More than 200 years of research shows that owning stocks, which represent an ownership stake in a business, is the best way to generate long-term wealth. Our stock investing guides will explain how common stocks work, what preferred stocks are, how to understand dividends, stock basics for new investors, and advanced stock trading techniques for those who are ready to learn the deep knowledge of finance.

One of the additions I have been considering adding to the KRIP is The Clorox Company. However, it appears somewhat overvalued right now, offering a lower earnings yield and slower sales growth compared to the S&P 500 if you view the index itself as a single stock, which doesn’t bode well on a relative basis. That…

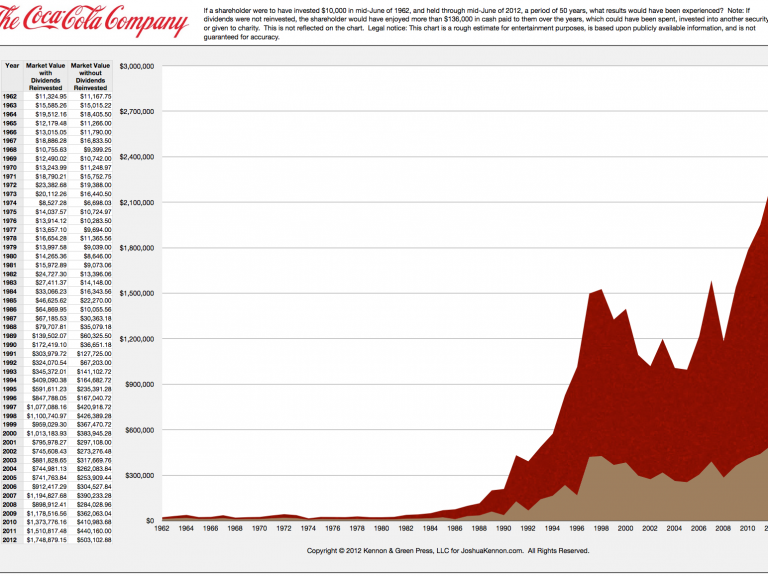

Last week, I posted on a 50-year investment history of shares of The Coca-Cola Company. As I was publishing this month’s About.com content, I began writing a piece that I called The Dividend Dilemma that focused on whether you should reinvest your dividends or not. Around the same time, one of the readers, Matt Nix,…

Shortly after World War I, Raymond Poincaré, the Prime Minister of France, decided against partnering with Royal Dutch Shell to fund the energy needs of the French people. One of his military commanders, Colonel Ernest Mercier, worked with 90 banks and businesses to establish a new oil company called French Petroleum Company (er, technically, Française des Pétroles Compagnie since they weren’t speaking English). The name might sound prosaic but keep in mind this was the era of “General Electric” and “Standard Oil”. The new undertaking began operations on March 28th, 1924. Today, that business is known as Total, S.A. and it is one of the six supermajor oil powers on the planet.

In 1936, Parker Brothers released an add-on to the popular Monopoly board game called the Stock Exchange. Although the core Monopoly game had two asset classes – real estate and a few common stocks in the form of the four railroads and two utility companies – the Stock Exchange add-on brought the experience to a…

I am reading the Wells Fargo & Company annual report again for the fourth time this year, as well as conference call transcripts, analysts reports, and a host of other documentation. I’ve been looking at making some additional purchases of Wells Fargo & Company for the long-term holdings through some of my personal retirement trusts and plans, including the only one I discuss on the site, the KRIP portfolio, because I’m convinced the “new” bank, which includes the acquisition of Wachovia during the Great Recession and financial meltdown that doubled the size of the “old” bank, is significantly undervalued.

Aaron and I were sitting in a sandwich shop trying to flavors in the new Coca-Cola Freestyle machine, when I began to wonder what it would take to build a $250,000 stake in a company like Coke by the time a person reached 35 years old. It was a fun academic thought experiment.

I’ve made no secret of the fact I’ve been a net purchaser of Berkshire Hathaway shares for the past year. The valuation seemed (and still seems) absurdly low relative to intrinsic value. Apparently, the Berkshire Hathaway Board of Directors and management agrees.1 The company is now looking at itself as the best use of the firm’s cash.

After breakfast this morning at the Animal Kingdom lodge, we headed over to Downtown Disney. As we shopped for souvenirs before flying back to Kansas City tomorrow, I was in the enormous World of Disney store when I realized the best possible souvenir I could have would be ownership in the business. From the kitchen section, surrounded by Mickey Mouse spatulas and Minnie Mouse oven mitts, I took out my phone, remotely logged into one of my personal brokerage accounts, and purchased a small memento in the form of 100 shares of The Walt Disney Company at $33.04 per share.

One of the things that helped me build wealth early in my career is the realization that there is no “stock market”. Instead, there are individual businesses and individual investors who own those businesses. From time to time, a business owner may want to increase or decrease his ownership in a company so he approaches…

In recent days, I have been immersing myself in the annual reports and other filings of a company called Brown-Forman. The company, which manufactures Jack Daniel’s whiskey, Chambord vodka, Korbel Champagnes, and other brands of spirits, is still controlled by the family that has owned it for more than a century, with two classes of stock trading on the New York Stock Exchange.