The Federal Government Collects More Absolute Tax Revenue Than During Any Other Period in American History

In recent years, the United States Federal Government has found itself in the fortunate position of collecting more inflation-adjusted, real purchasing power tax revenue than it has during any other period of its 242 year history. For the government’s 2019 fiscal year, tax receipts at the Federal level are expected to balloon to an almost unfathomable $3.422 trillion. With CPI ticking upwards, this is a slight decline in real purchasing power from the past few years despite the nominal rise but it is still sitting at the apex of historical cash flows. To put it into perspective, real tax dollars per capita – the amount the Federal government has to spend on every man, woman, and child in the country – have roughly doubled since 1960 when John F. Kennedy, a Democrat, was elected to The White House and, working with Congress, decided to simplify and cut rates in a bid to spur economic growth.

Stated more bluntly, there has never been more cash in the Federal Treasury to deliver goods and services to the American people.

The typical voter might be forgiven for not realizing this for two reasons:

- Congress overspends like a bunch of drunken sailors, trying to ensure their own re-election by doling out promises to people far in excess of what the world’s richest economy can afford. Anyone who spends any time watching what happens in Washington, D.C. can list examples of how bad the situation is; e.g., remember when Congress was pushing through budget allocations to force the Pentagon to buy war planes it didn’t want? Senators and Representatives alike awarded contracts to major political donors even if the expenditure was not desired by professionals working in government nor was in the best interest of tax payers. That means the $3.422 trillion in revenue isn’t enough to fulfill the wish list of payoffs so actual spending is estimated to come in at $4.407 trillion. This will require adding more than $1 trillion to the nation’s metaphorical credit card by increasing the national debt. Unlike Switzerland, which had the political will to implement a so-called “debt brake” to stop politicians from ruining the nation’s balance sheet, Americans accept the situation. That will turn out to be a mistake. Many of our advantages are a quirk of history and may not be there in the future; e.g., what happens if we are no longer the world’s reserve currency?

- A vocal minority on the far-left has arisen and begun using regressive talking points to try and win the White House in 2020. Anyone who bothered to take a deep dive into the election results this past November quickly realized an irrefutable fact: the “Blue Wave” that carried Democrats to power was overwhelmingly the result of American voters choosing moderate, centrist Democrats to take the reigns of the House of Representatives and put a check on Donald Trump; reasonable people who were liberal but who were, above all else, pragmatic and open to compromise to get the real economy and real political environment working for the average family. Outside of a handful of elections, all of which were a function of the individual candidates in the race, far-left candidates are so far out of the mainstream, they can’t win in even the most liberal states. In their own echo chamber, this far-left group – the same one that is somehow so delusional it still believes Bernie Sanders could have won the Presidency if Hillary hadn’t stopped him (news flash: it would have been a blood bath as brutal as Ronald Reagan’s 1984 electoral map) – is dominating the media with flashy, and completely unworkable, policy proposals. In many cases, those policy proposals are unconstitutional, too. Frankly, it’s both ironic and disgusting that these people call themselves “progressive” because their policies are anything but progress; just the recycled garbage that the world once discarded after it was thoroughly discredited and caused substantial human misery and suffering. If the majority of the Democratic party does not kill this cancer while it is still manageable, it will ensure Republicans control The White House for the next decade, threatening actual progressive victories such as progress on climate change mitigation, an accelerated transition to green energy, affordable tuition for college students, paternity and maternity leave for new parents to bond with their newborn or adopted child, equality for minority groups including in matters of public accommodation, a path to immigration for those brought to the United States illegally as minors, prison reform, the war on drugs, lowering the cost of healthcare for individuals and families, expanding the Child Tax Credit to help working-class and middle-class families, affordable housing, and protecting the public school system. The delusion of the far-left, who somehow thinks America shares their values, reminds me of some of my friends on the East Coast who were in denial that George W. Bush was going to win re-election in 2004. Not only did he win, he captured 3,012,166 more popular votes than his Democratic competitor. Maturity requires recognizing reality even when you don’t like it. Facts are facts. Wishing does not make a thing so.

Why, then, isn’t Congress investing in the middle class? Let’s take a look at some policy proposals that have been in the news over the past decade.

