More than 200 years of research shows that owning stocks, which represent an ownership stake in a business, is the best way to generate long-term wealth. Our stock investing guides will explain how common stocks work, what preferred stocks are, how to understand dividends, stock basics for new investors, and advanced stock trading techniques for those who are ready to learn the deep knowledge of finance.

Good morning, fellow Nestlé stockholders! It’s that magical day of the year when the annual dividend gets paid out to American owners (or, technically, those who have opted to buy the ADR). While those of you who hold your shares of Nestlé through Switzerland directly got your 2.15 CHF per share dividend on April 17th, those of you who opt for the Nestlé ADR traded here in the United States (which is likely most of you) get your dividends today!

I’m taking it as a given that practically everyone who reads this site has already gone through Warren Buffett’s stockholder letter, which Berkshire Hathaway released today. Personally, I love how, for only the third or fourth time in his career, Buffett essentially provides enough mathematical evidence to say to people, “You’re a moron for not buying Berkshire Hathaway at these prices, but I’ll never come right out and say it.” He did it in sort of a clever way, too, to encourage people to run the figures.

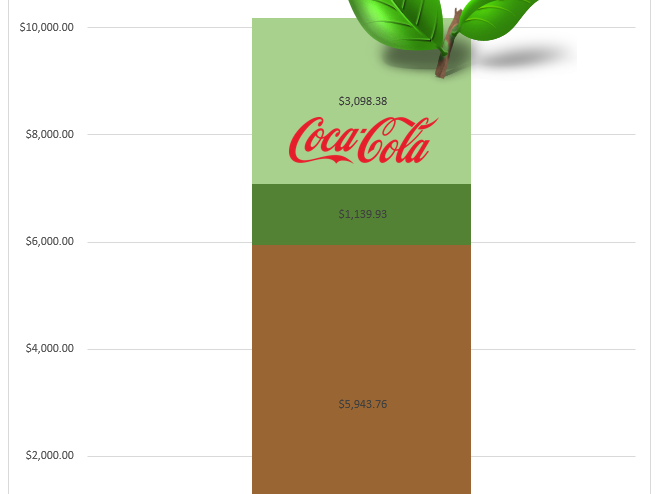

One of you, writing under the name Emma, posed a question in the comments section of another post. You asked me whether or not I thought a firm like Coca-Cola could repeat its historical performance. Rather than answer the question directly, I realized this would be a great opportunity to explain the variables that drive…

I’ve been setting up custodial accounts such as UTMAs, looking at dividend reinvestment plans, and more for the past few days.

I put in and order on Saturday to buy a few more shares of Nestlé SA on Monday for my family’s personal accounts. I spent much of the weekend reading the company’s 125th anniversary biography and studying the original balance sheets and income statements of the firms that went into forming one of the world’s most profitable holding companies.

I spent the past few days updating some of my own internal case studies, spreadsheets, and other documents, as well as wrapping up a few things that needed to be crossed off the agenda for the private businesses. I ended up putting together a collection of visual references covering some of the long-term holdings I keep for my household, among them Nestlé SA following my post on Monday.

One of the tricks I use to think of the stocks I hold as real businesses, just like the operating companies we own, is to get a physical representation of the firm, putting it in an investment cabinet. Now that I am building a 25-year energy portfolio as a personal side project for my household, I already have replica die cast oil tankers on their way from retailers and eBay. I’m having a hard time finding a comparable quality Total SA tanker, if they are even manufactured.

McDonald’s is one of those businesses that I love. The last time we talked about it was when I wrote the 25 Year Investment Case Study of McDonald’s, and showed how you could have turned $100,000 into anywhere between $1,839,033 and $5,547,089 depending on how you handled dividend reinvestment and the Chipotle split-off back in 2006, and the sorely lacking media coverage of McDonald’s results in February. No matter which way you look at it, despite periods of overvaluation and undervaluation, alternating with the underlying performance and the emotional moods of shareholders, McDonald’s has been a fantastic company. It makes its employees and shareholders a lot of money. It gives society something it wants, whether that be a plain salad with side of fresh fruit and a non-sweetened iced tea or a double cheeseburger with french fries and a Coca-Cola.

We’ve talked about the 1929 period a lot lately, but what you need to remember is that it was a walk in the park compared to 1933. It wasn’t until then that everyone had gone broke, given up hope, and sworn off stocks for life, leaving great businesses trading at double-digit dividend yields and a…

For the serious investors among you, I recommended a book about the 1929-1933 crash that is the single best statistical resource on the subject I have ever encountered. After talking about it on the site, I’m going back through the 700+ pages and I really can’t emphasize enough how seeing the effects of the worst…