses make another contribution to…

In 1960, Miller Gorrie was around 25 years old. Throughout his life, he had taken his earnings from paper routes and poured them into IBM stock, which had compounded at 20%+ for many years. This led to the young man possessing a portfolio worth more than $100,000, which adjusted for inflation, is more than $728,000…

The current valuation of Tiffany & Co. seems absurd to me. I do not understand why people are paying it. Let me walk you through the numbers.

I’m re-reading “Damn Right! Behind the Scenes with Berkshire Hathaway Billionaire Charlie Munger” by Janet Lowe and came across a passage that illustrates exactly the sort of thing I’m talking about when I harp on acquiring assets that constantly churn out piles of cash for you spend, redeploy into new investments, give to charity, or…

The experience of Johnson & Johnson owners over the past decade is informative in understanding the role valuation and growth plays in determining total return outcome. Let’s take a closer look.

The Graham-Newman Corporation was a stock company that essentially served as a hedge fund through which legendary investor Benjamin Graham managed money for his shareholders. It is the same firm where Warren Buffett worked in his twenties before moving back to Omaha and establishing the original seven partnerships upon which his fortune is based. According…

John S. Lemon, President of Tootle-Lemon National Bank in St. Joseph, Missouri (the city near the farm town where I grew up before moving to the East Coast at the end of my teenage years), died on March 17th, 1905. According to Volume LXX January to June 1905 of The Bankers’ Magazine: “He was born…

Sitting on my desk in front of me, as I type this article, is an analyst report by Morningstar for Wachovia dated December 31st, 2007. This is the bank that was built almost entirely on the foundation of R.J. Reynolds Tobacco in Winston-Salem. At the time, Wachovia common stock had closed at $38.03 and was paying a very rich 6.31% dividend yield. The analysts at Morningstar valued the shares at $61.00, indicating they were nearly 40% undervalued. Within 10 months, those same shares of Wachovia were trading for $1.00 following a catastrophic collapse.

[vc_empty_space][vc_column_text css_animation=”none”]

[/vc_column_text][/vc_column][/vc_row]