Investing is the process of putting aside money today in exchange for more money in the future. This process involves risk but, when well managed, can help grow your wealth over time due to the power of compounding. This is the investing archive that includes articles published on JoshuaKennon.com. If you are looking for more great content, visit Joshua’s Investing for Beginners site at About.com, a division of The New York Times.

As you probably know by now, The Walt Disney Company has acquired Lucasfilm Ltd. in a $4.5 billion deal. The studio owns franchises such as Star Wars and Indiana Jones. Half will be paid in cash and the other half will be paid in newly minted shares of the company, diluting the existing owners. However, the terms are so favorable that, frankly, it looks like George Lucas took a much lower price than he could have gotten elsewhere solely to have Disney protect the brand, given the latter’s reputation and massive resources. Not even including the cash that Lucasfilm itself produces, Disney could pay for the acquisition in less than 6.7 months using the money generated by its vast empire.

The New York Stock Exchange is set to reopen today after having been closed for two consecutive trading days as Hurricane Sandy made landfall on the Eastern seaboard. The last time this happened due to weather was in 1888, when a blizzard shut down the city. It could have been much worse. The lesson: You…

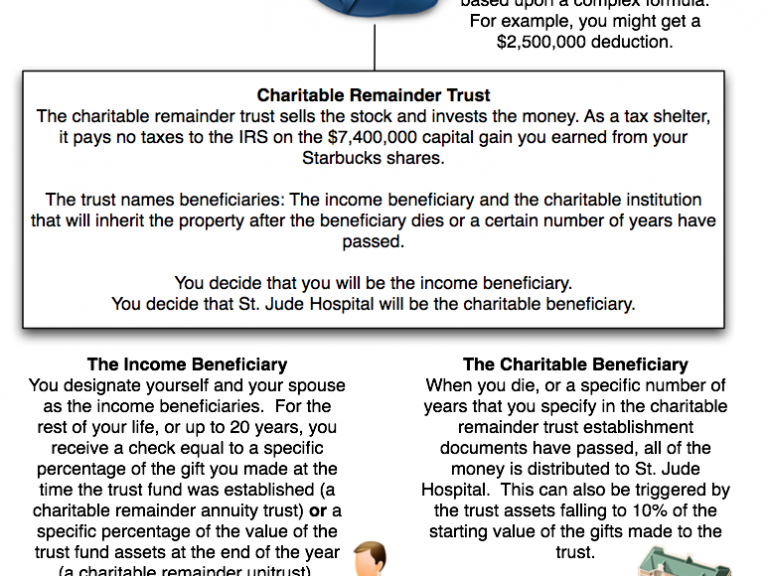

The past day or so, some prominent bloggers have been attacking Mitt Romney for using something known as a charitable remainder trust as a way to lower his tax bill. As someone who is voting for President Obama, let me tell you flatly: This is nonsense. The people demonizing Mitt Romney for his use of…

I often get messages from some of you expressing a desire to invest but not wanting to sign up for a life buried in balance sheets or income statements. The good news: In investing, you can do extremely well if you have a few good, big ideas in your lifetime. You don’t have to become a master of everything. You just need to understand what you are doing, focus on it with the persistence of a pit bull, and be patient during the periods when there is nothing attractive to do, content to sit on cash. There is no need to master every industry, or spend your evenings pouring over the disclosure documents of a pharmaceutical giant to make money. It isn’t necessary.

How to Remain Detached from the Stock Market and Treat Your Investments Like Private Businesses When I was much younger, I kept seeing Benjamin Graham’s famous allegory called Mr. Market mentioned by great economists, investors, and financial historians. I bought a copy of The Intelligent Investor to figure out why everyone was so enthralled with a book…

Some of you had asked me to explain how I research stocks – specifically, where I look for investment ideas, which data sets I use, and how I find potential holdings for the portfolios I manage for my household and businesses.

I’ve done case studies in the past of slower growing, highly profitable businesses such as Clorox, Nestlé, Coca-Cola, Procter & Gamble, and Colgate-Palmolive among them. We’ve also discussed case studies of some initial public offerings, such as an investment in Tiffany & Company twenty-five years ago. I thought it might be interesting to look at another…

Personally, my household owns shares of Nestlé SA, the Swiss-based chocolate, water, coffee, condensed milk, packaged food, and nutrition giant. I’ve never been able to get as much of it as I want due to valuation1, but whenever the stock is within striking distance of my conservatively estimated calculation of intrinsic value, I write a…

One of the additions I have been considering adding to the KRIP is The Clorox Company. However, it appears somewhat overvalued right now, offering a lower earnings yield and slower sales growth compared to the S&P 500 if you view the index itself as a single stock, which doesn’t bode well on a relative basis. That…

It is a fairly regular occurrence for me to get messages from individuals who advocate a portfolio consisting entirely, or almost entirely, of gold, held for the long-term. They usually follow the same pattern, are from the same demographic, and come through the contact form. This morning, there was a comment left about gold and I decided…