[vc_row][vc_column][vc_column_text css_animation=”none”] [/vc_column_text]

[/vc_column_text]

I could hardly sleep Friday night because of excitement. It felt like Christmas as a kid, when all that joy, happiness, and anticipation are bundled together. Only much, much greater. Imagine you had been waiting on Christmas to arrive for more than thirty years.

Many of you watched me put off this purchase for decades as I prioritized investing over consumption, but it is now here: Aaron and I finally settled on our “forever” piano. We purchased a Bösendorfer 230VC model with the Enspire Disklavier Pro add-on and a custom-inlaid Macassar ebony wood around the soundboard. It is being manufactured near Vienna, Austria for us and should arrive in the next year.

More than generation ago – all the way back in 1996 – the late Dr. Thomas J. Stanley released a book called The Millionaire Next Door that detailed how actual wealth accumulation differed from people’s incorrect assumptions. I think the formula for future generations of self-made millionaires will be slightly different.

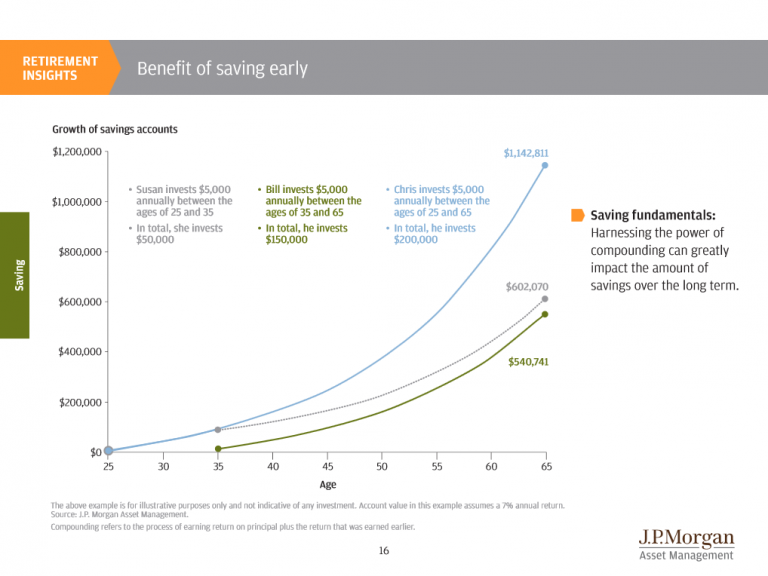

One of the major lessons I’ve tried to teach is that building your net worth comes down to two levers: Cash in and cash out. That’s it. That is the entirety of the game when you peer past the distractions and gaze into the heart of the mathematical reality. From a financial perspective, every action you take for your career or business ultimately only matters in so much as it someday serves to exert force on one of those levers so that more cash is flowing in than is flowing out, leaving a surplus. It sounds so simple but when you see things through the focus of this particular lens, you can more quickly identify the actions that are likely to have an outsized effect, both for good or bad, on net worth.

President Obama’s administration has announced that he wants to impose a one-time tax levy of up to 14% on the $2 trillion in foreign profits American companies have built up and not repatriated in exchange for making repatriation on future foreign profits that were subject to at least a 19% tax rate tax-free, encouraging domestic…

A friend of mine, a nuclear engineer, once explained that he doesn’t bother to contribute to forums or message boards when the topic of nuclear energy is brought up anymore because people are irrational about it, interested in their own confirmation bias rather than learning or having an honest discussion. Almost everyone I know working in…

One of the things that has stuck with me, and I’ve been contemplating for the past twenty-four hours, is the passage on alienability of beneficiary’s interest, particularly as in regard to spendthrift trusts.

An Update on the (Almost) Year-Long Energy Saving Program Almost a year ago, I began to notice some weird things with our electric bill. What followed was me getting obsessed with figuring out where the energy was going, even measuring the daily cost of operating my coffee pot. Then, a resolution to take $2.4 million…

Hands down, I am strongly convinced the single most incompetent source of regularly published financial advice or business information of any major newspaper in the United States is the money section of USA Today. The conclusions are often outright wrong, the understanding of accounting and economics vapid, and the headlines written to achieve nothing more than clicks without leaving the reader better informed than he or she was in the beginning. It is the fiscal equivalent of fluff, only worse because fluff can be fun without leaving an inaccurate impression on something as important as national economic policy.

There has been a lot of talk over the past few days of corporate inversion. Corporate inversion happens when an American company changes its domicile to another country by merging with a foreign entity. Inversions have been occurring at a rapidly accelerating rate. Pfizer attempted one of the largest inversions in history with the AstraZeneca merger that…

This May will be 10 years since Aaron and I graduated from university. I just looked up the cost for the upcoming academic year, which includes tuition, room, board, fees, and books, and it’s running at a rate of around $53,000 per annum. Assuming even modest annual increases, a 4-year degree would cost just shy of…

[vc_empty_space][vc_column_text css_animation=”none”]

[/vc_column_text][/vc_column][/vc_row]