A 20 Year History of Procter & Gamble Stock

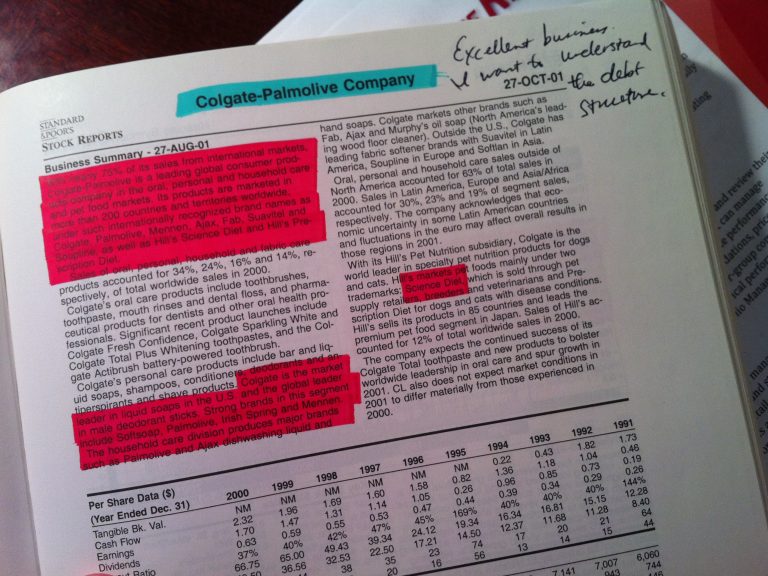

After writing about the 20 year performance of Colgate-Palmolive stock, my Aunt Donna asked me about Dawn dish soap, which is owned by Procter & Gamble. I broke out the historical dividend charts and went to work to create a comparison of how an investor would have fared had they parked money in P&G twenty…