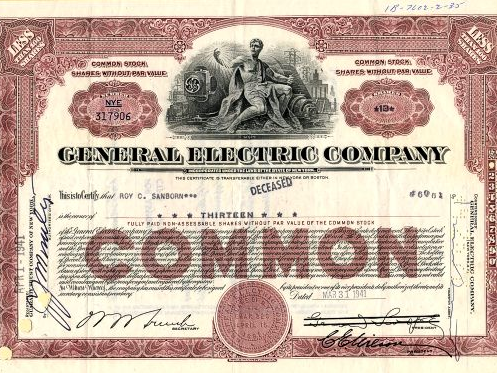

More than 200 years of research shows that owning stocks, which represent an ownership stake in a business, is the best way to generate long-term wealth. Our stock investing guides will explain how common stocks work, what preferred stocks are, how to understand dividends, stock basics for new investors, and advanced stock trading techniques for those who are ready to learn the deep knowledge of finance.

I am working on my What is a mutual fund? category at About.com and a thought struck me. I wanted to go back and look at the most recent investing lifetime (the 50 year period between 1960 and 2010). I imagined that an investor could have bought the S&P 500 stock market index (obviously you can’t…

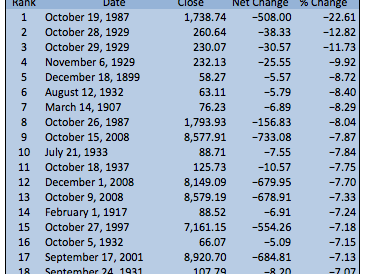

The media is making a big deal out of the recent stock market drops, acting as if we were living through some sort of new paradigm where stock collapses are unheard of and Wall Street rips off small investors. The past 200 years have been a fantastic time to be a long-term value investor despite some…

I write a lot about investing in stock and investing in bonds over at Investing for Beginners at About.com, a division of The New York Times. There is a reason I tend to be far more favorable to equity investments (stocks) than fixed income investments (bonds) when it comes to long-term investing and why much…

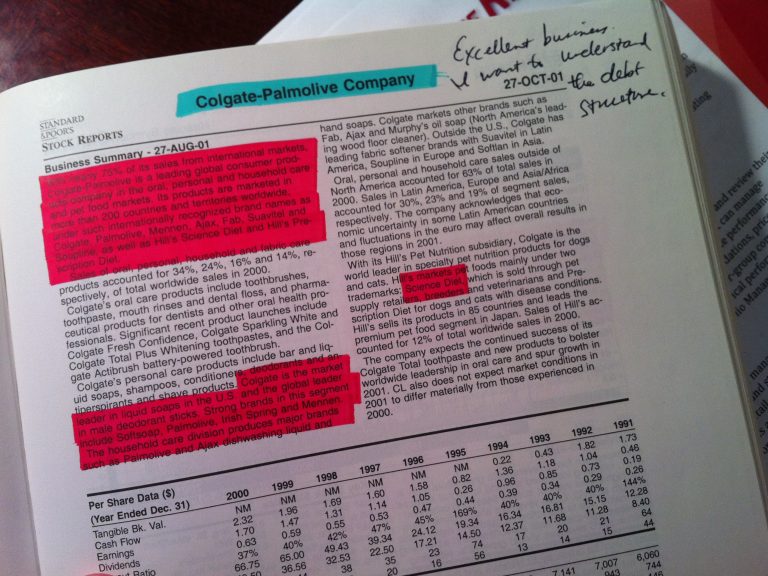

I’m still running several weeks behind but one of the things I’ve been working on is a response to a few of the questions submitted by FratMan, whom you’ve seen in some of the mail bag sections I believe. He’s mentioned a few times, such as in the comments sections here and here, that he likes…

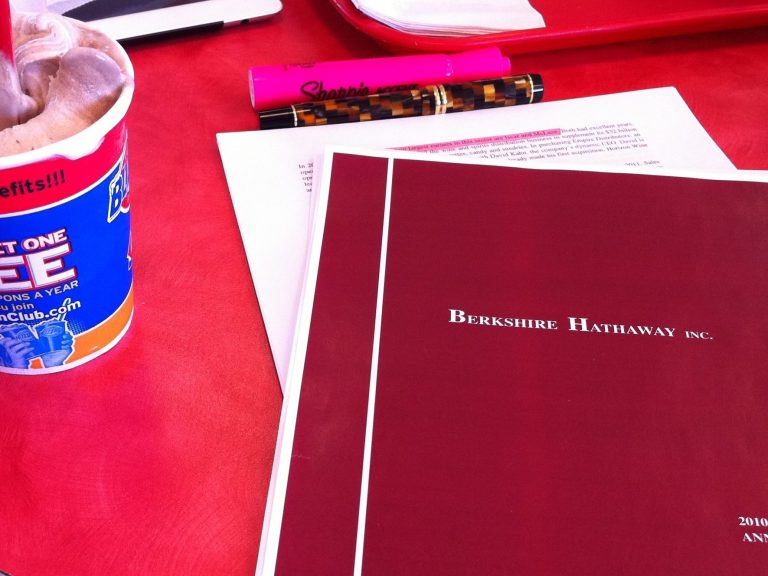

Berkshire Hathaway shares are now trading at around the lowest valuation relative to earnings and assets that they have since the dot-com bubble in the late 1990s. How is that possible? As the famed holding company of Warren Buffett has added businesses such as Burlington Northern Santa Fe, the stock price has treaded water so each dollar invested at today’s price represents more profit and equity than it did in the past.

The current valuation of Tiffany & Co. seems absurd to me. I do not understand why people are paying it. Let me walk you through the numbers.

The experience of Johnson & Johnson owners over the past decade is informative in understanding the role valuation and growth plays in determining total return outcome. Let’s take a closer look.

One technique I find helps a lot of investors act more rationally is one I developed during my late teenage years. I would convert all companies I was analyzing to $100 per share to make comparison of the figures and yields easier. In essence, this allowed me to ask the question, “How much profit am I buying for every $100 I put into this company?” If I paid a high multiple for a particular business, it forced me to justify the higher valuation by writing down my reasons for my belief.

I thought it might be useful to show you how I’d analyze an investment portfolio and calculate a reasonable estimate of not only expected growth in capital but the overall economic characteristics of the holdings.

Years ago, I vaguely remember hearing someone comment that it was interesting how differently we measure wealth today compared to British society at the end of the 19th century. This made me realize that most people don’t even know there is a difference; that there are primarily two ways you can think about measuring your wealth and which you choose for your own household will influence how you behave, the capital structure you employ, and even how you think about risk.