Investing is the process of putting aside money today in exchange for more money in the future. This process involves risk but, when well managed, can help grow your wealth over time due to the power of compounding. This is the investing archive that includes articles published on JoshuaKennon.com. If you are looking for more great content, visit Joshua’s Investing for Beginners site at About.com, a division of The New York Times.

[vc_row][vc_column][vc_column_text css_animation=”none”] [/vc_column_text]

[/vc_column_text]

McDonald’s is one of those businesses that I love. The last time we talked about it was when I wrote the 25 Year Investment Case Study of McDonald’s, and showed how you could have turned $100,000 into anywhere between $1,839,033 and $5,547,089 depending on how you handled dividend reinvestment and the Chipotle split-off back in 2006, and the sorely lacking media coverage of McDonald’s results in February. No matter which way you look at it, despite periods of overvaluation and undervaluation, alternating with the underlying performance and the emotional moods of shareholders, McDonald’s has been a fantastic company. It makes its employees and shareholders a lot of money. It gives society something it wants, whether that be a plain salad with side of fresh fruit and a non-sweetened iced tea or a double cheeseburger with french fries and a Coca-Cola.

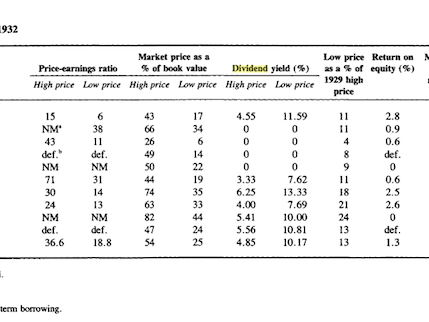

We’ve talked about the 1929 period a lot lately, but what you need to remember is that it was a walk in the park compared to 1933. It wasn’t until then that everyone had gone broke, given up hope, and sworn off stocks for life, leaving great businesses trading at double-digit dividend yields and a…

For the serious investors among you, I recommended a book about the 1929-1933 crash that is the single best statistical resource on the subject I have ever encountered. After talking about it on the site, I’m going back through the 700+ pages and I really can’t emphasize enough how seeing the effects of the worst…

A week ago, I recommended a now-out of print book from 30 years ago that was an academic study of the Great Depression called The Crash and Its Aftermath. It is, hands down, the most useful statistical survey of the Great Depression and the 1929-1933 period I have ever read. It instantly ranks up there…

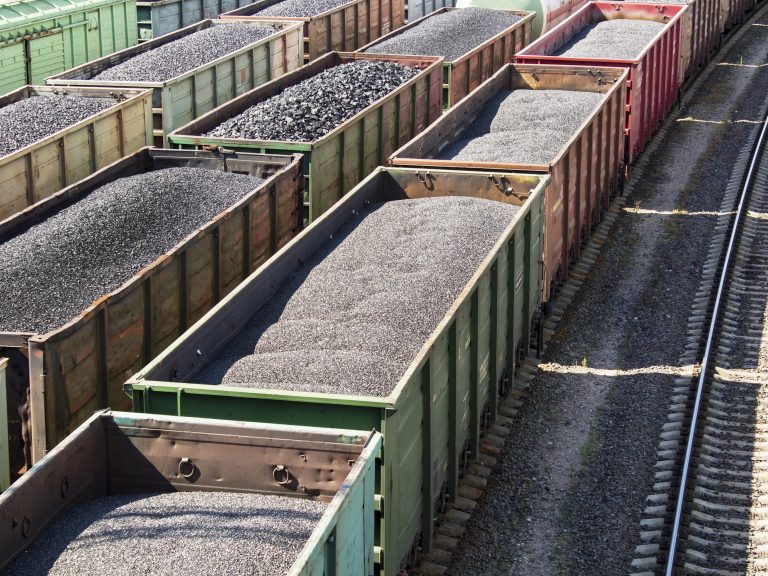

The developments on the income statement and balance sheet of Union Pacific between 2005 and 2013 are an excellent example of why it is important for you to analyze data yourself, and come to conclusions based on reasonable, rational, intelligently organized facts. The willingness to take action when others do not agree with you, and to have your action backed up by solid evidence, can make the difference between being comfortable and ending up rich. Two of the world’s wealthiest titans demonstrated this truth, not only when buying shares of Union Pacific, but other railroads, as well.

It’s been 1-2 years since we talked about the intrinsic value of Berkshire Hathaway. The last time I publicly commented in any meaningful way was to say that I thought Morningstar was wrong in its model. This put me in the interesting position that rarely happens: I thought intrinsic value was higher than the analysts who were publicly writing about it. Normally, I’m the one exclaiming that the estimates and variables used were too rosy.

I’m working my way through a 1985 book called The Crash and Its Aftermath: A History of Security Markets in the United States, 1929-1933, which covers the darkest days America has ever known. In 1932, during the depths of the Great Depression, the long-term United States Treasury bond yield was 4.25%. At this moment in time,…

A comment reply I needed to post about the Wachovia banking collapse was too large to fit in the comment thread so I am publishing it as a mail bag feature. It deals with my thoughts on investing in bank stocks and holding a large exposure to the banking industry.

It was another night of testing peasant dishes from French cuisine. This round included a Leek and Potato Soup with carrots, turnips, and a small amount of cream. The entire pot couldn’t have more than 900 calories in the aggregate but it was delicious and cost less than $7.

I’ve noticed an array of articles exclaiming that savings bonds, including both the Series EE savings bonds and the Series I savings bonds, beat stocks over the past ten or fifteen years. Nearly every time I make my way into one of these essays or news stories, I just shake my head because the surprise displayed by the men and women penning these pieces indicate a complete lack of competence. Those of you who have any experience managing money or with history immediately know my objective: No asset class, per se, is sacrosanct. What matters is the price you pay for the asset relative to how much underlying cash it generates.

[vc_empty_space][vc_column_text css_animation=”none”]

[/vc_column_text][/vc_column][/vc_row]