Investing is the process of putting aside money today in exchange for more money in the future. This process involves risk but, when well managed, can help grow your wealth over time due to the power of compounding. This is the investing archive that includes articles published on JoshuaKennon.com. If you are looking for more great content, visit Joshua’s Investing for Beginners site at About.com, a division of The New York Times.

[vc_row][vc_column][vc_column_text css_animation=”none”] [/vc_column_text]

[/vc_column_text]

I’ve been thinking a lot lately about Buffett Associates, Ltd., which is the most famous and first “real” professional investment partnership that Warren Buffett established on May 1st, 1956 after he returned to Omaha following his time working for Benjamin Graham at the Graham-Newman Corporation. He was 25 at the time (would turn 26 that…

I’ve been writing quite a bit about dividends and dividend investing over at Investing for Beginners at About.com. One of the things I wanted to explain, but I feel is still advanced for that particular readership base, is something known as the dividend discount model, or rather a back-of-the-envelope adaptation of it. (Please note that…

I’ve been talking a lot about trust funds lately. I calculated that if someone put $50,000 in a trust fund today, 70 years from now, they could have a dynasty trust paying each of their heirs a $25,000 cash check (in today’s dollars, net of taxes) at Christmas. There are a lot of assumptions that may not pan out in that figure, but it’s a decent guess.

Trust funds are terribly misunderstood. They are one of the most flexible planning tools to nurture, create, and pass on wealth ever known to man. They can be as rigid or as flexible as you desire. Even more importantly, you don’t have to be rich to use trust funds. These structures are not relegated to the realm of the Rockefeller and Walton families.

You all know that Peter Lynch was the first investor that made the stock market make sense to me during childhood. He is one of the greatest investors of all time, having compounded the mutual fund he ran for 13 years at 20%+ annually, generating an absolute return of more than 1,000% for his…

A new addition to the Scrooge McDuck collection joined the office today. It was only released in Europe but I liked it so much it had to join our Carl Barks compendium.

A family member of mine was looking at houses and I started thinking about Charlie Munger when he said it is important to keep a lot of the “silly needs” out of your life. (This particular family member is doing a great job managing his budget, but in general, it made me wonder about society…

A family member of mine has a daughter who is selling Girl Scout cookies. To help, I decided to buy half-a-dozen boxes of cookies. That led me down a research path to figure out who, exactly was making money from baking those treats.

Four Companies Control 94.8% Market Share of the Domestic Cigarette Industry in the United States On this blog, in my articles, and even in my books, I have often used the example of how capital allocation determines the wealth one ultimately has. Many times, I used the illustration of a married couple, both of whom…

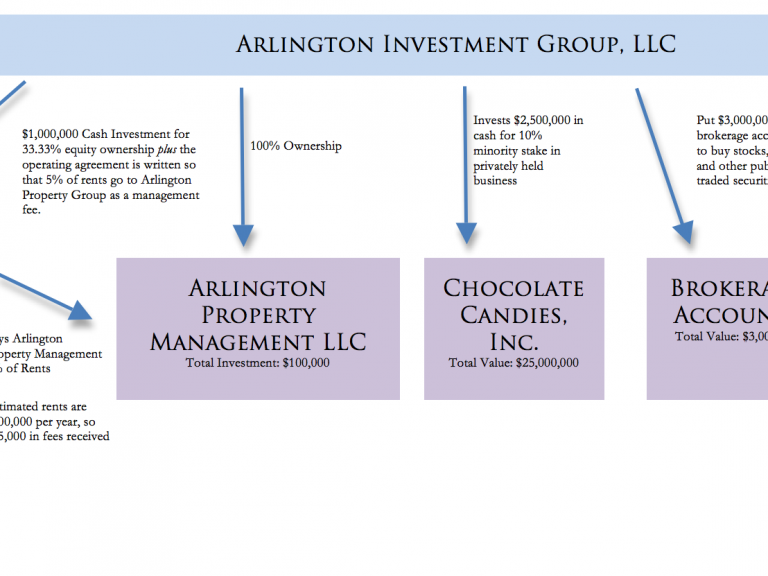

How a Holding Company Works A holding company is a special type of business that doesn’t do anything itself. Instead, it owns investments, such as stocks, bonds, mutual funds, gold, silver, real estate, art, patents, copyrights, licenses, private businesses, or virtually anything of value. The term holding company comes from the fact that the business…

[vc_empty_space][vc_column_text css_animation=”none”]

[/vc_column_text][/vc_column][/vc_row]