Investing is the process of putting aside money today in exchange for more money in the future. This process involves risk but, when well managed, can help grow your wealth over time due to the power of compounding. This is the investing archive that includes articles published on JoshuaKennon.com. If you are looking for more great content, visit Joshua’s Investing for Beginners site at About.com, a division of The New York Times.

[vc_row][vc_column][vc_column_text css_animation=”none”] [/vc_column_text]

[/vc_column_text]

Our real estate purchases in and around New Albany, Ohio continue. In addition to the two houses we already bought, we are under contract to acquire a commercial property. We’ve also started moving the pieces to someday have more kids.

The paradox of 2024 for investors is that the stock market keeps getting more expensive but individual blue chip stocks are getting cheaper. I’d argue this has created a wonderful environment for long-term value investors.

After a long search, we have selected New Albany, Ohio as our personal and business headquarters with all operations shifting in 2024. If you haven’t heard of New Albany, yet, you will. Sooner rather than later. Over the coming years, it will be home to one of the largest microchip manufacturing facilities on the planet.

As the United States returns to a normalized interest rate environment, things are going to get interesting. A few of my personal thoughts on the situation in which we, as a country, now find ourselves.

Buried thousands of pages within its newly-enacted buget, the State of Ohio just quietly created a new Ohio Homeownership Savings Account program that allows individuals and married couples in the Buckeye State to take a tax deduction in exchange for saving for the purchase of a house. I think this could be the start of something interesting, especially if it takes off across other states and/or the Federal government.

The news has been filled with stories about GameStop and other stocks with high “short” interests being squeezed in recent weeks so there is no point in me rehashing the specifics. There is a lot I could cover about the actual procedure for how trades settle, how short squeezes happen, who is innocent and guilty, and a host of other relevant topics. Enough ink has been spilled, digital and print, that I’m going to focus on the bigger picture, instead. This whole situation is not good.

Keeping an eye on numerous individual companies, as well as a broad array of economic data, I am far more optimistic about the next ten years than I was this time last month. Yes, there will still be challenges, but it looks like much of the worst-case scenario has been averted. Now, it’s about navigating the problems we will encounter due to the specific policy decisions made in the midst of the pandemic.

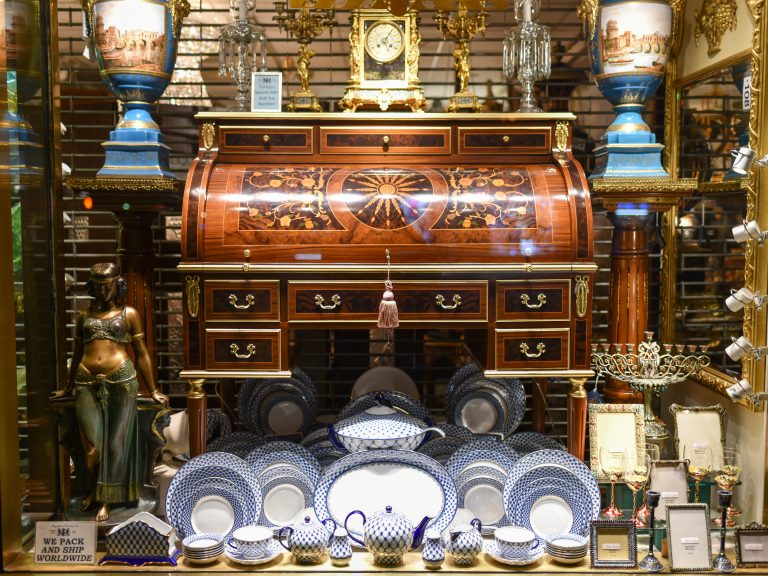

I’ve been watching, with increasing interest, the catastrophic market decline that has been playing out in antique case goods, furniture, decor, and other related historical items. This category of assets, which had been on a steady, upward climb for nearly thirty years prior to the Great Recession, has been in a free-for-all, nosediving with such violence that the implosion is breathtaking in both scope and severity.

I’ve been thinking about the next 25 to 50 years; mapping out plans for my personal life, my family, the firm, and, to some degree, certain societal changes that I think are important and worthy of significant political and financial investment. Part of this involves estate planning and how we think about leaving money to our future children.

Mondelez International, maker of Cadbury Chocolate and Oreo Cookies, has launched a takeover bid for The Hershey Company. Long-term owners should not be happy about it.

[vc_empty_space][vc_column_text css_animation=”none”]

[/vc_column_text][/vc_column][/vc_row]