[vc_row][vc_column][vc_column_text css_animation=”none”] [/vc_column_text]

[/vc_column_text]

A Look At How the Father of Value Investing Calculated the Intrinsic Value of an Ordinary Share of Common Stock Benjamin Graham, the rich investor, professor, and mentor to Warren Buffett, once proposed a quick back-of-the-envelope intrinsic value formula for investors to determine if their stocks were at least somewhat rationally priced. He encouraged investors…

Using Wal-Mart Stores as an Example of Earnings Yields vs. Treasury Bond Yields I was up until 5 a.m. this morning reading through the past few years’ of Wal-Mart Stores, Inc. annual reports, filings with the SEC, analyst reports, transcripts, and other documents. It is about time to have the businesses make another contribution to…

In 1960, Miller Gorrie was around 25 years old. Throughout his life, he had taken his earnings from paper routes and poured them into IBM stock, which had compounded at 20%+ for many years. This led to the young man possessing a portfolio worth more than $100,000, which adjusted for inflation, is more than $728,000…

The current valuation of Tiffany & Co. seems absurd to me. I do not understand why people are paying it. Let me walk you through the numbers.

I’m re-reading “Damn Right! Behind the Scenes with Berkshire Hathaway Billionaire Charlie Munger” by Janet Lowe and came across a passage that illustrates exactly the sort of thing I’m talking about when I harp on acquiring assets that constantly churn out piles of cash for you spend, redeploy into new investments, give to charity, or…

The experience of Johnson & Johnson owners over the past decade is informative in understanding the role valuation and growth plays in determining total return outcome. Let’s take a closer look.

I started thinking about people who lose everything, or what Charlie Munger calls returning “to Go”, as in the Monopoly board. Once you are rich, your primary motivation shouldn’t be to get richer, it should be to avoid wipeout risk, or returning to go. But as a training exercise, I decided to contemplate what I would do if I woke up tomorrow and the last ten years had been a dream. What would my first course of action be to rebuild until I got my financial affairs in order?

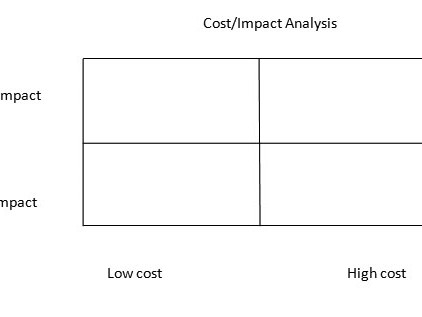

There are a lot of things you can take from corporate America and apply to your personal life. One of my favorites is a cost/impact analysis. If you are having difficult sorting all of the work and projects you need to finish, one way to make the decision easier is to draw a box and…

The Graham-Newman Corporation was a stock company that essentially served as a hedge fund through which legendary investor Benjamin Graham managed money for his shareholders. It is the same firm where Warren Buffett worked in his twenties before moving back to Omaha and establishing the original seven partnerships upon which his fortune is based. According…

John S. Lemon, President of Tootle-Lemon National Bank in St. Joseph, Missouri (the city near the farm town where I grew up before moving to the East Coast at the end of my teenage years), died on March 17th, 1905. According to Volume LXX January to June 1905 of The Bankers’ Magazine: “He was born…

[vc_empty_space][vc_column_text css_animation=”none”]

[/vc_column_text][/vc_column][/vc_row]