Our Value Investing Research Process for Stocks

A week or two ago, I wrote an article called Understanding Stock Repurchase Plans for About.com, a division of The New York Times, which discussed Sonic Restaurant and the massive stock buy back program that had taken place over the past few years.

In it, I walked the readers through a lot of the math and explained that I had purchased a couple hundred shares to watch and monitor the stock through one of my companies, Mount Olympus Awards, LLC. (I’ve since increased it to about 500 shares to continue watching and waiting to see how events unfold).

Some of the readers wanted to know how I read a stock report or analyze a company. Buffett often jokes, “Well, I start at the beginning and work my way through the end.” There is a lot of truth in that. Still, I thought it might be helpful to include some details on the process by which I put together our research.

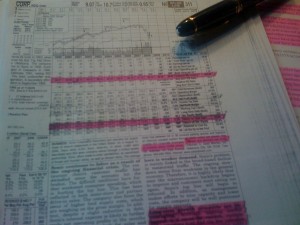

Here’s a shot from my iPhone of a typical investor packet cover sheet, in this case the one for Sonic Corporation that was used when I wrote my report on the share repurchase program for About.com.

How I Structure the Investment Files or Packets for Each Company

In terms of specifics, I often have an what we call in-house an “investment packet” or an “investment file” constructed on companies that have passed an initial screen or have piqued my interest somehow. (The initial screen consists of things that I look for in potential investments such as low valuation relative to historically high returns on non-leveraged assets).

This packet contains several things:

- A full version of the most recent 10K filed with the Securities and Exchange Commission

- A full version of the most recent proxy statement

- A full version of the most recent two or three annual reports

- A written transcript of the most recent few conference calls with Wall Street management has given

- A copy of reports regarding the company from Value Line, Morningstar, and S&P; typically, the value line report gets bound or stapled on top of the entire packet and used as a cover sheet.

Sometimes, I know I’m not interested in a company as an investment within a few minutes. There have been firms in the past where I threw the report across the room because it was so offensive in terms of how management was handling shareholder capital or the risks that were buried in the 10K.

I’m Looking for Returns on Capital, Valuation, and Lurking Risks

One of the main purposes of investment research is to uncover lurking risks. A lurking risk, as I call it, can come from anywhere. For instance, some companies have their debt insured and if the third-party insurer is downgraded, the company itself would face a default event and be forced to pay back all of its long-term debt immediately, potentially causing bankruptcy. You clearly need to know about the health of the third-party insurer, in this case, before you could make a decision on the valuation of the stock you are analyzing. Sonic Restaurant is one of these.

If a company still interests me, I may read 200 to 300 pages on it. My work is made much easier if it’s an industry I understand thoroughly (like property and casualty insurance where reading loss development tables and studying deferred acquisition costs for GAAP accounting vs. statutory accounting doesn’t require a lot of mental lifting because of my background). I tread much more carefully if I do not have a detailed history with an industry, such as a company that manages a fleet of ocean liners and shipping boats I read a few years past.

We have rows of file cabinets filled with stock reports, 10K filings, proxy statements, conference call transcripts, and other data for us to pull on the companies we monitor. It makes it easy to go back and see what we had written and concluded about a company years before to provide a narrative in historical context.

Once a decision is made, we typically move quickly. We have a system that allows me to monitor most of the family’s accounts across the board and with a few clicks from a secure terminal, we enter orders and trades are executed. Back when General Electric was at $6 to $8 per share and we were buying it by the bucketful, it took under a few minutes to have the system execute trades for our business accounts, personal brokerage accounts, and retirement funds, with the shares allocated appropriately. The same goes for building options positions such as LEAPs, which we used extensively during the crash.

As you read the article, please keep one thing in mind: I absolutely am not recommending any individual stock and my personal exposure to Sonic, as I mention early on in the piece, is thus far limited to a small five hundred shares so I can watch, and wait, for further developments to unfold. This merely provided me with the perfect real-world case so I could point out how these things look when they actually come across your desk, instead of being in a textbook or theoretical. If you are just starting out as a new investor, it should help you understand the concept of stock repurchases better. I may sell those shares a few months from now, or buy massive blocks of additional shares to create a real position of consequence. Either way, I’m not going to update what I’m doing with it because it is merely the vehicle through which I want to explain this important concept to you. Don’t get hung up on the business itself.