Income Inequality Is Partially Caused By Women Joining the Work Force

We’ve talked about income inequality a couple of years ago; specifically touching on the role of marriage patterns and assortative mating in household income levels. We’ve also discussed the economics of assortative mating more directly – the deeply ingrained tendency of people to marry other people like themselves with similar educational backgrounds, cultural values, personalities, and career orientations.

One interesting result of this is that the women’s liberation movement in the 1960s and 1970s planted seeds of radical income inequality that are just now coming to fruition. Of course, it’s not the only cause of income inequality, but it certainly does play a meaningful role in the gap that has developed between the well-heeled and the penurious.

I thought it would be useful to revisit it using real world numbers to illustrate just how large of a gap it can cause now that women have been in the workforce for a generation or two, and are enjoying higher educational rates than men. I also wanted to highlight it, again, because it is one of the best illustrations of how various disciplines reinforce one another to create societal outcomes; a factor you must take into consideration when analyzing data if you desire to understand it. Biology, economics, sociology, psychology; it’s all telling the same story, from different perspectives. Knowing that makes it easier to understand what is happening and try to understand the underlying causes.

An Examination of Median Lifetime Earnings By Highest Educational Attainment

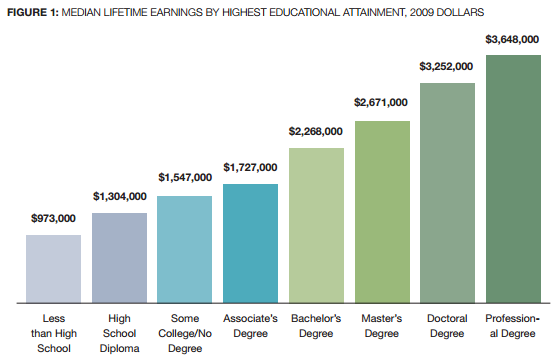

To understand how the women’s liberation movement is partially responsible for that widening gap between the rich and the poor, we have to look at the vast income differentials a person is likely to experience in life based on his or her educational attainment. Georgetown University has a great report on Median Lifetime Earnings by Degree (PDF) that breaks down a lot of the data and specifics.

What this chart doesn’t show, but can be found with a bit of quick research into other data sources, is that there are even wide ranges within categories. Consider a Bachelor’s Degree. While the median lifetime earnings of someone who has earned his or her Bachelor’s Degree is $2,268,000, the actual figure is going to depend on the career focus. A liberal arts major in the scientific and mathematical fields will earn between $2,600,000 and $3,000,000, while one who went into education, office support, or transportation is likely to earn only $1,400,000 to $1,800,000. For those of you interested in the specifics, here is a list of the best paying college degrees and here is a list of the worst paying college degrees.

Why does all of this matter to income inequality? For those of you who study socioeconomic data, the results will come as no surprise:

- Educated people are much more likely than the general population to get married

- Educated people are much more likely than the general population to stay married for life

- People are likely to marry someone with educational attainment equal to their own

- Marriage rates have been declining for those with lower levels of educational attainment

This creates a sort of double-whammy effect for income inequality.

- Generations ago, almost all mothers were likely to be married. Today, the Centers for Disease Control says that 46 out of every 100 births in the United States are to single mothers. A single mother is much more likely to have only a high school diploma or less.

- Generations ago, most women did not have a college degree, meaning that the overall household income for a married couple with a college-educated person in it was lower than it is today.

The mathematics of economies-of-scale are just as powerful for a household as they are a corporation. Adding the loss of marriage probability for the lower classes (there is a reason that marriage has been called the greatest anti-poverty program ever invented) and the additional lifetime earnings differential for the highly educated, you start to see how easy it is for an exponential difference in wealth accumulation and standards of living to happen. Even worse, it doesn’t stop there. People who aren’t married and / or are in the lower educational brackets are:

- More likely to smoke

- More likely to drink

- More likely to squander money on things like gambling

- More likely to be obese, which results in higher medical costs in the long-run.

It creates this sort of snowball effect. Not only is more cash spent on transactions that do not compound positively, life expectancy is also shorter, meaning there is far less time to compound in general. This matters a great deal. A high school graduate saving $10,000 a year and earning average long-term rates on blue chip common stocks would end up with $5,376,369 if he died at 60 years old. If, instead, he lived to 90, he’d leave an estate worth $95,459,381. Hence, the old joke among value investors that the greatest secret to getting rich is to “live a long time”. You don’t have to be particularly smart, just disciplined and let the passing of the seasons do the heavy lifting.

All of it matters. It’s a bunch of forces interacting together that, when they collide, lead to exponentially different outcomes. As in chemistry, adding one substance to another can lead to some explosive results. That’s the nature of the universe. Human institutions are no exception.

