[vc_row][vc_column][vc_column_text css_animation=”none”] [/vc_column_text]

[/vc_column_text]

Here are some words of wisdom I came across about portfolio management and building wealth from billionaire Charlie Munger. We’ve really made the money out of high-quality businesses. In some cases, we bought the whole business. And in some cases, we just bought a big block of stock. But when you analyze what happened, the…

Before you invest a single penny of your money into a potential stock, bond, project, or other asset, there are two questions you should ask yourself. These two questions could have saved a lot of investors from asset bubbles and bankruptcy court. #1 – Does the Investment Offer an Adequate Rate of Return All Things…

I write a lot about investing in stock and investing in bonds over at Investing for Beginners at About.com, a division of The New York Times. There is a reason I tend to be far more favorable to equity investments (stocks) than fixed income investments (bonds) when it comes to long-term investing and why much…

After writing about the 20 year performance of Colgate-Palmolive stock, my Aunt Donna asked me about Dawn dish soap, which is owned by Procter & Gamble. I broke out the historical dividend charts and went to work to create a comparison of how an investor would have fared had they parked money in P&G twenty…

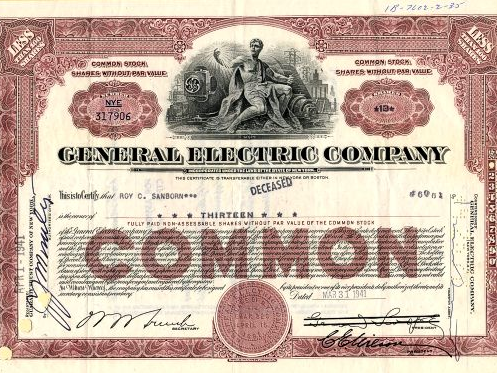

A Look At How the Father of Value Investing Calculated the Intrinsic Value of an Ordinary Share of Common Stock Benjamin Graham, the rich investor, professor, and mentor to Warren Buffett, once proposed a quick back-of-the-envelope intrinsic value formula for investors to determine if their stocks were at least somewhat rationally priced. He encouraged investors…

Using Wal-Mart Stores as an Example of Earnings Yields vs. Treasury Bond Yields I was up until 5 a.m. this morning reading through the past few years’ of Wal-Mart Stores, Inc. annual reports, filings with the SEC, analyst reports, transcripts, and other documents. It is about time to have the businesses make another contribution to…

You have to think independently and make up your own mind. That is the responsibility each of us has. That doesn’t mean you can’t look for input from others but you cannot outsource the obligation to rationally think, decide upon a course of action, and live with the results of your decision. Apparently, Munger hasn’t…

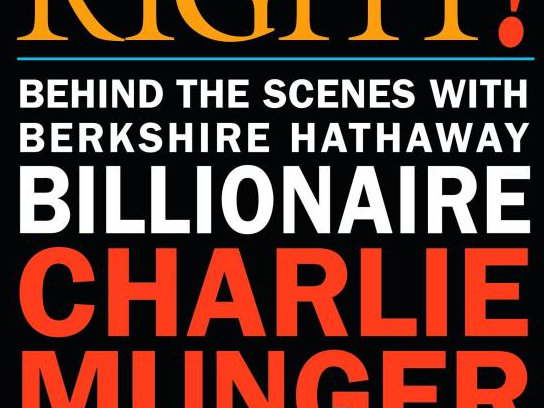

I’m re-reading “Damn Right! Behind the Scenes with Berkshire Hathaway Billionaire Charlie Munger” by Janet Lowe and came across a passage that illustrates exactly the sort of thing I’m talking about when I harp on acquiring assets that constantly churn out piles of cash for you spend, redeploy into new investments, give to charity, or…

One technique I find helps a lot of investors act more rationally is one I developed during my late teenage years. I would convert all companies I was analyzing to $100 per share to make comparison of the figures and yields easier. In essence, this allowed me to ask the question, “How much profit am I buying for every $100 I put into this company?” If I paid a high multiple for a particular business, it forced me to justify the higher valuation by writing down my reasons for my belief.

I thought it might be useful to show you how I’d analyze an investment portfolio and calculate a reasonable estimate of not only expected growth in capital but the overall economic characteristics of the holdings.

[vc_empty_space][vc_column_text css_animation=”none”]

[/vc_column_text][/vc_column][/vc_row]