Twenty-Four Years: Disneyland, the Carnation Cafe, a Poisoned Apple, and Thoughts on Life

I’ve always been introspective. Over the past year, though, I find that I am spending more time examining my life so far; re-evaluating decisions, trying to gain additional insight from my experiences, and really being honest about what I want for the rest of the time I’ve been gifted. I think there several reasons for this.

- I’m 36 years old, which means I see 40 approaching sooner rather than later. That seems like a good time to take stock and look around at things for the next phase in life.

- We will most likely become parents to our first two kids, born through gestational surrogacy, in the next 18 months depending upon a variety of factors in the schedule, many of which are out of our control. Thinking about being responsible for two helpless people who rely on us for everything changes the way you look at the world.

- We went through a massive career change by emerging from semi-retirement, starting an asset management firm, and moving nearly 1,700 miles across a continent (a move that involved sorting through boxes going back to our births, including childhood toys, old photographs, school programs, notebooks, homework assignments, business documents, and more).

- It’s become clear that the oldest generation in my family isn’t going to be around forever. When I was born, I was fortunate enough that several of my great-grandparents were alive. I have memories of them. Then they passed away. More and more, I see not only my family members, but parents of friends and acquaintances experience the downfalls of aging. I’ve been thinking a lot about the saying, “The family into which you are born is not the family you have when you die.” That’s such a strange feeling to me. At some point, it will be Aaron, me, our kids, grandkids, nieces, nephews, etc., but all of the people I remember from my childhood will be a memory living on only in our hearts. Thankfully, technology has solved some of this. I used to think about the fact that the older generation talked about how the thing they hated most about losing their parents and grandparents was forgetting the sound of their voice after enough years had passed but that’s no longer a problem.

There are others, some personal events that I need time and distance to process, but that’s the gist of it.

This Easter weekend was one of the best I’ve had in a long time. Aaron and I had a date lunch at the Carnation Cafe on Main Street in Disneyland. We booked it several weeks ago because 1.) we’ve been trying to make a point to step away from desks every once in awhile and 2.) we’ve been eating healthier and I wanted a cheat day where I could enjoy the old-fashioned meatloaf that I had the last time we ate here (which was five years ago, for those of you who have been around for awhile).

Aside from the fact the weather outside was my favorite – slightly chilly, dark overcast, windy, but not rainy – it was nice to use our annual passes. We’ve only visited the parks a handful of times since moving to California last summer. As both stockholders and the owners of Kennon-Green & Co., it was even nicer to watch the multitudes of smiling families enjoy themselves as they bought meals, snacks, souvenirs, art, costumes, toys, and housewares, funding future dividend distributions that are destined for our, and our clients’, pockets. I can’t even imagine what it’s going to be like when the new Star Wars world opens on May 31st. As a result of the stock’s run-up following the detailed announcement of the upcoming streaming service (as of the close of the stock market on Friday, shares of the entertainment giant had reached $139.92), it now represents the second largest equity position at the firm and is on the cusp of overtaking the combined market value of Berkshire Hathaway Class A and Class B shares for the crown.

Before we ordered, Aaron was texting his mom that he couldn’t talk at the moment. She had just tried to call but the crowds on Main Street were too loud to hear.

I had a salad with raspberry vinaigrette … I usually don’t like raspberry but it’s pretty good in this form.

For dessert, Aaron ordered a chocolate malt and I ordered a banana split. This gargantuan sundae arrived on the table. Despite both of us trying to attack it, a huge part was left because there is simply no way we could consume that much sugar in one setting. It was ridiculous in the best sense of the word.

