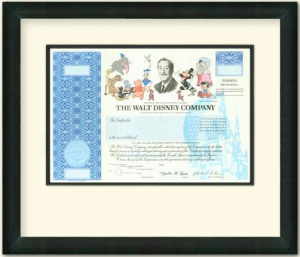

I Bought 100 Shares of The Walt Disney Company as a Souvenir During My Visit to the Resort

After breakfast this morning at the Animal Kingdom lodge, we headed over to Downtown Disney. As we shopped for souvenirs before flying back to Kansas City tomorrow, I was in the enormous World of Disney store when I realized the best possible souvenir I could have would be ownership in the business. From the kitchen section, surrounded by Mickey Mouse spatulas and Minnie Mouse oven mitts, I took out my phone, remotely logged into one of my personal brokerage accounts, and purchased a small memento in the form of 100 shares of The Walt Disney Company at $33.04 per share.

The Walt Disney Company owns Walt Disney, Pixar, Marvel Comics, and a host of other intellectual property and media networks including ESPN.

Short of unforeseen circumstances, the plan is to keep the stock until I die (or at least are well into my golden years), serving as an enjoyable reminder of the experience every quarter when I review a consolidated report of our investment holdings. There will always be a single round lot, separated into reserves, marked with an asterisk in an out-of-the-way brokerage account that hasn’t been used very much save for special circumstances such as this. It’s my version of a snapshot or home movie that should survive long after any knickknacks, clothing, watches, or bags would.

This makes me happy, even though I don’t consider Walt Disney stock particularly compelling on a valuation basis (though, to be fair, the stock does seem reasonably priced) at current market levels, and we’re talking about a relatively tiny amount of money. Here is how I think about it: Today is Warren Buffett’s 81st birthday. In 52 years, I will be 81 years old. If The Walt Disney Company, with dividends, grows at 10% per annum for the next 52 years, the $3,304 that I put away today would have grown to $469,310 in pre-tax nominal terms.

That means when I am his age, God willing, I will be looking at the balance sheet, seeing a small asterisked investment that will have a cross-referenced file filled with movie clips and photographs from the trip. It’s my way of leaving a marker; kind of like planting a flag on the moon, that I can come back and visit in the future. The difference between what I could have earned by allocating the money to my main portfolios or businesses and what I do earn by owning Walt Disney stock at these levels is worth it to me because of the memories attached to the event. This would be an example of the sentimental streak that runs so deeply in my personality.

What will I do with it when I’m older? I might give the shares to my grandchildren, pay for them to visit a Disney resort every year, or donate it as a contribution to the Kennon & Green Foundation.

Note: There is no guarantee that The Walt Disney Company will grow at 10%, or even still be in business in 50 years. That’s a risk I’m willing to take because I’m essentially buying the stock as a souvenir that has a potential for a satisfactory payoff, but I’m not banking on or projecting that.