Congress Already Has the Funds to Provide Tuition-Free University Education

Imagine, for a moment, that Congress wanted to provide tuition-free university education for all qualified adults who came from families or households earning $125,000 or less per year. Ambitious, right? Not really. The estimated cost of the program would be only $47 billion per annum. (If the program had less stringent requirements, the cost might be somewhere between $70 and $80 billion per annum.) Those figures are next to nothing out of $3.422 trillion in Federal tax receipts. Provided certain conditions were met, the investment would pay for itself down the road in the form of much higher human capital and economic growth; a fantastic use of tax revenue that resulted in a net profit to taxpayers and citizens over time, both in terms of higher future tax revenue and standards of living due to greater economic prosperity, technological innovation, lower crime, and longer lifespans. Such a program could be put in place right now if the American people demanded it. Not a single penny in additional taxes would need to be levied because we already have the money.

Yet, Congress refuses to do it for several reasons. Some of these reasons include:

- Outside of a handful of young voters, most constituents clearly don’t want it badly enough to press the issue with their representatives in any meaningful, organized way. This means investment in youth-targeted programs tend to be pushed aside for investments targeting the elderly, who are more likely to engage politically.

- There exists a substantial percentage of voters who believe that university graduates should be a minority of the population with a greater emphasis on vocational trades and other professional training, focusing on good jobs rather than learning how to think about policy or complex issues (not everyone needs to study Keynes or debate Greek philosophy). This could be navigated by expanding the program to trade schools.

- There is a belief among a substantial portion of voters that the university system is not fair and certainly not representative of the nation as a whole; that it, rather, serves as a form of political indoctrination, and/or blatant racial discrimination, leading to a backlash against educational funding as collateral damage. Regardless of how one feels about the matter, or whether or not someone believes that affirmative action is both necessarily and desirable, on an individual and household basis, voters are motivated by how the situation helps or harms themselves and their family members. They are aware, even if generally, of the facts laid out in the 2009 book, “No Longer Separate, Not Yet Equal” by Princeton University sociology professor Thomas J. Espenshade and Alexandria Walton Radford, who completed her PhD in sociology at Princeton University, in which the academics demonstrated that controlling for a wide range of factors, a black student would have to score only 1000 on his or her SATs to have an equal chance of admission as a white student, who would need to score 1310, or an Asian-American student, who would need to score 1450. No amount of wishful thinking is going to change the fact that most people will perceive that, on an emotional level, as a penalty for success in which an intrinsic trait – in this case, their race – is used against them, holding them back from admission. Two people could like the same movies, enjoy the same food, speak the same language, have grown up in the same town, have the same household income, the same number of siblings, attend the same high school, earned the same grades, practice the same religion, play the same sports and musical instruments, only to find that, when push comes to shove, if one is Asian and the other is black, the former will need to outperform by 450 points on the SAT just to be offered the same chance at a better life. This violates what Charlie Munger has called the “Kantian Fairness” mental model. It gets into something deep, and primal, in the psyche about what it means to be a good person and to treat others how you want to be treated. No amount of explanation or discussion will close that gap for a meaningful percentage of the electorate. It’s human nature.

- There exists a philosophical worldview among a considerable percentage of Americans that once reaching adulthood, a person and/or his or her family should be responsible for self-sufficiency and personal improvement.

Stated candidly, the reason we don’t have tuition-free higher education in this country has nothing to do with taxes on the wealthy, the corporate tax code, or a lack of funding. It is a matter of priorities and worldview. An intelligent politician with a lot of charisma, backed by a compelling economic argument, could push through such a proposal and radically improve the nation. This comes down to political will, not a lack of capital because – and I’ll say it, again – the money is already in the U.S. Treasury. The country could redeploy part of the existing budget and have the funds to do it today.

On a side note, consider this: by not living within its means, when we return to a normalized interest rate environment, the interest expense on the increase in the national debt this year alone would have been enough to cover the entirety of this program in the more stringent form. This is one of the reasons fiscal responsibility matters.