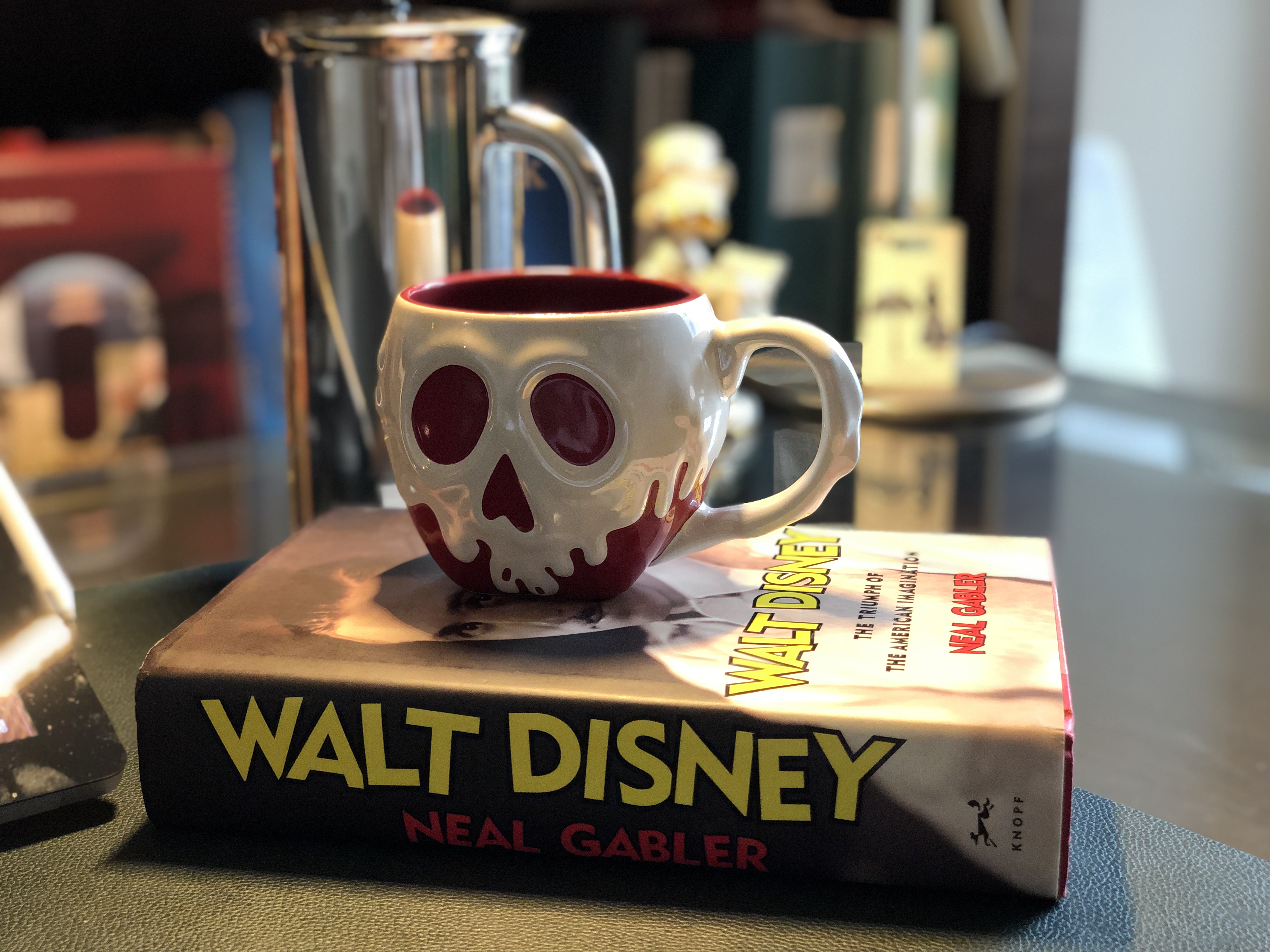

After dinner, we browsed the gift shops and I ended up getting a Poisoned Apple coffee mug from Snow White. It’s not only really well designed, it makes me happy because it reminds me that all of the early expansion – the thing that sent the studio over the top and laid the modern foundation of the empire – was the profits generated from that single film. It is the reason the pillars of Disney’s corporate headquarters look like the Seven Dwarfs. A week ago, Aaron and I wrote a quick note to our firm’s clients and mentioned Disney. I was drinking from the mug as we typed the message.

I cannot fully convey the sense of wonder, and gratitude, I felt as I sat there. Nearly twenty-four years ago, I was in the Magic Kingdom as a 12 year old boy. It was my first and only childhood vacation to a Disney theme park as such a trip wasn’t economically feasible for us. I was grateful, and happy, for the opportunity but also ambitious. I hated that we couldn’t afford to fly and that we couldn’t stay on a Disney property. I saw California, and how beautiful it was, and wished I could live somewhere like it. On top of this, I was so far in the closet, I was essentially chilling with Aslan in Narnia; something that was understandable given the political climate and religious environment in which I grew up (which you have read about here and here). Even had I come out, there was no hope of ever getting married and starting a family. Yet, now I found myself back on that same ground on Easter weekend, a resident of the Golden State, sitting across the table from my husband, talking about becoming parents, and looking around with the knowledge that we and the private clients of our firm collectively own millions upon millions of dollars worth of Disney common stock; that not only can we afford to visit whenever we want, and buy anything we desire, but that the park is now ours – all of the clothing and toys, ice cream sundaes and churros, collectibles and costumes being sold around us ended up back in our, and the other stockholders’, pockets, destined to fund future dividends, share repurchases, mergers, acquisitions, movie projects, and park expansions. This was made even sweeter by the Coca-Cola Corner and the Starbucks Coffee Shop found in close proximity, millions upon millions of dollars worth of ownership in those enterprises also sitting on the equity book, producing additional capital gains and dividends.

