[vc_row][vc_column][vc_column_text css_animation=”none”] [/vc_column_text]

[/vc_column_text]

As some of you probably surmised from the Neiman Marcus and Community Coffee Company posts, I have been studying brands and brand equity for the past few weeks. It is a fascinating concept that exists because of the interplay between basic economics and human psychology. Most of the time, brand equity changes slowly. More rarely,…

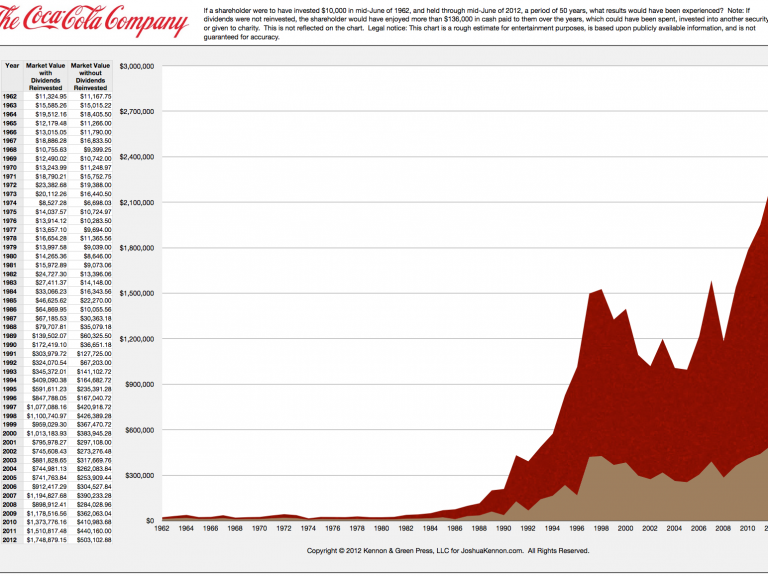

Last week, I posted on a 50-year investment history of shares of The Coca-Cola Company. As I was publishing this month’s About.com content, I began writing a piece that I called The Dividend Dilemma that focused on whether you should reinvest your dividends or not. Around the same time, one of the readers, Matt Nix,…

For longer than I can remember, I have come across Community Coffee, a family-owned coffee roaster that is famous in the Southern United States, particularly the Louisiana area. I have always intended to order their coffee to try it for myself but it would slip my mind. During a recent episode of True Blood, I noticed it…

I’ve spent a big part of today doing investment research on synthetic gemstones vs natural gemstones. Following the recent reading foray into the world of jewelry retailing, distributing, and mining, I kept coming across a company called Chatham. They had reportedly perfected the art of manufacturing gemstones such as rubies and sapphires inside of a…

It’s long been said that it is more important to avoid bad investments than it is to find good investments. “A single bad deal can wipe out a lifetime of work,” or so the sentiment goes. There is a great truth in that. It was the first thing I thought of this morning when I read the Wall Street Journal coverage of the Bank of America / Countrywide Mortgage merger four years ago.

Imagine it is 1987. Tiffany & Company is raising money by issuing shares to the public at $23.00 each. You have some savings and are thinking about starting a business. Instead of running your own enterprise, you decide to focus on your day job and become a co-owner of one of the most famous businesses…

When Peter Lynch was 33 years old, he was put in charge of the obscure Magellan fund, which had $18 million in assets. This was 1977, so today that is about the same as $63 million. The amazing thing about Peter Lynch is, it would have been effortless for him to raise billions of dollars…

I was reading an argument earlier about how Europe needs a “Lehman Brothers moment” to scare the member nations into swift action. It reminded me of one of my favorite passages from Barbarians at the Gate that discussed the merger of Lehman Brothers and Shearson.

If you were going to take a family vacation, you would never just get in the car and start driving, picking random turns at intersections. If you did, you would be lucky to end up anywhere meaningful. The chances of stumbling upon a Disneyland or New York would be remotely small. Instead, you decide where…

With the season premier of True Blood upon us, I began thinking about how lessons on life, money, and success are all around us if you just pay close enough attention. If you understand how compounding works, it is so easy to get rich if you have enough time. Consider Sam Merlotte, the Bon Temps bartender and resident landlord. His character is around 30 years old, give or take several years, when the show began.

[vc_empty_space][vc_column_text css_animation=”none”]

[/vc_column_text][/vc_column][/vc_row]