[vc_row][vc_column][vc_column_text css_animation=”none”] [/vc_column_text]

[/vc_column_text]

How can people do this and live with themselves? This is the sort of thing that if I were running a company, I don’t care if we made millions of dollars a year in profit doing it, I’d shut it down. I believe it is immoral. Sure, it breaks no laws that I know of but it strikes me as ethically wrong. It is the reason we need stronger consumer protection laws in the United States. I believe it preys on the ignorant; the people who don’t know any better and who are trying to secure their future.

In honor of the new energy portfolio I’m setting up for my family, I thought I’d do a 25 year case study of an investment in Chevron common stock. The point is to illustrate how the biggest, most boring companies on the planet are not, in fact, so boring when you look at the remarkable…

The biggest mistakes are often not seizing the huge opportunities that are right in front of you. One of my least favorite stories of this economic tragedy involve a man named Ed Toman, who lived in Southern California back in the 1940s and 1950s and played an important role in the early days of the McDonald’s restaurant empire.

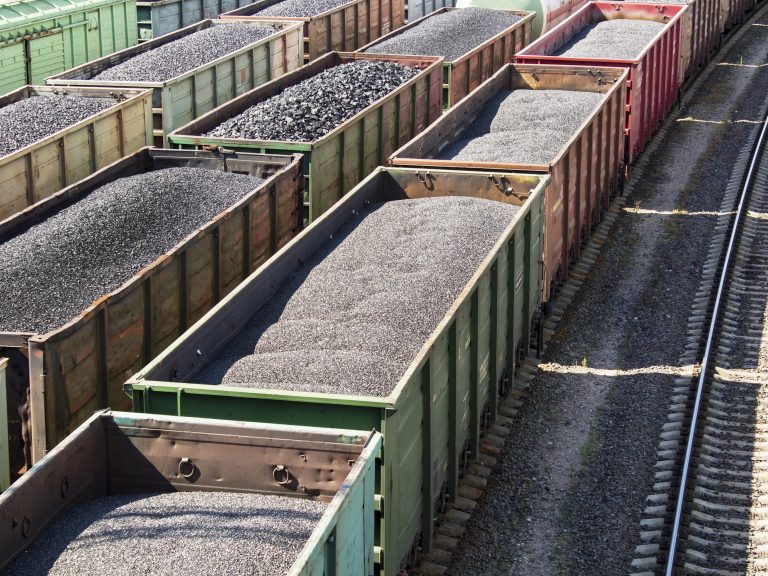

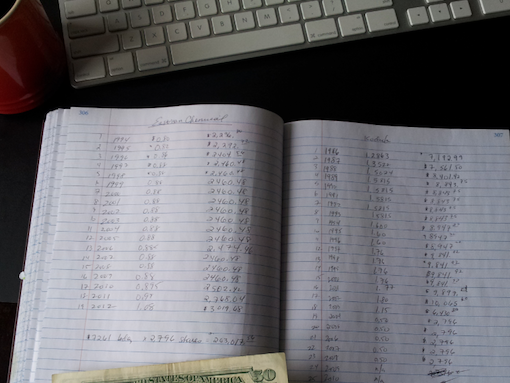

The developments on the income statement and balance sheet of Union Pacific between 2005 and 2013 are an excellent example of why it is important for you to analyze data yourself, and come to conclusions based on reasonable, rational, intelligently organized facts. The willingness to take action when others do not agree with you, and to have your action backed up by solid evidence, can make the difference between being comfortable and ending up rich. Two of the world’s wealthiest titans demonstrated this truth, not only when buying shares of Union Pacific, but other railroads, as well.

This McDonald’s case study looks at what a $100,000 investment in the restaurant’s common stock would have turned into over a 25 year holding period. It is one of my favorite investment research projects because there are four possible outcomes depending on how you behaved with your shares. It illustrates the importance of finding a…

A Case Study of Eastman Kodak How the Bankruptcy of One of America’s Oldest Blue Chip Stocks Would Have Turned Out for Long-Term Investors One year ago, Kodak declared bankruptcy after more than 130 years in business as a leading blue chip firm that gushed profits for its owners. I wrote Kodak’s demise at the…

In the 1920s and 1930s, a banker named Pat Munroe in the small town of Quincy, Florida noticed that even during the depths of the Great Depression, otherwise impoverished people would spend their last nickel to buy a glass of Coca-Cola. With good returns on capital, and a once-in-a-century valuation so low that the business was trading for less than the cash in the bank, “Mr. Pat”, as he was called, encouraged everyone he knew to buy an ownership stake in the firm. He would even underwrite bank loans, backed by Coca-Cola stock, for his responsible depositors to encourage people to acquire equity.

I thought it might be useful to look at another great American enterprise that everyone knows, that has been part of many investor’s portfolio for decades, and is often ignored: The Hershey Company.

Update: This post originally covered a 25-year investment case study of General Mills. Since I am publishing it a few days into the new year, we can look at an additional year of data (all of fiscal 2012) so I modified the figures and compound annual growth rates to account for that extra year, stretching…

I’ve made no secret of my love of employee-owned businesses. If you want to find the best working conditions, the highest pay, the best employee benefits, and the most cohesive strategies, all else equal, you are going to find them working for a company that has no outside shareholders and is instead owned by the…

[vc_empty_space][vc_column_text css_animation=”none”]

[/vc_column_text][/vc_column][/vc_row]