My hair is much, much grayer (which is hard to tell in this picture but it’s there) and I now have a few wrinkles but it’s a trade-off I’d gladly make again.

How did this happen?

Twenty-four years. Decision after decision. Chipping away at it a little bit every day. Living below our means. Trying to become wiser. Remaining constantly curious and obsessively focused. Reading as much as we could. Over and over again, the tiny advantages we amassed began to build upon themselves as they kicked off then reinforced a virtuous cycle.

It compounded.

That’s really the secret.

For the past few weeks, I’ve been going over something Charlie Munger said. He talked about the importance of arranging your life so that every possible advantage [is] working for you; that by doing this, the end result will be far more than the sum of the individual components. That strategy is profound and powerful. It explains a lot about how we arrived here. I should write about it someday.

I’m also struck by how much I owe to heroes I’ve never met. The ones this community is likely to know are people like Charlie Munger and Peter Lynch, who espoused the value of a liberal arts education and, in doing so, convinced me to pursue a classical music education during my undergraduate years so I could focus on a wide range of humanities disciplines to help me learn how to think; people like Warren Buffett who demonstrated that you could be honest and behave with integrity while still getting rich. There are hundreds of them … the men and women who made up the case studies, such as the one about Dolly Parton I shared with you. From a distance, and without even knowing it, they became my teachers and mentors. Some of them did this from beyond the grave. It’s difficult to overstate the influence of Benjamin Graham, Philip Fisher, or Peter Drucker; to discount the operational efficiencies I learned from studying not just the day-to-day business decisions, but capital structure employed by Sam Walton and others who gained the benefits of leverage through the use of negative cash conversion cycles (I remember being in my early twenties, years before I ever thought of starting this blog, and our collection of projects producing more than $30,000 in non-inflation adjusted cash, on average, per month for us to put to work for the first time – and doing it with effectively no required capital investment – feeling like I had found the holy grail.) I’d read biographies of people like Rockefeller, Carnegie, and J.P. Morgan, trying to figure out the lessons I wanted to take from their lives, both positive and negatives.

Because I had no connections and no family network to high finance, books, articles, interviews, and other sources were my lifeline. When Aaron and I moved to Newport Beach, we had to arrange for three separate storage facilities to accommodate the massive collection of paperwork and tomes we had amassed, many of which are now out of print and reveal the history of entrepreneurs and companies. Sometimes I’ll have three or four copies of the same treatise, marked up during different periods of my life, allowing me to see the progression of my thinking and understanding. I read anything and everything I could get my hands on that I thought might be useful to designing and constructing my compounding machine – industry-specific publications such as manuals for managers in the reinsurance industry, accounting textbooks, reports prepared for or by committees in Congress, academic papers. I browsed archived newspaper stories to understand the context around specific events and periods. I dug through court records to try and learn more about specific trusts and inheritance structures. And that’s the curated collection – during the move, I finally parted with (quite literally) several tons of papers, a lot of which consisted of financial news stories and articles printed during the 1990s that I had highlighted, annotated, and kept for reference. I shredded and destroyed notebooks covering the 1990s, 2000s, and early 2010s, filled with my writings and case studies, clearing the deck. There were entire boxes filled with handwritten copies of my early Investing for Beginners articles at what was then About.com.

All of these people helped me, even the negative examples of life events providing illustrations of what to avoid. I read history and political books, economic textbooks, and books of proverbs and maxims. I bought specialty dictionaries for specific fields, such as finance, and would read them to try and discover the things I didn’t know that I didn’t know. So many people, over so many centuries, shared their knowledge and passed it on for me to take, incorporate into my own life, make it uniquely my own, and benefit.

It took twenty-four years of preparation to get to this place, at this moment. If, God willing, Aaron and I have an ordinary life expectancy or better, I truly believe that we have an opportunity to build one of America’s great family fortunes over the next five decades. From this base, with our knowledge and experience, I think we can move mountains. The table is now set and the advantages are building upon other advantages, reinforcing each other. All we have to do, to quote Charlie Munger, is spend the rest of the time we have been gifted being “consistently not stupid” and the achievements we are almost certain to enjoy over the coming half-century should be breathtaking. That is a wonderful place in which to find ourselves.

Twenty-four years. I keep thinking about that number and how much life was lived between then and now; the friendships and experiences, the travel and projects, the births and deaths, the investments acquired and divested. I also find myself thinking about what I should do to help others who come after me – to share what I’ve learned, and my take on it, so they can improve their own lives and achieve their own dreams, however that looks and whatever those are.