Infrastructure Funding Has Fallen Behind Because Politicians Don’t Want to Hurt Their Re-Election Chances

One of the major ways our infrastructure is funded in the United States is through the use of a gasoline tax. This is both desirable and fair because:

- It incentivizes the use of clean energy and lower carbon emissions – someone driving an out-of-date gas guzzler who is outsourcing pollution pays more – resulting in a more pristine environment, lowering deaths and health care costs; and

- The people who use the service pay most of the costs; e.g., if Walmart or Amazon is shipping large trucks over the road, using the public highway system to deliver goods more efficiently, they (and the customers who buy goods from them) should be paying a lot more for the asphalt, salt, maintenance, and upkeep than a college student who rides his or her bicycle everywhere.

However, politicians are addicted to short-term gains at the expense of long-term progress because many cannot stand to do anything that might harm their re-election chances. As a result, gasoline taxes are not particularly popular because everyone seems to want to avoid paying their part – again, this is a tax that only gets triggered if a person chooses to drive and is influenced by what he or she decides to drive. The result: Congress has refused to adjust the gasoline tax for inflation since 1993, making up budgetary shortfalls in infrastructure funding from the regular operating budget; in essence, by raiding the $3.422 trillion that should be used for other things. That means gas has been taxed at $0.184 cents per gallon for 26 years! That’s more than a quarter-of-a-century! The gasoline tax should be at least $0.342 cents per gallon today. What is sad is that adjusting it instantly wouldn’t makeup for all of the revenue that should have been collected in the interim nor the general tax revenue that has been taken from the budget and could have been used to fund things like education. Maintenance is cheaper than repair, yet here we are.

One potential solution: Congress could pass a law that adjusted the gasoline tax for inflation, having it slowly ramp up over several years then automatically correcting itself on a rolling basis, allowing future politicians to more easily avoid the “blame” of doing the right thing.

In addition, this is one area where I think Congress should be willing to incur debt because the payoffs often exceed the cost once they factor in the economic gains that arise from infrastructure spending. For example, what if Congress were to create 30, 50, or 100-year infrastructure bonds, offer a fixed-interest rate of 3% to 5%, and exempt all of the interest income from Federal and state taxation? It could easily raise trillions of dollars to embark on a building project, the scope of which has not been seen since the 1930s. Investors, including foreign financial institutions, would fight for an allocation of such a security. The same way a business needs to invest in property, plant, and equipment to ensure future success, a nation must do the same. Our railroads and subways are an embarrassment compared to most of the developed world. We should have next-generation broadband in every major city. We should offer massive incentives to switch the entire power grid over to nuclear energy, augmented by certain renewable energy sources such as wind and solar.