The Real World Numbers for Income Inequality Between Two Households

In practical numbers, this means that our single mother with only a high school degree might earn only $1,304,000 over her lifetime. Looking at a typical person in the United States, she has a higher probability than the general public of spending a good deal of that on cigarettes, beer, and lottery tickets. It’s just a fact. Yes, there are exceptions, but we’re talking about large populations and probable behaviors. Meanwhile, the married couple down the street – both of whom are now more likely to have gone to college and both of whom are more likely to be working – are going to be raising their children on lifetime earnings of $4,536,000. They are more likely to shove their cash into 401(k) plans, savings bonds, and blue chip stocks.

This is not to say there aren’t substantial problems with the tax code, as structured, in the United States, nor that assortative mating and women’s liberation are entirely responsible for the rise in income inequality (they aren’t). Rather, it is simply an acknowledgement of the numbers: Even if tax rates were exactly the same as they were generations ago, and even if technology and globalization had not conspired to decimate the lower-middle classes through automation and outsourcing, income inequality would still be much higher today than it was in the past as a result of women joining the workforce and enrolling in universities at a rate unthinkable throughout all of human history. Two doctors, lawyers, accountants, executives, or professors living under the same roof are going to accrue much greater benefits as the income from the second paycheck is almost entirely untapped, leaving it to build net worth or spend on greater luxuries.

This data confirms, indirectly, one of the findings of Dr. Thomas J. Stanley from the University of Georgia in his research that led to the bestselling books, The Millionaire Next Door, The Millionaire Mind, and Stop Acting Rich. While college graduates make up less than 25 out of 100 people in the United States, when you examine millionaires, more than 90 out of 100 of them have a college degree. The most common occupation of millionaire spouses is teaching, which itself requires a college degree. Educated people like being around other educated people. It’s hard to fall in love with someone if they can’t understand what you’re reading or discussing. Most people want equals to themselves. Education and marriage tends to correlate highly with financial success.

In a very real sense, equality in education and employment leads to income inequality among households. I don’t know anyone who thinks treating women equally was a bad thing, so this is a side effect that isn’t going away as the underlying cause isn’t going to be, nor should it be, reversed. The cold fact is that the more options people are given to live their lives, the wider the spread between the optimal and sub-optimal choices is going to grow.

What we are seeing in economics is simply reflecting what biologists and sociologists have known for a long time, which is that mating patterns in lifelong relationships often revolve around shared interests and similar backgrounds. That this basic reality now presents a perceived social problem in asset concentration levels is one of the things that keeps life interesting.

(On a sidenote, this is one of the reasons that there is a strong, vocal minority that is constantly talking about the benefits of education and the importance of making it affordable and attainable to everyone capable of doing the work. Once someone picks up the habits it instills, they are unlikely to part with them willingly, enjoying the resulting better life outcomes.)

If you want to be rich, become educated (paying a rational price for your college degree relative to its earnings potential and avoiding a lot of student loan debt), and marry someone at least as high up on the educational attainment chart as you are. Make sure they have a compatible temperament, too. Otherwise, I’ve already told you my thoughts on the best age to get married.

Update: I released this post from the private archives, where it was placed several years ago, on 05/26/2019 as part of a special project, which you can track here. In the six years since it was originally written, this trend has not only continued, but accelerated. Successful individuals are self-segregating, coupling up, then moving to concentrated geographic areas to be around others like them. The result: over the past ten years, nearly all of the economic gains have gone to the top fifty banking markets. Meanwhile, additional trends have begun to develop within the marriage figures themselves as individual freedoms and equality expanded. In August 2016, the Department of the Treasury, through the Office of Tax Analysis, released Working Paper 108, entitled Joint Filing by Same-Sex Couples after Windsor: Characteristics of Married Tax Filers in 2013 and 2014 [PDF]. Note that this followed the Supreme Court Windsor decision saying the Federal Government must recognize lawful marriages of same-sex couples but before the landmark Obergefell decision that required every state to perform such marriages and offer them on the same terms as opposite-sex marriage so the full effect had not even begun to hit, yet, and won’t be measurable for several years. That working paper found that on their 2013 tax filings, married opposite-sex couples earned $107,970, a number far above the typical American household. Married female-female couples earned even more at $124,760. Married male-male couples earned an astonishing $165,540. Economies of scale matter. Any system that leads to greater individual freedom of choice is going to lead to greater inequality. This inequality has also been exacerbated by changes in interest rates; something that plays a far more powerful role than most people realize. A reasonable person might logically conclude that inequality is here to stay unless family formation and incentives are addressed. Even then, it might have risen to a naturally higher baseline than was the case in the past as a result of these greater individual freedoms and the resulting economies of scale.