Investing is the process of putting aside money today in exchange for more money in the future. This process involves risk but, when well managed, can help grow your wealth over time due to the power of compounding. This is the investing archive that includes articles published on JoshuaKennon.com. If you are looking for more great content, visit Joshua’s Investing for Beginners site at About.com, a division of The New York Times.

The Wall Street Journal had a recent story detailing the trend of small investors jumping back into stocks, some trading options and futures. I’m old enough now, combined with twin quirks of being interested in finance at such a young age and having my lifespan line up with some interesting times in the capital markets, that I’ve watched this play out three times. At this point, you’d think it would lose its novelty but I still find my mouth dropping open and my head shaking in disbelief, mixed in with a bit of sadness. Reading what people are doing with their hard earned money – money that they exchanged for part of their life by selling time that could have been used traveling, reading, painting, or hanging out on the beach – doesn’t compute. If you took $5 out of their wallet, they’d throw a fit, but they’ll gamble $5,000 on something they barely understand.

I’m going through the corporate bond filings of pharmaceutical giant Eli Lilly just out of curiosity. They have a huge patent cliff coming up, during which time as much as 40% of their revenue base will be exposed to generic competition. I wondered what it would do to the risk metrics on the senior bonds so I pulled the Moody’s rating and reading over the figures as I listen to an old 1970s song called Snookeroo.

I spent a big percentage of my day reading indenture documents for corporate debt securities because I was helping someone pick up some additional fixed income investments for a retirement portfolio. I managed to get my hands on a nice block of high-grade, non-callable debentures from a major packaged foods company with a 4.3% yield-to-maturity on the remaining decade before maturity, but still have a bit of their dry powder left to spend.

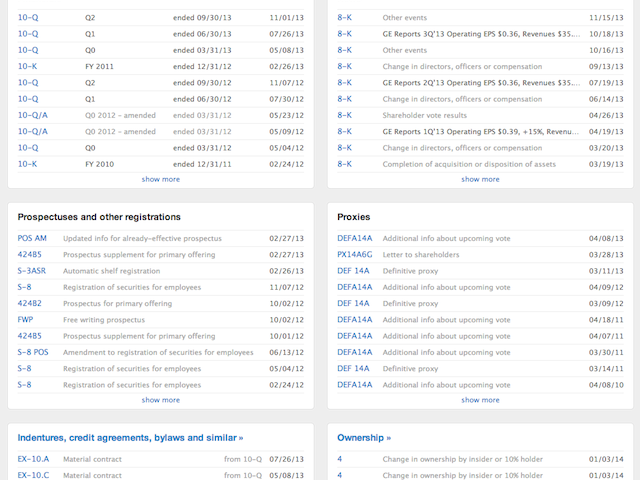

This is, without a doubt, one of the simplest, coolest, most useful investment tools I’ve ever come across on the Internet. Enter a ticker symbol and – Bam! – the records for the company filed with the Securities and Exchange Commission and divided into their own boxes, separating financials such as the 10-K and 10-Q…

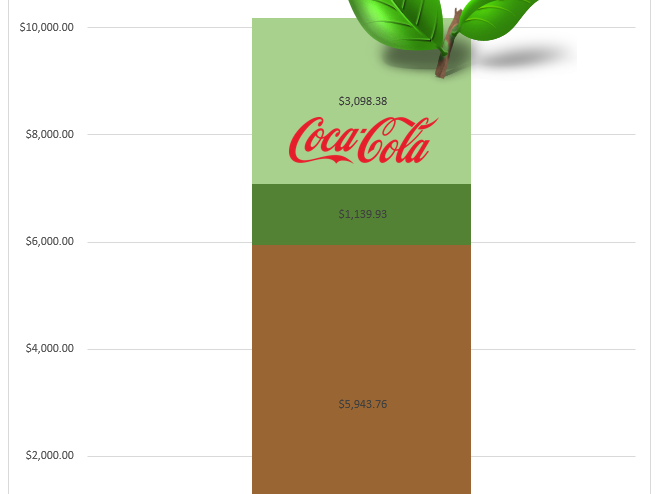

One of you, writing under the name Emma, posed a question in the comments section of another post. You asked me whether or not I thought a firm like Coca-Cola could repeat its historical performance. Rather than answer the question directly, I realized this would be a great opportunity to explain the variables that drive…

I’ve been setting up custodial accounts such as UTMAs, looking at dividend reinvestment plans, and more for the past few days.

Imagine that you have a new neighbor. We’ll call him Rod Smith. One day, he shows you his portfolio. He has a little over $1,000,000 in common stocks. “I have this great idea!”, he tells you, excitedly. “I decided to buy a list of companies I like and pick up around 421 shares of each.…

This is one of those inside-baseball questions that the serious, more-than-part-time investors out there will probably enjoy. Hi, Joshua. I could read your blog all day. Thanks for everything that you do. When I read your commentary on payout ratios, it seems to focus on EPS payout ratio, or dividend coverage. I don’t understand why you don’t…

On an earlier post about the new Disney MyMagic+ program, which discussed capital budgeting from the investor’s perspective, there was a question left in the comments by Donald Pato about money market funds and money market accounts. I couldn’t fit my response in the comments box, so I am writing it as a stand-alone post…

I put in and order on Saturday to buy a few more shares of Nestlé SA on Monday for my family’s personal accounts. I spent much of the weekend reading the company’s 125th anniversary biography and studying the original balance sheets and income statements of the firms that went into forming one of the world’s most profitable holding companies.