The United States Already Spends More on Healthcare Than Any Other Country

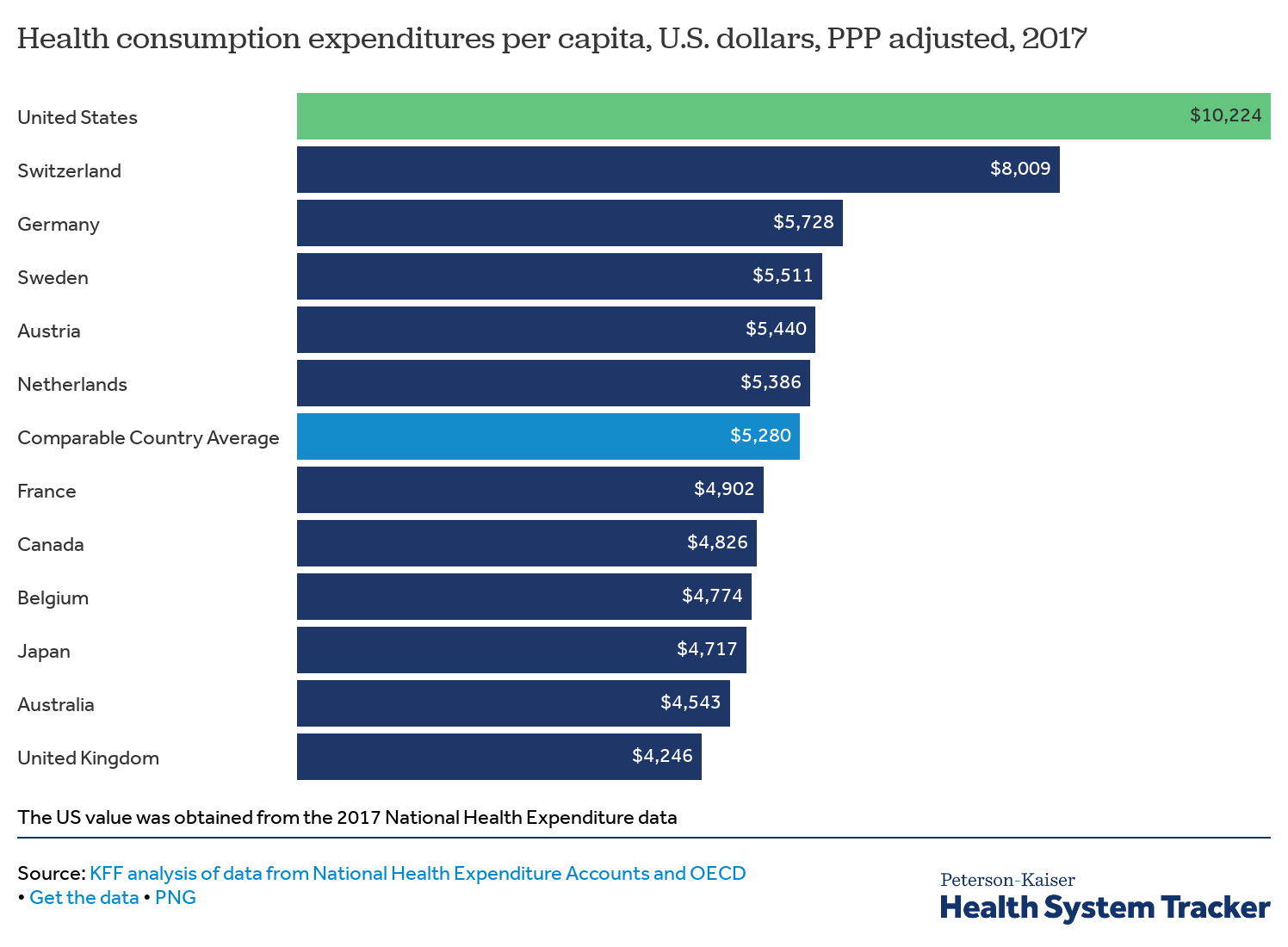

One of the leading risks of bankruptcy in the United States is an unexpected medical emergency. Someone could have done everything right in life then get hit by a drunk driver at an intersection only to find his or her entire net worth destroyed due to five, six, or even seven-figure medical bills. This situation is not due to a lack of tax revenue or funding. In fact, it isn’t even close. The United States economy devotes more absolute dollars per capita towards health care costs than any other country in the world. On a Purchasing Power Parity (PPP) basis, in 2017:

Many Americans have this strange pathology that often comes down to, “let’s throw money at the problem and see if it fixes it”. Such an approach won’t work here because a lack of money isn’t the issue. Aside from being unconstitutional and destroying the economy (ironically leading to a tax shortfall), raising taxes even to the point of total confiscation on the top, say, 5% or 10% of society wouldn’t do a damn thing to alleviate this situation because there are structural issues with healthcare delivery in the United States. Too many people have their proverbial hand in the cookie jar along the healthcare delivery system supply chain, creating fiefdoms that are extraordinarily profitable and that no one wants to willingly give up. Doctors and patients alike are mostly screwed over by this system, which is far too complex to describe in a single blog post but are well-known to those familiar with the healthcare industry. (The system is now so punishing to doctors that many medical school students are outright told to avoid going into General Practice as the payoff isn’t worth the sacrifices, especially for those who have to cover their own education costs.)

Consider just one example: more than a decade ago, Republicans and Democrats got together to pass a bill that was ostensibly designed to lower prescription drug costs for low income individuals and families. In reality, the bill was written in a way that, while it did provide some relief for the poor, it effectively served as a transfer of wealth from taxpayers to pharmaceutical giants. The devious brilliance of this was that anyone attempting to overturn the law will be accused of siding with pharmaceutical companies and harming society’s most vulnerable, not defending the taxpayer.