Investing is the process of putting aside money today in exchange for more money in the future. This process involves risk but, when well managed, can help grow your wealth over time due to the power of compounding. This is the investing archive that includes articles published on JoshuaKennon.com. If you are looking for more great content, visit Joshua’s Investing for Beginners site at About.com, a division of The New York Times.

[vc_row][vc_column][vc_column_text css_animation=”none”] [/vc_column_text]

[/vc_column_text]

Now that the dividend has been paid on the Swiss shares (April 22nd), the stockholder meeting concluded (April 16th), and Citibank is working with the Swiss Tax Authorities to distribute all of those beautiful Swiss Francs shipped over from Vevey to the United States for holders of the ADR to receive their U.S. dollar equivalent payouts later this month on May 29th when the process has completed (can you believe it’s already been a year since the last time we had this conversation?), I wanted to write about Nestlé.

I would argue, strongly, that an abundance of evidence shows the typical investors grossly misunderstand the mathematics of diversification and the role it can play in a well-constructed portfolio. Allow me to walk you through some examples that might provide further insight to how you should be thinking about the concept.

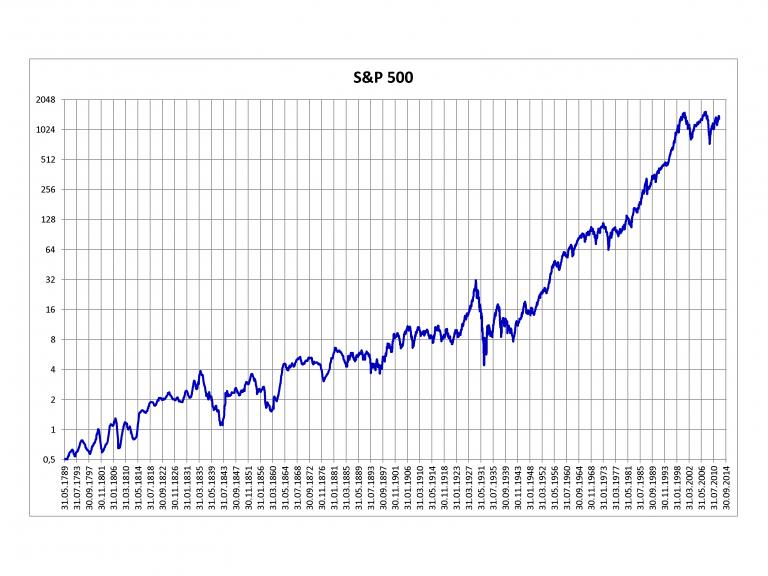

Over the past couple of decades, quiet, subtle, barely-noticed changes in the methodology of the S&P 500 have resulted in the index barely resembling the one that produced the historical returns investors now seem to implicitly assume they will earn in the future.

March 3rd, 2015, is the 10th anniversary of National Pancake Day. If you head to an IHOP, you can get free pancakes. They ask, but you are not required, to make a donation to charity in lieu of paying for your meal, with the goal being to raise $3,500,000 this year for Children’s Miracle Network Hospitals.

You might want to consider bringing your own maple syrup, though. As you know, one of the few things in life that irritates me to no end is the (what I consider) stupidity of the pancake industry, which has now, in 2015, nearly completely replaced every single store brand maple syrup with “pancake” syrup instead, which is really dyed corn syrup.

It is absolutely nuts to me to see this clip of Warren Buffett that was discovered. In it, he was just shy of 32 years old, roughly the same age I am now. He was completely unknown outside a tiny circle of people, though rich, wasn’t one of the richest men in the country (let alone…

President Obama’s administration has announced that he wants to impose a one-time tax levy of up to 14% on the $2 trillion in foreign profits American companies have built up and not repatriated in exchange for making repatriation on future foreign profits that were subject to at least a 19% tax rate tax-free, encouraging domestic…

By now, all of you know what happened recently with the Swiss Franc, Euro, and, as an extension, the price change of Nestlé shares in the United States. It caused a stream of messages to come in through the contact form like I haven’t seen in a long time, all with the same theme. Here…

The Night Black Wall Street Burned to the Ground When I became obsessed with investing as a child, convinced it offered me the greatest probability of escaping what I saw as an economic dead end due to the community in which I lived, I spent years reading everything I could about any and every event…

As we approach the end of 2014, I’m looking back on the year. One of the major changes from an investing perspective what a modification Aaron and I made in the investment policy manual. That doesn’t happen often. We added a handful of companies to the list of permanent business; those companies we consider so…

I’m putting together a retirement portfolio for several people I know. One of them is proving to be a fun intellectual exercise. Essentially, the mandate calls for me creating a ghost ship of a portfolio that, once it has set sail, will drift almost untouched for the next 30+ years when it will be gifted to the children at the end of the life expectancy of the owner. Beginning in 7 to 10 years, the owner will start taking 3% to 4% distributions to augment an otherwise secure retirement. The portfolio is to be allocated 70% to a collection of 70 to 100 blue chip stocks, 25% to high-grade bonds, and 5% to cash or cash equivalents.

[vc_empty_space][vc_column_text css_animation=”none”]

[/vc_column_text][/vc_column][/vc_row]