[vc_row][vc_column][vc_column_text css_animation=”none”] [/vc_column_text]

[/vc_column_text]

With the death of Whitney Houston a few days ago, I was doing a case study of her life and the lessons that can be learned from her successes and failures (update: I have written a case study on Dolly Parton’s business success, which you can read here). One of the big ones has little…

There are three ways to make a lot of money in business. Typically, most businesses that are successful at making money do it in one by focusing on one of three models. They either: Sell many things at a low price Sell few things at a high price Sell many things at a high price By way of example, let’s look…

We’ve talked about how a holding company works in the past, provided a beginner’s explanation of holding companies, and even looked at two high profile private holding companies owned by America’s richest families, Walton Enterprises, LLC and Cascade Investment, LLC. I even gave a very basic explanation over at About.com as to how family members can invest together through a limited liability company. Tonight, I thought I’d go over a very basic, very simplified explanation of a much more advanced concept that isn’t appropriate for most people but will show how a family holding company can be used to gift millions of dollars tax-free to heirs and others, while retaining control of assets and binding a group together economically. This is a high-level, conceptual explanation. Do not act on any of this without consulting with your own tax attorney, tax accountant, and other qualified advisers. None of this is investment advice. None of this is tax advice. None of this is legal advice.

I wanted to give you some insight into the approach and strategies Aaron and I use to get what we want in life; to build our home and businesses into a cohesive system that works to reinforce each other and bring us happiness and financial freedom, which includes freedom over our time.

I’ve told you in the past that Berkshire Hathaway appears to be trading at the lowest valuation in nearly a decade. Recently, Morningstar revised its intrinsic value estimate for the Berkshire Hathaway Class B shares, stating they believe the stock has an intrinsic value of $89 per share (equal to $133,500 per Class A share since it takes 1,500 Class B shares to equal a single Class A share). I find this interesting for several reasons. First, Morningstar’s intrinsic value calculations are often reasonable, in my opinion. On more than one occasion, we’ve been within a single percentage point after I had valued a firm and then cross checked third-party estimates as part of the process to see if there were major disagreements. But in this case, I just think they’re wrong.

Wendy’s recent commercial introducing the remade cheeseburger named after founder Dave Thomas is one of the best examples of marketing and psychology I’ve ever seen. It’s brilliant; mental models applied in a constructive way. I’m not going to take the fun out of it, but be on the lookout for some of the clues…

The Internet is buzzing with a clip from Terrell Owens’ reality show on VH1. In a recent installment of the program, T.O. begins to cry about the money troubles he faces after discovering that his finances aren’t adding up, his credit score is in the 500’s, he has mortgages due on real estate and he…

In recent days, I have been immersing myself in the annual reports and other filings of a company called Brown-Forman. The company, which manufactures Jack Daniel’s whiskey, Chambord vodka, Korbel Champagnes, and other brands of spirits, is still controlled by the family that has owned it for more than a century, with two classes of stock trading on the New York Stock Exchange.

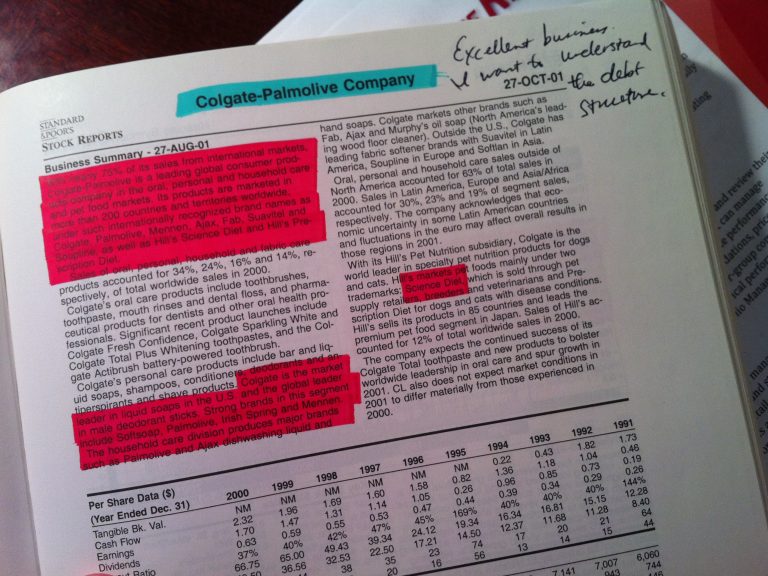

After writing about the 20 year performance of Colgate-Palmolive stock, my Aunt Donna asked me about Dawn dish soap, which is owned by Procter & Gamble. I broke out the historical dividend charts and went to work to create a comparison of how an investor would have fared had they parked money in P&G twenty…

I’m still running several weeks behind but one of the things I’ve been working on is a response to a few of the questions submitted by FratMan, whom you’ve seen in some of the mail bag sections I believe. He’s mentioned a few times, such as in the comments sections here and here, that he likes…

[vc_empty_space][vc_column_text css_animation=”none”]

[/vc_column_text][/vc_column][/vc_row]