[vc_row][vc_column][vc_column_text css_animation=”none”] [/vc_column_text]

[/vc_column_text]

One of the major themes running through my body of work, both on this site and at Investing for Beginners, can be summed up in the statement, “Know your risks”. I hammer it home all the time; “risk-adjusted return”, talk about remote-probability events, explaining how much of wealth building is learning to “tilt probabilities in [your] favor”, admonishment to never invest in something you don’t fully understand and couldn’t explain to a Kindergartener in a couple of sentences. Consider this real-life tragedy a morality tale that can help you protect your own family.

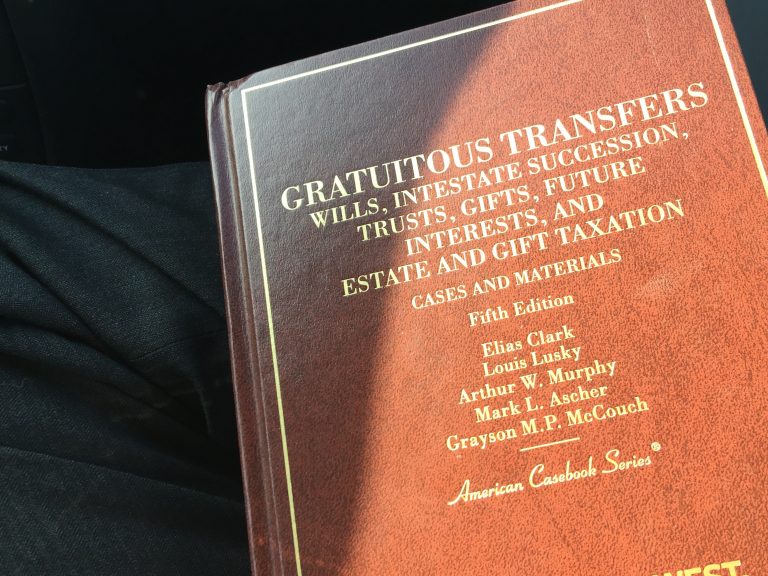

One of the things that has stuck with me, and I’ve been contemplating for the past twenty-four hours, is the passage on alienability of beneficiary’s interest, particularly as in regard to spendthrift trusts.

Are you in the mood for a case study resource for your own investment policy manual? If so, brace yourself because this one is heartbreaking. You can learn a lot from it, and save your own family a great deal of tragedy, but it’s going to involve surveying the ruins of the lives of others…

Correlated risks that aren’t apparent at first glance can be some of the most dangerous risks to your business or investment portfolio because you haven’t adequately prepared for something to go wrong. That is why I so often mention correlated risk so that you don’t think you’re more diversified than you are in reality.

[vc_empty_space][vc_column_text css_animation=”none”]

[/vc_column_text][/vc_column][/vc_row]