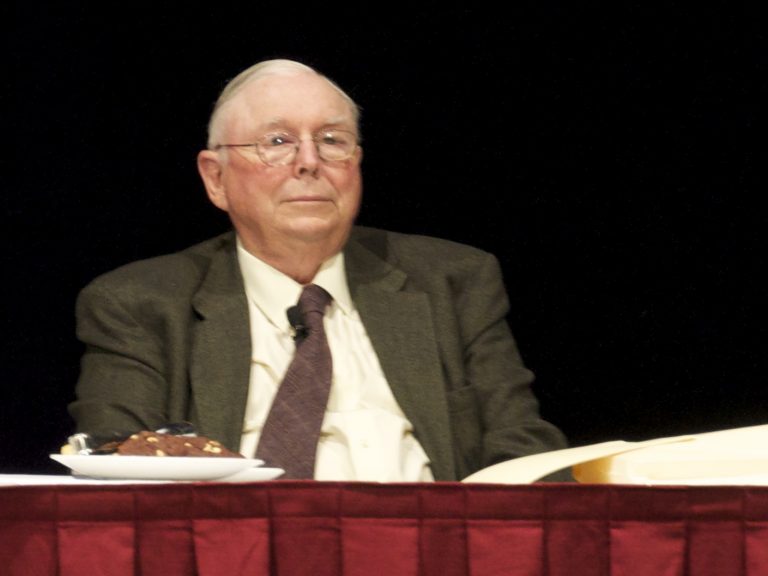

Investing Advice from Charlie Munger

Here are some words of wisdom I came across about portfolio management and building wealth from billionaire Charlie Munger. We’ve really made the money out of high-quality businesses. In some cases, we bought the whole business. And in some cases, we just bought a big block of stock. But when you analyze what happened, the…